Natural gas seems to be locked in a range that prevents it from being truly economic across the demand cycle. As you can see from the graphic below, for about half of 2020 it was below the $2.00 mark. Weather forecasts for a cold winter, beginning in August of 2020, began to ramp it toward its ultimate 2020 high of ~$3.50 per MCF on October 30th. If you average out the 2020 sales price for gas you get something like $2.17 MCF.

MarketWatch

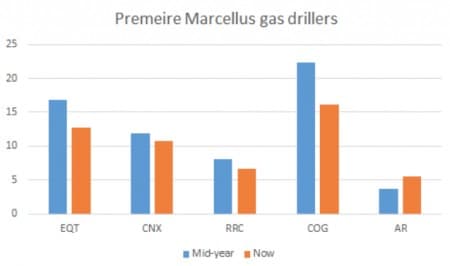

That’s a price that most of the gas drillers can make a little money on, but it does nothing for their stocks. As you can see in the chart below, four of the five largest U.S. gas drillers have lost value over the past six months. Of the top five, only Antero Resources, (NYSE: AR) has been able to reward its shareholders with capital appreciation.

Chart by author

In this article, we will review some of the forces driving natural gas, and see if we can develop a thesis for a catalyst that will enable the drillers to become more investible. Few if any of them pay a dividend, so capital appreciation is the only reason to buy-in.

The problem with gas

Natural gas always seems to be ready to come into its own and achieve a sales price that would broadly justify the expense undertaken to produce it. Forecasts were for the withdrawal season, which we are now in, to see prices above $3.35 MCF. One metric to establish a justifiable investment, even though many of the drillers have cut their breakeven costs to under two dollars an MCF and hedging can further insulate them from extremely low prices, is the debt they carry as a proportion of their Enterprise Value. For example, EQT Corporation, (NYSE: EQT), the largest producer of natural gas in America, has an Enterprise value of ~$8.2 bn. $4.7 bn of that figure is long term debt, making a debt to capital ratio of 0.57%. Not in a danger zone, but getting toward an uncomfortable 60%, where bankers might begin to think of increasing the interest rate of their loans. Many of the gas drillers are cutting back on growth capital to reduce debt. In the case of EQT Corporation, CAPEX has been reduced by 50% YoY to help reduce total debt. Related: Rising LNG Prices Welcome News For U.S. Exporters

Even the giant Supermajors, like Chevron, (NYSE:CVX) are struggling with their gas acreage as regards producing value. Last year in an Oilprice article I discussed the $11 bn asset write down the energy major was taking on its Marcellus (Appalachian) assets. The Marcellus is the most prolific shale gas play in the U.S. And, although CVX bought into the Marcellus for billions in 2011, it sold out to EQT for a paltry $735 mm last month.

CVX is not alone in giving up on making money in natural gas, with a pivot toward liquids. ExxonMobil, (NYSE: XOM) just announced a $20 bn asset write down that will feature heavily their Permian and Marcellus acreage acquired primarily in their $41 bn buyout of XTO Energy in 2009. The XTO purchase was a strategic move toward gas during a period when the price of natty had been in the $5.00 MCF range. No sooner did XOM sign the check for XTO, than gas prices began to revert toward $3.00 MCF, and have averaged down since.

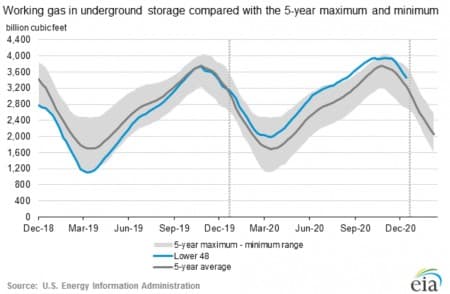

What exactly is the problem with natural gas that keeps prices in the basement? In a word, supply. You can see in the EIA graphic below that we began the withdrawal season with nearly 4-TCF in storage, an all-time high.

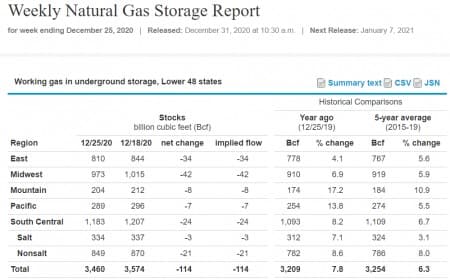

If you follow the blue line in the graphic above, it is evident that drillers have over-produced the last year or so beginning in late 2019, and driven storage volumes well above the 5-year average. This is new territory for gas in recent times. Cold weather in early December has cut into this volume nicely as the Weekly Gas Storage Report shows below, and it is actually creating a moderately bullish response in the gas market this week. But it is only about $0.10 MCF and will evaporate in the next week or so if weather patterns hold.

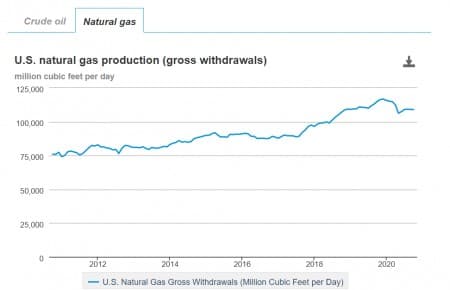

Through October of last year, new drilling was creating gas volumes of 110 BCF/D, much of which was going into storage and adding to the present surplus volume. As of the EIA Drilling Productivity Report for December, about 81 BCF/D are still being produced, keeping us at an attrition level that will do little to chip away at the core storage volume that keeps a cap on prices.

We can summarize the short term problem with gas as being too much inventory, with the replacement of new reserves at too rapid a rate to materially degrade the imbalance between supply and demand. Even with the restraint being shown by the gas drillers in terms of CAPEX for drilling, there is just too much gas.

The 2021 thesis for natural gas

This brings us to the essential element of this article, what are the expectations for 2021? Can we expect market drivers that will break natty out of the doldrums and deliver returns to drillers that make them investible?

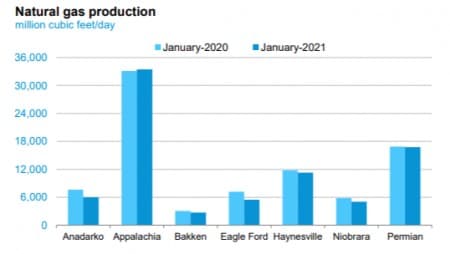

EIA

Let’s review the major applications for gas to get a sense of the market. As we have established, winter heating is the key driver, and gas futures are up moderately thanks to a cold-snap that is driving prices marginally higher.

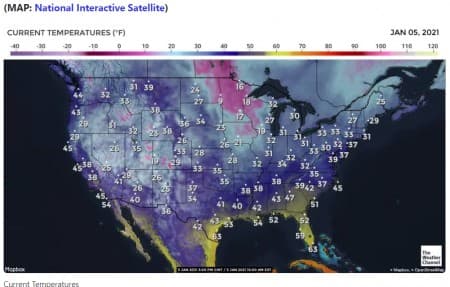

Weather Channel

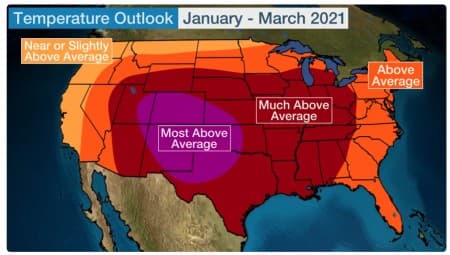

This is going to be very transitory though as the graphic below suggests in its three-month forecast. Much of the country will be enjoying warmer than normal temperatures soon. Related: How To Play 2021’s First Oil Rally

Weather.com

Cold weather as a thesis for growth in gas prices is not going to work for long. My expectation is that by mid-January we will be headed back to the low $2’s per MCF for natty based on this metric.

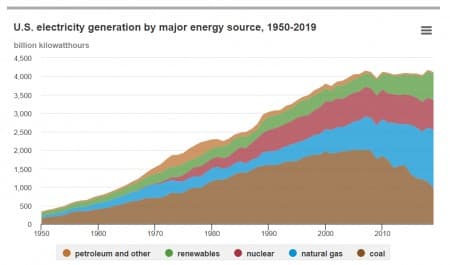

Electricity generation is another core thesis for natural gas consumption, as generators shift away from burning coal. You can see in the EIA graphic below that natty is the single largest source of energy for power generation in this country. This is followed closely by renewables, primarily wind and solar.

EIA

In the most recent EIA-STEO, Short Term Energy Outlook, the use of gas for power generation increased by 2% in 2020 to 37%, but is forecast to fall in 2021 to 34% due to higher prices, and shift to renewables. This also will be impacted by a reduction in power consumption from the effects of Covid.

Renewables, thanks to a boost from federal tax credit programs designed to stimulate growth in the green sector, will gain much of the market share being ceded by coal. In 2021 energy from renewables will rise to 21% of the total market. Massive increases in generating capacity from wind, 33 new GW of capacity by 2021, and almost 27 new GW of solar capacity by YE 2021.

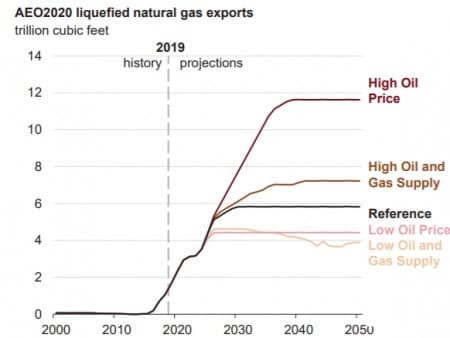

The other growth story for natty is in the area of LNG production. And, unlike the other two key areas, growth in U.S. LNG output seems destined to be a reality, at least for the next few years.

Your takeaway

Natural gas, while it is often seen as a bridge fuel to a cleaner energy future, faces challenges on a couple of key fronts. First, the productivity of new gas wells is so high that even the drastically reduced drilling now taking place in the U.S. is delivering new supplies at a rate that nearly equals daily withdrawals. This does not help with the inventory imbalance that carries over from the prior year. Second, tax-advantaged renewable forms of energy, especially wind and solar, are gaining ground at the expense of natural gas, and only cheap prices can slow this trend. I said, slow but not stop.

While natural gas will remain an important source of energy for power generation for decades, current trends do not favor it for year over year growth. Only in the LNG space where gas cannot be replaced does the growth story hold. But, it is doubtful foreign LNG demand can sustain higher prices in this commodity.

With no changes likely in any of these narratives for 2021, I view gas-related stocks as a trading opportunity for sharp-eyed traders willing to keep their eyeballs glued to their computer screens. I cannot make a case for them as a long term investment though.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- How To Play The Oil Price Rebound In 2021

- OPEC+ Meeting Ends With Major Surprise Cut From Saudi Arabia

- WTI Tops $50 As Oil Rally Continues

And although gas prices are currently low because of a glut in the market, this will soon change with the accelerating global shift from coal to gas particularly in China, the world’s largest gas market and the European Union (EU) and the fast-growing global demand for electricity and petrochemicals.

In the global oil and gas business risk and high return on capital go hand in hand. Renewables aren’t in the same category of oil and gas as investing in them doesn’t carry the same risk as exploring for oil and gas and therefore they generate far less return on capital.

That is why the global oil industry has neither the intention whatsoever to truly greenwash itself nor the ability to achieve the lofty goal of zero emissions by 2050. It will be doing itself, the global economy and climate change a great service by maintaining the core business that has sustained it for decades, namely oil and gas while sensibly reducing its emission footprint.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London