As Russia braces for further sanctions from Washington D.C. over their alleged role in "meddling" in the 2016 U.S. election, they are reportedly prepping a $1 billion yuan-denominated bond issuance in an effort to preemptively diversify financing risks away from the West. According to Bloomberg, the sale will total 6 billion yuan and could come as early as next week.

Russia hired Bank of China Ltd., Gazprombank and Industrial & Commercial Bank of China Ltd. to arrange investor meetings for the sale of 6 billion yuan ($907 million) in five-year notes, according to people familiar with the plans. The issuance is slated for the end of this year or beginning of 2018, they said, speaking on condition of anonymity because the deal isn’t yet public.

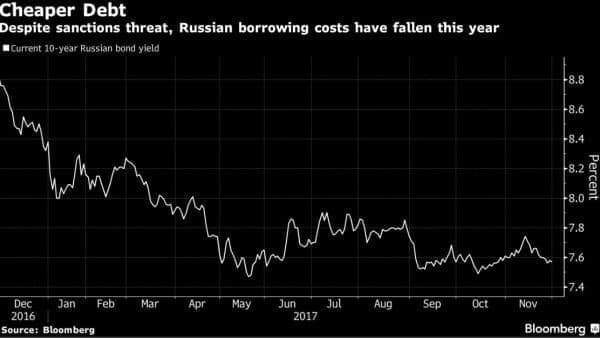

The sale has been under discussion since U.S. and European sanctions in 2014 over the takeover of Crimea blocked many state-owned Russian companies’ access to Western capital markets. A report due next quarter from the U.S. Treasury on the potential consequences of extending penalties to include Russian sovereign debt has increased pressure on the Finance Ministry to seek out alternative means of borrowing.

“It would be wise of Russia to tap the yuan market now,” said Vladimir Miklashevsky, a senior economist at Danske Bank A/S in Helsinki. “China remains Russia’s biggest trade partner, China’s enormous financial system has lots of buying potential, too.”

While Bank of Russia Governor Elvira Nabiullina has said there will be “no serious consequences” from U.S. sanctions on new domestic government debt, economists in a Bloomberg survey estimated the move could add 50 basis points to 150 basis points to borrowing costs.

(Click to enlarge)

The Yuan-denominated bonds, known as dim-sum bonds, would be listed on the Moscow Exchange and available for investors to purchase via the Moscow branch of ICBC.

Related: The Oil Information Cartel Is (Finally) Broken

Of course, in addition to advancing Russian diversification interests, a successful sale of yuan-denominated Russian debt would also advance China's interests in the internationalization of the yuan.

If Russia goes through with the sale, it would be the first sovereign issuance of yuan-denominated bonds outside of China since 2016, according to Dealogic, with prior issuances in Hungary, Mongolia, the U.K. and the Canadian province of British Columbia.

By Zerohedge

More Top Reads from Oilprice.com:

- Oil Majors Are Leading The Recovery Race

- China's EV Plan Could Cause An Oil Price Crash

- Venezuela Is Losing Its Best Oil Buyer