Oil prices started August in the red, and kept falling into the afternoon, with both benchmarks trading down more than 3% near Monday’s close.

The price of a WTI barrel slipped $2.54 (-3.43%) per barrel on Monday at 4:30 p.m. EDT, end the day at $71.41, while the Brent crude benchmark was trading down $2.35 (-3.12%) at $73.06.

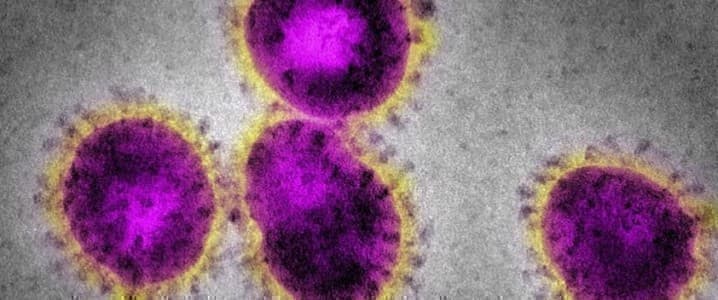

The catalyst for the sharp Monday drop is a surge in the number of Delta variant coronavirus cases in the world’s largest oil importer, China. Any dent in oil demand in this large of an importer will be felt in the global oil market.

The Delta variant has spread to 32 Chinese provinces within the last two weeks, indicating a rapid spread.

The Delta variant is surging elsewhere, too. Reports surfaced on Monday that Australia was facing a possible “nightmare scenario” as a New South Wales outbreak sees an increase in the number of people in intensive care.

As the number of reports surrounding the Delta variant increase, so too do the fears surrounding oil demand, particularly if a new round of lockdowns are announced in a high oil-consuming nation such as the United States.

Although oil inventories have come down below the five-year average in the United States, travel restrictions or restrictions on activities would eat into the oil demand that has only just started to recover.

Dr. Francis Collins, Director of the U.S. National Institutes of Health, said that in order to avoid another lockdown scenario, people—including vaccinated people—will have to wear masks at indoor gatherings.

The idea that vaccinated people should resort to mask-wearing despite their vaccination status comes after the Massachusetts coronavirus outbreak, where more than half of those infected had been fully vaccinated.

Monday’s negative oil prices even came despite tensions in the Middle East that saw an oil tanker off the Omani Coast attacked by drones, killing two.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Shell Reports $5.5 Billion Net Profit And Hikes Dividends

- Analysts See Oil Trading Closer To $70 Through Year-End

- Why Norway Won’t Give Up On Oil & Gas