This past weekend, Venezuela failed to make $237 million in bond coupon payment, blaming "technical glitches" when in reality it simply did not have the money (or wish to part with it). Adding the $349 million in unpaid bond interest accumulated over the past month as of last Friday, that brings Caracas' unpaid bills to $586 million this month, just days before the nation must make a critical principal payment. And, as BofA sovereign debt analyst Jane Brauer writes, while the bank's base case assumption is that Venezuela will make its debt service payments this year, "the probability of a short term default has increased substantially with coupon delays" and it could come as soon as this Friday, when an $842 million PDVSA principal plus interest payment is due, and which unlike typical bond payments does not have a 30 day grace period but instead is followed by a second $1.1 billion PDVSA coupon on Nov 2, also without a 30 day grace period.

As Brauer writes, Venezuela has been in as similar situation of payment uncertainty in the recent past, with bond prices plummeting right before a big payment. For example, just before a big principal payment was due in April 2017 Venezuela received a $1 billion loan from Russia just one week before the due date. At that time Ven 27s dropped 16 percent in a month (from $52 to $45) and recovered completely within a month. Ven 27 has fallen to $35, as Venezuela has demonstrated that it will be a challenge to make all payments on time. The difference between now and April is that coupon payment delays then came after, not before the payment.

Meanwhile, Venezuela has managed to redefine the concept of payment "on time" which now means "by the end of the grace period"

As we keep track of missed payments, the 5 missed payments, so far totaling $350 million all have a 30-day grace period, as did the $237 million payments over the weekend.

The concern is that the principal payments coming up have:

-No grace period in the bond indenture for an event of default

-Three business day grace period before triggering CDS

The concerning principal due dates are coming up, the first of which is this coming Friday, which means in less than 48 hours Venezuela could be in default unless it can find $842 million:

-Friday, Oct 27 PDVSA 2020 $842 million

-Thursday Nov 2 PDVSA 17N $1,121 million

The collateral against the first bond is PDVSA's Houston-based refining and retail subsidiary, and in just a few hours, the bondholders may be the (un)happy new owners of said subsidiary. Related: Canada’s Oil Output To Grow For Decades To Come

"This weekend, there's either going to be a lot of bond holders and traders drinking champagne, or there's going to be a lot of stressed fund managers," said Russ Dallen, managing partner at Caracas Capital Markets

And to help everyone involved, here are some key tables, courtesy of BofA:

- Table 1. Ordered by due dates, missed payments and payments due today for Venezuela sovereign and wholly-owned quasi sovereign issuers.

- Table 2. Sorted by grace period end dates for missed payments and those due today

- Table 3. Debt service due dates for the next 9 months

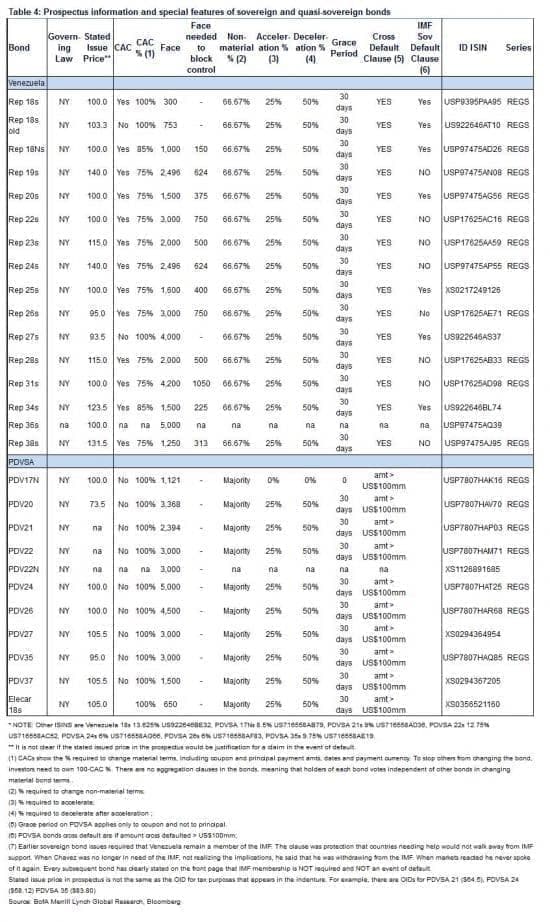

- Table 4. Bond Attributes and face needed to block CACs

Table 1

(Click to enlarge)

Table 2

(Click to enlarge)

Table 3

(Click to enlarge)

Table 4

(Click to enlarge)

By Zerohedge

More Top Reads From Oilprice.com:

- Are Petrocurrencies Heading For Extinction?

- Iraq Conflict Won’t Trigger Oil Rally

- The Impact Of EVs On Commodities In One Chart

Financial implosion will further reduce the quality of their heavy low grade crude. Ultimate political chaos will result in at least a temporary halt to export output.

This mess will have to sort itself out and there will be a window of time where the market will adjust to loss of Venezuelan output just like it adjusted to loss of Iranian and Libyan output.