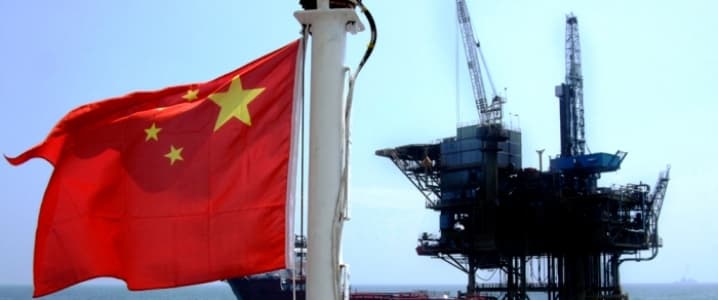

In a move that could upend the pricing and trading of one of the world’s most actively traded commodities, China plans to finally launch its long-awaited and delayed yuan-denominated oil futures contract on March 26, Reuters reported on Friday, quoting two sources familiar with the latest developments.

China has been preparing to launch its oil futures contract for years and has postponed or shelved plans several times, but it looks like now it is close to launching an oil futures contract that will give it more clout in crude pricing and promote its currency as a truly global one.

With the contract, to be launched on the Shanghai International Energy Exchange, or INE, China hopes to create an Asian crude oil benchmark that would better reflect pricing for the oil imported and consumed in the world’s top importing region, Asia, and the world’s largest oil importer, China.

An official at the INE told S&P Global Platts today that the oil futures contract would be launched on March 26, after the exchange had recently received the approval from China’s State Council—the final hurdle to the launch of the contract.

Some details about the launch of the oil futures contract are expected to come in later today, the INE official told S&P Global Platts.

The launch of the yuan oil futures contract will be a wake-up call for traders and investors who haven’t been paying attention to Chinese plans to create the so-called petroyuan and shift oil trade out of petrodollars, Adam Levinson, managing partner and chief investment officer at hedge fund manager Graticule Asset Management Asia (GAMA), said in October last year. Related: LNG: Glut Today, Shortage Tomorrow

Although the petroyuan is not expected to immediately supplant the petrodollar, the world’s top oil importer launching a crude oil futures contract in its domestic currency is a sign that the Chinese want their yuan to play an increasingly important role in global trade, starting with the oil trade.

According to some analysts, the success of the yuan oil futures contract greatly depends on the Chinese regulation (and room for intervention) on the market, which could deter international investors from bringing huge volumes into the contract. Others believe that while it makes sense that the world’s key oil import market launch yuan oil futures, it would take years for the yuan to really threaten the supremacy of the “entrenched” petrodollar.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Nearly Half Of All Public Buses Will Be Electric By 2025

- Oil Market Makes Major Shift As US Oil Heads To Middle East

- The Oil Bubble Has Burst. What Now?

And the fool in DC just declined a free airbase on top of the world's largest gas & condensate field. Tired of winning yet?

When the US dollar loses its world reserve currency status the USA will be a Third World country. It will be unable to pay its US$20 trillion national debt and it will no longer be able to print the dollar to wage endless wars and control the world as a hegemon.