Back in the days when US oil demand controlled the price of oil, a massive recession in the United States would have sent oil to 12.00 dollars a barrel. That era, which ended last decade, was defined by ongoing spare capacity in OPEC, low-cost oil in Non-OPEC, and nascent demand for oil in the developing world. That was then, and this is now. And so it’s rather quaint that the energy analysts from that previous era still gather each week on American financial TV, to discuss the inventories at Cushing, Oklahoma. Inventories at Cushing, Oklahoma? The US has been removing discretionary demand for oil for years, starting back in 2004. And current unemployment in California is at 13.2%–another new post-war high. Yet oil is at 82.00 dollars? Get these analysts off TV. Please. We need analysis of diesel demand in Guangdong, and Uttar Pradesh.

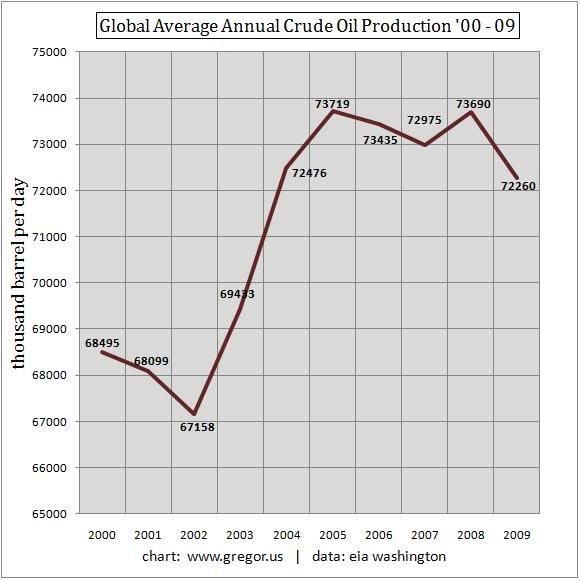

With the closing out of the decade we also have the full data set, on global crude oil production. As you can see from the chart below, the twin peaks of oil production in 2005 and 2008 reveal that while the world was able to respond to a moderate price advance coming out of 2002, nearly all of the price action above 40.00 dollars a barrel starting in late 2004 did not produce more supply. Welcome to peak oil: when the world’s remaining supply of oil is more diffuse, of lower grade, harder to extract, and is unable to flow in the aggregate at higher production levels.

There is an extra measure of comedy today to our defunct and inward-looking group of oil analysts here in the States, as it was revealed that these weekly measures of US inventories are highly flawed. Well, actually, we knew that. But it’s always nice to get the proof. From tonight’s Wall Street Journal:

…documents, obtained through a Freedom of Information Act request, expose several errors in the Energy Information Agency’s weekly oil report, including one in September that was large enough to cause a jump in oil prices, and a litany of problems with its data collection, including the use of ancient technology and out-of-date methodology, that make it nearly impossible for staff to detect errors…Internal emails and a report from a consulting firm prepared in September describe a process at the EIA that served the oil world well in 1983, the first year that oil futures traded, but hasn’t kept up as the inventory data have become more influential and the nation’s oil infrastructure has become more complex.

The familiar names that you see on financial TV here in the US, talking about oil, are generally living in a past that no longer exists. One really has to go to London, Sydney, and Toronto to find not only the best minds in energy, but TV hosts smart and informed enough to even handle the conversation. Global oil production peaked in the 2005-2008 period and now trades at levels thought unthinkable in 2005 when unemployment levels in the OECD were half current levels, if not lower. The US no longer controls the geology or oil, or the price of oil. But, we carry on as though we will again in the future. After all, in places like California which is seeing a competitive race for the Governorship, phrases like Getting Back on Track are all the rage.

By. Gregor MacDonald