On August 6th, the first batch of sanctions against the Islamic Republic will go into effect. This includes sanctions on the acquisition of US dollar banknotes by Iran's government, sanctions on its trade in gold and other precious metals, sanctions on sales and transfer of aluminum, steel, coal, and graphite, and sanctions on Iran's automotive sector. However, the second set of sanctions of November 4th will hit the crucial energy and banking sector.

With the announcement of the re-installation of sanctions by President Donald Trump, Iran is in a unique position. Although the threat of sanctions is hanging over the country like the Sword of Damocles, Tehran is in a relatively comfortable position internationally to withstand pressure from Washington as the other signatories of the JCPOA remain supportive. Germany, France, and the UK have promised to soften the pain for Iran in order to keep the country in the nuclear agreement.

In recent announcements, the current U.S. administration said that it intended to hit Tehran where it hurts by bringing their oil exports to virtually zero. However, the potential risk of a price explosion globally due to decreasing production in other regions such as Venezuela, Nigeria, and Libya, has somewhat softened Washington’s approach. Waivers could be provided to some importers.

For now the current regime has restricted itself to mere threats and announcements, but as domestic pressure from hardliners continues to rise, Iranian President Hassan Rouhani could soon be forced to reinvigorate the nuclear program. Iranian officials have already been ordered to start preparations to deploy machines for advanced nuclear enrichment, putting pressure on European states to provide incentives to keep the Islamic Republic in the nuclear accord. Related: Saudi Arabia Halts Oil Shipments At Key Chokepoint

The first sign of the French, British and German governments falling through on their promise, came in the week of 16 July. Iran was told by the European powers that they are investigating activating accounts for the Iranian central banks with their national central banks in a bid to open a financial channel for Iran to continue its economic activities in euro, sterling, and other denominated accounts, thus bypassing the dollar.

This is significant as companies could be restricted in their access to the dollar as a consequence of continuing business in Iran. Furthermore, Washington intends to impose secondary sanctions on firms dealing with Iran, meaning that companies which are active in both countries will face sanctions in the U.S.

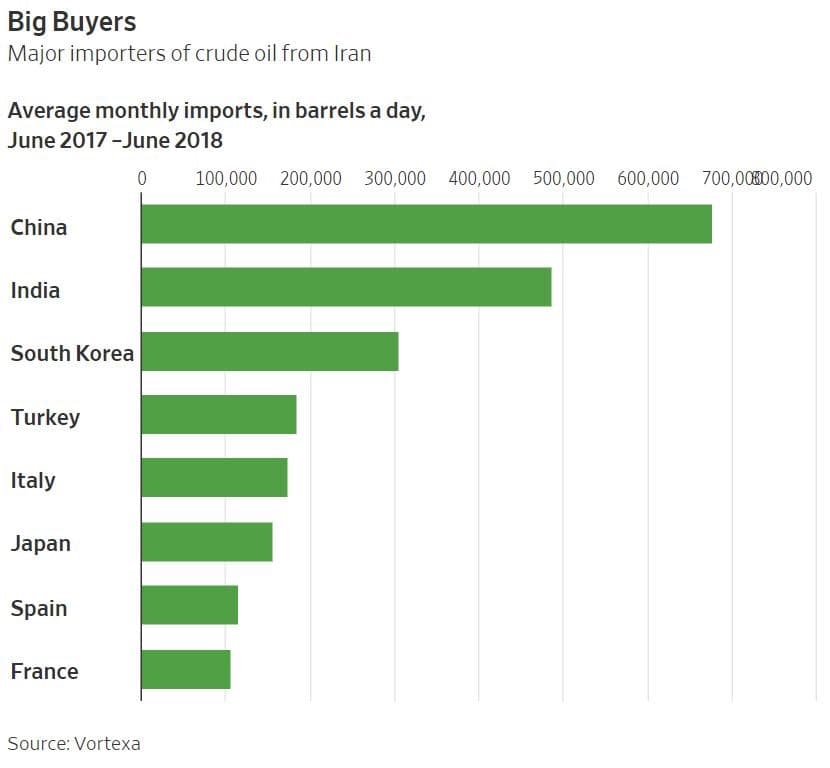

The bellicose language of Trump and the trade war with China have somewhat turned the table concerning oil trade between Iran and the Asian giant. The threat of an economic war is now turning into an actual hot one, which has compelled Beijing to increase pressure on Washington. Chinese refiners are already reducing the imports of U.S. crude oil, turning towards Iranian sources. Imports of U.S. crude reached 400.000 bpd at the beginning of this month, but are quickly decreasing due to the trade war. Furthermore, China is by far the biggest importer of Iranian crude, which could even rise further in order to offset decreasing U.S. crude. Related: The Three Best Oil Majors Of 2018

(Click to enlarge)

Furthermore, China’s state-owned companies doing business in Iran don’t worry about the secondary sanctions as they don’t have any significant business in the U.S. Besides, Iran’s national oil company is more than happy to accept payments of their oil in Chinese yuan instead of the dollar as this provides another way to circumvent financial sanctions. Russia also has a big state-owned energy companies, which does no access U.S. markets. Next to that, Moscow has shown interest in investing the equivalent of $50 billion in the Iranian energy sector, which could significantly increase Russian presence and influence in Iran.

Although Iran’s position internationally is increasingly becoming precarious due to pressure from Washington, not all hope is lost in the Asian country. Tehran is strengthened by the fact that it receives the support from most major powers besides the U.S. Tehran hopes that the Europeans provide enough economic stimulus for it to ignore the hardliners and remain in the nuclear deal. The trade war the U.S. is waging with almost every major economy in the world has further strengthened Iran’s position. The question now remains, how long is Tehran able to withstand its inner demons in the shape of its domestic politics and hardliners who demand a tougher stand against the U.S.?

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

Have major importers of Iran oil publicly stated continued support? Yes

Does Iran have more fiscal avenues to accomplish this today as opposed to pre Iran deal? Yes

So not only will Iran likely find a way, they will make more money doing so because the oil market fluff resuling from 2018 potus tweet barking will continue to energize oil pricing volatility. And that's without even introducing other fundamental forces which can drive oil prices up.

Enjoy.

One reason is that the overwhelming majority of nations of the world including US allies and major buyers of Iranian crude such as China, India, Japan, Turkey and South Korea are against the principle of US sanctions in general and particularly the sanctions on Iran. They resent the tendency of the United States to slap sanctions on any country with which it doesn’t see eye to eye. Countries of the world are not going to comply with US sanctions against Iran and would challenge the US to impose sanctions on them.

The other reason is the petro-yuan which has virtually nullified the effectiveness of US sanctions and also provided a viable alternative to bypass the petrodollar altogether. Iran will be paid in petro-yuan for its oil exports to China, by euro for its exports to the European Union (EU) and by barter trade for its exports to India, Turkey and Russia.

China and India have a great sway in the global oil market and also with Iran being major buyers of Iranian crude. They on their own could ensure that US sanctions against Iran will fail.

India will never halt its imports of Iranian crude no matter what pressure the United States puts on it. India announced that it doesn’t recognize any sanctions but UN sanctions and that it will ignore US sanctions on Iran and continue to import Iranian crude. In a nut shell, India is angling for a better deal from Iran.

And with the United States intensifying its trade war against China, the Chinese would be more than happy to buy more Iranian crude as a way of retaliating against Washington and also bolster the petro-yuan. Furthermore, Iran will likely offer significant discounts to China thus enticing it to scoop up ample supplies on the cheap.

As long as the EU particularly France and Germany stay with the Iran nuclear deal and ignore US sanctions, there will be no valid reason for Iran to reinvigorate the nuclear program and walk away from the nuclear deal.

And despite the bellicose language of President Trump and Iran’s threat to close the Strait of Hormuz if its oil exports were prevented by US sanctions, I don’t think there will be a need for Iran to take such a drastic measure since US sanctions are doomed to fail. Moreover, such drastic action might lead to a war with the United States. Still, Iran’s threat to close the Strait of Hormuz should be taken seriously

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London