There was a sigh of relief from global markets when the leaders of China and the U.S. met on the side-lines of the G20 summit to agree upon a temporary truce in their trade war. However, despite the good news, the existing 10 percent tariff on U.S. LNG has remained unchanged. According to White House Spokeswoman Sarah Sanders, China had agreed to immediately start importing more U.S. agricultural, energy, industry, and other products. The arrest of Huawei CFO Meng Wanzhou in Canada, however, is set to be the first test of this new truce.

Playing hardball

China was easily the most maligned country during Trump’s presidential campaign, but most analysts expected him to moderate his tone once he was in office. A year after his election, President Trump landed in Beijing for an official state-visit that appeared from the outside to have been a great success. The expectation from outsiders was that the personal chemistry between Xi and Trump would facilitate the coming negotiations between the two economic giants.

Approximately a year after that first encounter, the two Presidents agreed to a truce after what had been a long and tense trade war. This truce is especially good news for the American energy industry as China is the single biggest oil and natural gas consumer on the planet. It is particularly important for LNG as the trade war started just as the second wave of U.S. LNG investments came online.

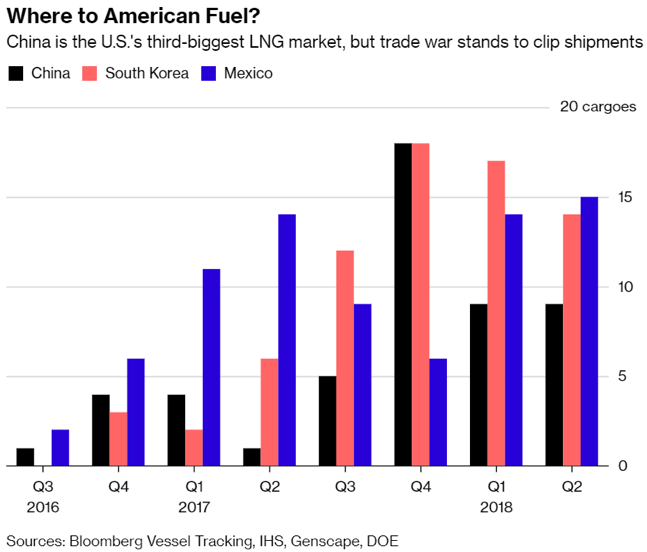

(Click to enlarge) The phenomenal growth in LNG demand has made China a highly desired market for exporters. American energy would be a natural fit for the world’s largest natural gas growth market. However, the politicization of energy trade has made the second wave of LNG investments in the U.S. less attractive as long-term contracts underpin financial security. Despite the strategic necessity to diversify suppliers, fraught relations with Washington could make Chinese buyers choose politically less risky exporters. After a brief peak, LNG from the U.S. has gradually decreased since the trade war started.

Political arm wrestling

The arrest of CFO Wanzhou was especially bad news for the LNG industry because it shows that political tensions are unlikely to fade any time soon. According to the CEO of Liquefied Natural Gas Ltd. "The whole trade issue puts a damper on things directly with Chinese customers and the rest of the buyers are also sitting back". The company aims to make a final investment decision to proceed with the Magnolia LNG project next year, but as trade disputes persists, the timing "is a little iffy".

Related: OPEC+ Deal To Be Forged In March

The Chinese Foreign Ministry warned of ‘consequence’ if Canada and the U.S. refuse to release Huawei’s CFO. Wanzhou’s detention could lead to another round of political arm wrestling between Washington and Beijing. Neither can afford to give the impression of being weaker than the other.

On the other hand, the truce and trade negotiations are about much more than just Huawei. Trump's administration seems to have been caught off guard when it comes to the arrest of Wanzhou. U.S. officials have already declared, in an apparent attempt to stop the incident from impeding crucial trade talks with Beijing, that President Trump did not know about the intention to arrest Huawei’s CFO.

It is likely that Beijing and Washington will be able to come up with a face-saving solution in order not to derail the more crucial trade talks. Regardless of its outcome, this crisis could be another sign to Chinese buyers of LNG of the risks they face when making long-term agreements for American natural gas. The strategic nature of energy requires a stable flow. The good news for buyers is that there are more players on the bloc.

Qatar has recently announced the lifting of its self-imposed moratorium on LNG production. The tiny Arab country wants to increase production from 77 million tonnes/year by another 23 to 100 million. Also, Russia’s Novatek intends to make a final investment decision regarding its Arctic-2 LNG project. With so many suitors, Chinese energy importers are free to take political stability into consideration alongside economic factors.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Canadian Crude Rises 70% On Unprecedented Output Cuts

- Saudi Arabia’s Biggest Geopolitical Error

- Iran Widens Discount For Crude To Asia

It's ridiculous...

Why should the USA producers care?

They will compete with the NG producers, not consumers!

Let China buy from Qatar, and Europe from the USA!

Why should the USA producers care?

They will compete with the NG producers, not consumers!

Let China buy from Qatar, and Europe from the USA!"

Yes but Europe also happens to prefer to buy from Russia and Qatar. Even if Europe is politically friendly towards the US, they're not going to pay 2x as much for it.