Although it is a very rare occurrence to see Nigerian grades trade at levels stipulated by the Nigerian National Petroleum Company (NNPC) every month, the issuance of its official selling prices generally reflects the market’s current sentiment. Today’s current feeling about Nigerian crudes (and Western African ones generally) is that of weakness. Attesting to the difficulty of placing West African cargoes recently it should be noted that up until mid-April roughly half of May 2021 loaders were still available, normally the overwhelming majority of them would be cleared by that point surely. In this article, we assess 3 main trends that have brought Nigerian crudes to the low point at which they are now – fierce competition from usual rivals and incrementally from US cargoes, the tepid recovery of European markets and the sudden collapse of India.

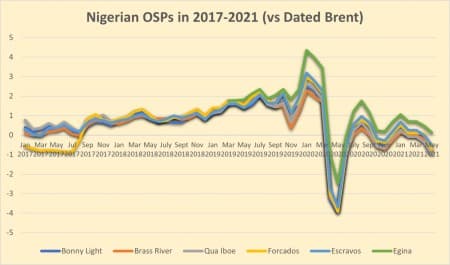

But let’s first take a look at NNPC’s official selling prices for May 2021. If one is to disregard the April-June 2020 period that saw every possible differential plummet to multi-year lows, the new Nigerian OSPs for May plummeted to their lowest in more than a decade. NNPC dropped its main export streams – Bonny Light, Brass River, Erha, Qua Iboe – by 61-62 cents per barrel from their April 2021 prices, with them amounting to -0.9, -0.8, -0.65, -0.97 USD per barrel against Dated Brent. As low as this might seem, these levels are some 40-50 cents per barrel better than the actual May spot market. It was inevitable that May OSPs decrease given that aggregate exports are inching back (to 1.68mbpd next month), however, the extent of the slump was aggravated by the below factors.

Related Video: Oil on Guard over Yemen as Saudi, Iran Meet in Secret

Graph 1. Official Selling Prices of Top Nigerian Grades in 2017-2021 (against Dated Brent, USD per barrel).

Source: NNPC.

Competition Heating Up

The OPEC+ years have brought about an unprecedented expansion of light sweet crudes available to buyers, refiners across continents can choose from a plethora of options. Most of oil-producing nations are gradually increasing their output, be it a consequence of easing OPEC+ quotas or simply due to their own volition to benefit from the reasonably profitable prices above 60 USD per barrel, meaning that refiners in Asia or Europe can create complex strategies on what to refine in the upcoming period. Now that the market has been backwardated for several months already, the shipping market no longer experiences any dearth of vessels, i.e. freight costs would be manageable for the buyers. Thus Nigeria, located mid-way between Europe and Asia (and having largely lost the US crude market), is compelled to fend off competitors from all sides.

April 2021 will witness a solid inflow of light sweet US grades to Asia, amassing a monthly total of 44MMbbls. That is some 10MMbbls higher month-on-month than in maintenance-heavy March. Concurrently, WTI delivered to Singapore fell to its lowest in a year, flirting the 0 line of Dated Brent in mid-April; WTI DES Rotterdam plunged into negative territory in the first days of April and has remained there ever since. Similarly, in Europe where both Azeri and CPC saw a massive depreciation – the former fell as low as 0.10 USD per barrel vs Dated (generally should garner a premium of 1-2 USD per barrel), whilst the Kazakhstani flagship grade nosedived to -3.25/-3.50 USD per barrel against Dated Brent. Thus, Nigeria’s rivals are pumping crudes onto the markets and accepting anaemic differentials as a necessary albeit painful element of the trading game.

India’s Buying Spree Cut Short

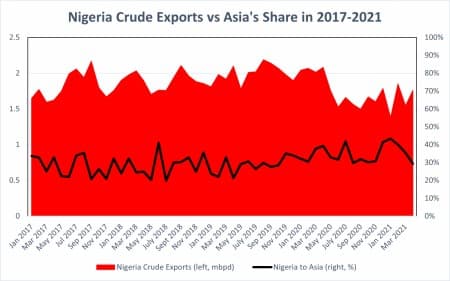

India has routinely been the top buyer of Nigerian grades, the not-too-light and not-too-heavy quality of Nigeria’s flagship crudes suits India’s plentiful refiners almost perfectly. Last year 17% of Nigerian crude exports went to India, equivalent to 300kbpd on an annual average basis. Nigerian oil producers will have an extremely tough time trying to maintain those levels of crude exports. First the ever-widening Brent/Dubai EFS has narrowed down arbitrage potential from Nigeria, which, at a time of increasing export quotas (went from 1.64mbpd in February 2021 to 1.68mbpd in April) was a rather unpleasant development. Related: The Ugly Truth About Renewable Power

Graph 2. Nigeria’s Crude Exports vs Asia’s Share in Nigeria’s Exports in 2017-2021 (million barrels per day, %).

Source: Thomson Reuters.

India’s current COVID travails foreshadow further difficulty for placing Nigerian cargoes in their prime market outlet. National demand for transportation fuels is bound to drop by at least 20% in April in India as regional governments introduced lockdowns once again, including the capital New Delhi. Although initially destined for several weeks, the lockdowns can be extended for a couple of months as the dangers of the new COVID strain discovered in India, labelled B.1.617, are still difficult to assess. One thing we can ascertain already: throughout December 2020 – March 2021 oil producers from Nigeria loaded an average of 11-12 MMbbls. This April the total volume to be loaded in Nigerian terminals towars India will amount to 8.8 MMbbls and May 2021 is bound to decrease even further.

Spanish Demand Still Off the Table

Spanish refiners have routinely been to the lighter side of the Mediterranean spectrum, therefore it should not come as a surprise that Spain maintained its role as an important buyer of Nigerian crudes (0.23mbpd), trailing only to India. On the back of Europe still struggling to revive its economy at least to pre-COVID levels, Spain has been suffering from depressed demand. Coastal refiners have felt the pinch of the ongoing market slump more than landlocked ones did, unfortunately for Spain all but one of its refineries are located next to the Mediterranean and Atlantic Ocean, thus being subject to the intense regional competition. Most coastal refineries have been running at 60-70% nominal capacity for almost a year. Truth be told, even the only inland refinery in Puertollano has shut down all fuels production in April 2021.

Graph 3. Nigerian Exports to Spain in 2017-2021 (million barrels per day).

Source: Thomson Reuters.

At the same time, during the autumn months of 2020 when the 2nd wave of COVID was battering Spain again, Nigerian exports stayed within the statistical average all the while differentials were stronger than they are now. In March 2021, only one Escravos Suezmax cargo left the loading terminals of Nigeria for Spain; all this after a really robust February when a total of 9.2MMbbls was loaded. This harkens back to the above-mentioned competition with US, Caspian and North African grades – a joust that Nigeria is evidently losing. Weak demand and third-wave lockdowns notwithstanding, neither the American WTI nor the Caspian CPC has seen any ground-breaking changes in total volumes loaded en route to Spain.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- How Russia Could Kickstart Another Oil Price War

- The 5 Most Influential Oil Companies In The World

- Bullish Oil News Offset By New Lockdowns In India