Oil markets went for a wild ride this week in the aftermath of the drone strike on one of the world’s most important crude processing facilities. The attack led to Brent crude futures spiking by 20 percent in early Monday morning trading. Despite the severity of the supply outage (some 5.7 million bpd), Saudi Arabian and OPEC sources quickly reaffirmed the markets that crude flows wouldn’t be upended.

As a result, prices fell 6 percent on Tuesday morning, and continued to fall on bearish inventory data that same day.

Riyadh was quick to confirm to some of its Asian trading partners that it would be able to supply all contracted volumes. Thus far, there have been no reports of failed loading/delivery, even though rumors emerged on Thursday morning that the Saudis had requested to buy additional crude oil volumes from Iraq. True or not, Saudi Aramco sources were quick to deny that this wasn’t the case.

The U.S., China trade war and concerns about the global economy have, for months, fueled bearish sentiment in markets, but this week, albeit briefly, traders’ attention returned to the supply side of the equation.

The central questions this week are: how quickly can Saudi Arabia restore its production capacity and how severe is this supply outage in reality?

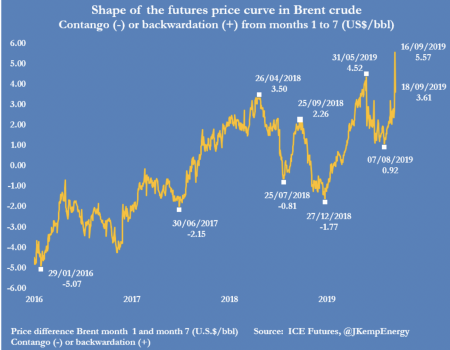

Although they can’t tell the entire story, Brent spreads can shed a light on what the most informed oil buyers currently think. Related: U.S. And Russia Battle It Out Over This Huge Iraqi Gas Field

At the start of the curve, the 1-month Brent spread is trading at 107-cents backwardated, suggesting that the outage will last at least a few weeks. The 2month/3month spread is trading at 94-cents backwardated, the 3month/4month spread is trading at 67 cents backwardated and the 4month/5month Brent spread is trading at 49 cents backwardated. We have to go all the way out to the 7month/8month spread to find a diff that is trading at less than 40-cents of backwardation

The strong backwardation in the futures price curve here suggests that major oil buyers don’t fully believe the Saudi argument that it will restore full production by the end of September.

Bearish sentiment in August nearly led to a contango situation in the market, and while many analysts still believe that the second half of 2019 will see relative tightness in crude markets, sentiment matters.

(Click to enlarge)

While bullish sentiment lifted the futures price curve on Monday, the tides changed on Wednesday with the price difference between one-month and 7-month Brent contracts narrowing rapidly, suggesting a more bearish outlook.

While uncertainty remains about how Washington and Riyadh will respond to what they have identified as attacks that came from Iranian soil, with Iranian equipment, there seems to be some kind of consensus that the market remains adequately supplied.

For now, the geopolitical risk premium in oil remains intact, and oil continues to trade slightly higher, but unless the Persian Gulf is shocked by another attack like the one on Abqaiq and the Khurais field, prices aren’t likely to skyrocket again in the short-term.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- IHS Markit: US Natural Gas Prices To Fall To 50-Year Low

- The US Massively Underestimates The Trade War Blowback

- European Carmakers Face Perfect Storm

While the Saudis are trying to assure the markets that full production will be back by the end of September, there are indications that the repairs could take months and not weeks. Even a month could totally exhaust Saudi stored crude oil and this will be reflected in significant jumps in oil prices perhaps even going beyond $80.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London