One day after the Geneva-based UN Conference on Trade and Development (Unctad) warned central banks are at risk of triggering a full-blown global recession in their pursuit of higher interest rates to reach their 2% inflation targets, World Trade Organization economists published a report on Thursday morning outlining global growth will be sharply lower than forecasted for the remainder of 2023.

WTO economists said world trade and output began to slow in the fourth quarter of 2022 due to the Federal Reserve's tighter monetary policy and tighter monetary policy in Europe and other major economies. A combination of snarled global supply chains, the property market downturn in China, and the consequences of the war in Ukraine add continued downward pressure on international trade.

"The trade slowdown appears to be broad-based, involving a large number of countries and a wide array of goods," the economists said, adding, "Trade growth should pick up next year accompanied by slow but stable GDP growth."

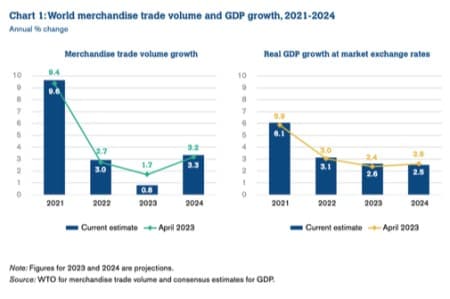

The Geneva-based institution expects the merchandise trade volume in 2023 to slightly increase by .8% from last year, compared with an April forecast of 1.7%. That's well below the 2.6% annual growth recorded since the global financial crisis about 16 years ago.

"The projected slowdown in trade for 2023 is cause for concern, because of the adverse implications for the living standards of people around the world. Global economic fragmentation would only make these challenges worse, which is why WTO members must seize the opportunity to strengthen the global trading framework by avoiding protectionism and fostering a more resilient and inclusive global economy. The global economy, and in particular poor countries, will struggle to recover without a stable, open, predictable, rules-based and fair multilateral trading system," WTO Director-General Ngozi Okonjo-Iweala wrote in a statement.

WTO said, "The exact causes of the slowdown are not clear, but inflation, high-interest rates, US dollar appreciation, and geopolitical tensions are all contributing elements."

In a separate report, Infrastructure Capital Advisors CEO Jay Hatfield told Yahoo Finance Live that if rates stay this high, "We'll have a global recession, and the US may even get dragged into it."

And Richard Kozul-Wright, the director of Unctad's globalization and development strategies division, said: "The global economy is stalling, with Europe teetering on the edge of recession, China facing strong headwinds and financial stresses are reappearing in the United States."

Meanwhile, Fed members and staffers see no recession in the near future, while 84% of corporate executives warn of an incoming downturn as early as 2024.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Russia Lifts Ban On Seaborne Diesel Exports

- Central Banks Continue To Boost Gold

- Cornish Metals Aims To Make Europe A Key Player In Tin Production