Energy rich, capital poor countries have few options when seeking to develop their resources than to partner with international energy company giants on whatever terms they offer, however iniquitous they might seem.

But the last few years have seen a number of energy-rich nations push back by citing delays, rising costs, environmental concerns, etc., letting the chips fall where they may.

The latest nation to deploy this tactic is Bolivia.

The Bolivian government has decided to "revise" the participation of the Pan American Energy (PAE) LLC consortium on developing its $1.6 billion Caipipendi natural gas field in Tarija.

The Caipipendi Bloc consists of Margarita and Huacaya fields. The government directed PAE to surrender its 25 percent equity stake to Bolivia’s state-owned oil and natural gas company Yacimientos Petrolíferos Fiscales Bolivianos SA (Bolivian Oil Company, or YPFB) YPFB Chaco subsidiary.

The reason? PAE’s failure to comply with its investment plan to develop the Caipipendi natural gas field.

While La Paz has moved against PAE, the operator of the Caipipendi natural gas field,

it left British Gas and Spain’s Repsol YPF SA Argentina subsidiary equity shares, at 37.5 percent apiece untouched. The Caipipendi natural gas field is a major supplier of Bolivian gas to Argentina and the government has sought to increase its natural gas production in order to boost its exports to Argentina.

A cynical nationalization takeover bid, or a genuine concern over unfulfilled contract commitments?

It apparently depends on which Bolivian government official you care to listen to.

Bolivian Energy Minister Juan Jose Sosa said during a Radio Panamericana broadcast, “Pan American hasn’t contributed its percentage, so we’re carrying out an obligatory transfer of the contract to a YPFB subsidiary.”

Agency for the Development of Macro-Regions (Ademaf) director Juan Ramon Quintana said that "the recovery of the (Bloc Caipipendi PAE) shares" was to allow "the State to participate in gas production."

As a consolation prize, YPFB, as the firm is known, will take into account PAE’s investments in the project up to now with a view to negotiating a settlement.

Not that PAE could not have seen it coming, as on 12 March 2010 PAE turned to international arbitration over the nationalization of its stake in YPFB Chaco, filing a claim with the International Council of Societies of Industrial Design (ICSID), which is still pending.

The stakes are high, as two years ago Bolivia pledged to almost quadruple its natural gas exports to Argentina to 27.7 million cubic meters per day (mcmpd) by 2026. According to current YPFB data, Bolivia currently exports 30 mcmpd to Brazil and 7.7 mcmpd to Argentina.

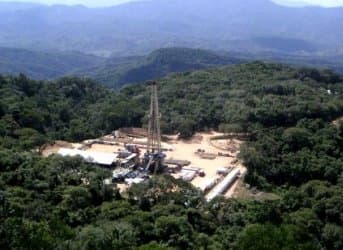

Accordingly, the Bolivian government has placed high hopes on increased production from the Caipipendi Bloc and is counting on the field to help boost the country’s natural gas production 40 percent to 66 mcmpd by 2014 to meet its supply contracts with Brazil and Argentina. The Caipipendi Bloc natural gas field is in southeastern Bolivia, with an estimated reserve of almost 4 trillion cubic feet (tcf), which will increase to 12 tcf after development is complete.

But the action by the government of President Evo Morales may not proceed so smoothly. PAE LLC is 60 percent owned by BP Plc and is one of Argentina's largest oil and natural gas producers and BP Plc has massive legal and fiscal resources to fight such an action.

Chinese state-owned China National Offshore Oil Corp. (CNOOC) narrowly dodged a bullet on the PAE debacle however, as last November Argentina’s Bridas Corp., a venture co-owned by CNOOC, canceled a deal to buy BP Plc’s stake in PAE after Argentina ordered oil companies to repatriate future export revenue. In the ensuring debacle CNOOC’s CEO Yang Hua resigned the same month.

Nor is the dispute limited to aggrieved international partners.

The Caipipendi Bloc consists of the Margarita and Huacaya natural gas fields and there is an ongoing dispute between the departments of Tarija and Chuquisaca over the proposed interlinking of the two gas fields. YPFB proposes that the Margarita natural gas field, located in Tarija territory, be fully connected to the Huacaya natural gas field, The conflict arises because only the Margarita natural gas field is producing, for which Tarija department currently receives 18 percent royalties. But Chuquisaca department is demanding that as the Margarita natural gas field is interconnected to the Huacaya natural gas field, it deserves a share of the revenues.

It would seem then that the Caipipendi Bloc is likely to tie up both regional and international courts of arbitration for the foreseeable future, leaving Chinese officials no doubt offering prayers to their ancestors for having avoided the Andean debacle.

By. John C.K. Daly of Oilprice.com