As Europe braces for the cold of winter arriving in the coming days, the natural gas market is about to face its first major test of the season. Recent weeks have seen relative stability in the TTF market, following the resolution of potential strikes by LNG workers at Chevron's key Australian production sites on October 18th. With Europe’s weather turning colder next week, it’s an opportune time to assess the current state of the gas market.

Winter Arrives

The winter of 2022/23 defied expectations with its mildness, allowing Europe to conclude the season with unprecedented levels of unused gas storage. This year, while the urgency to refill storage capacity hasn't matched last year's frantic pace, analysts agree that the main risk for gas demand and prices across Europe hinges on the severity of the coming winter. John Kemp of Reuters highlights this, noting that Frankfurt’s temperatures have been consistently above seasonal averages, resulting in heating demands being almost 38% below average.

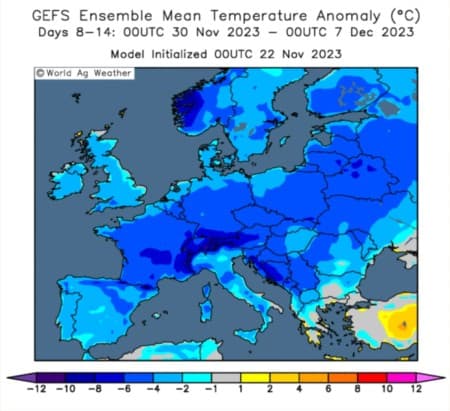

However, the forecast suggests a significant shift is imminent. Data from the Global Forecast System, a National Centers for Environmental Prediction (NCEP) weather prediction model, suggests that temperatures across Europe will be between 2 to 10 degrees Celsius below average in the week of Monday 4th December, as shown in the map below. Dropping temperatures across Europe will likely boost heating demands, exerting a bullish influence on gas prices. Yet, any price surges may be tempered by the current high storage levels.

Related: China Cuts Back on Venezuela Oil Purchases After U.S. Sanctions Relief

SOURCE: WORLD AG WEATHER

Storage Remains High

As of November 21th, EU gas storage levels impressively stand at 98.69%, according to Gas Infrastructure Europe. Such robust storage figures imply that it would take an extraordinarily harsh winter to jeopardize Europe’s energy security. John Kemp projects that, based on average temperatures, gas stocks should hover around 50% at Winter’s end in 2023/24, and even in a colder scenario, levels should stay above 30%.

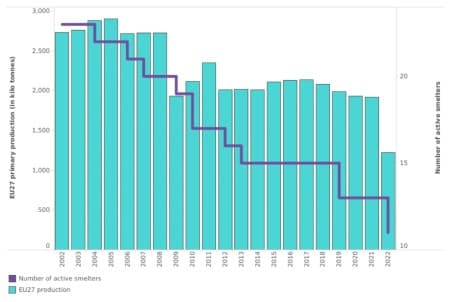

This resilience is partly due to a decrease in industrial activity across Europe. With EU member states committed to reducing gas consumption by 15% against a five-year average until March 2024, reduced demand from energy-intensive industries has been a significant factor. For instance, the steep decline in primary aluminium production in 2022, driven by high power costs, exemplifies this trend. The graph below from industry association European Aluminium shows the decline in production and in active smelters in Europe.

SOURCE: EUROPEAN ALUMINIUM

Emerging Demand and Regional Risk

While Europe’s gas storage levels have slightly dipped from their peak of over 99.6%, this gradual decrease signals a growing demand that is already attracting LNG cargoes to the continent’s waters. This is reported by the Hellenic Shipping News, indicating a shifting dynamic in the market.

Yet, the landscape remains complex. An uptick in demand from other regions, especially Asia, could redirect LNG cargoes away from Europe, potentially escalating prices. Moreover, the recent seizure of a cargo ship in the Red Sea by the Iran-aligned Houthi rebels of Yemen serves as a stark reminder of the ongoing risks in the Middle East. The lingering uncertainties surrounding the Israel/Palestine conflict underscore the potential for broader regional impacts, including on the natural gas market.

As winter’s chill sets in, Europe’s natural gas market is on the cusp of a crucial period. The current high storage levels offer a buffer against immediate threats to energy security, but the market remains sensitive to a host of external factors. These range from regional conflicts and geopolitical tensions to shifting demand dynamics globally. As such, while Europe may be better positioned than last year, the market's inherent volatility and susceptibility to external shocks remain key themes as we head deeper into the winter months.

By ChAI Predict

More Top Reads From Oilprice.com:

- Oil Prices Remain Depressed After OPEC+ Shocked Markets

- IEA: Big Oil Faces ‘Moment of Truth’ Over Renewables Investment

- Oil Spill Shuts In 3% of Daily Production in the Gulf of Mexico