What a difference just one year can make. This time last year energy planners in Beijing were caught in an embarrassing situation when they moved too quickly to replace both residential and commercial coal usage with cleaner-burning natural gas. Beijing’s move came just months before a colder than expected winter season slammed much of the country, particularly its northern provinces. The result was gas shortages that forced temporary shutdowns of key industries and the diversion of gas to residential end-users to make up for the lack of gas supply. The increased demand coming from China at the time also caused prices for LNG on the spot market to increase, exacerbating the problem for the country’s gas suppliers that were trying to keep a lid on prices.

Yet, over the ensuing year not only did China prepare better than the previous season, including earlier procurement of LNG and filing more storage tanks but warmer weather this winter has helped, also causing the country to procure less LNG on the spot markets via short term contracts. China also ramped up its domestic gas production to multi-year levels last year, increasing production by 7.5 percent on the year in October 2018 and by 6.3 percent between January and October, compared to the same period last year, according to the National Bureau of Statistics of China. Related: The Natural Gas Crash Isn’t Over

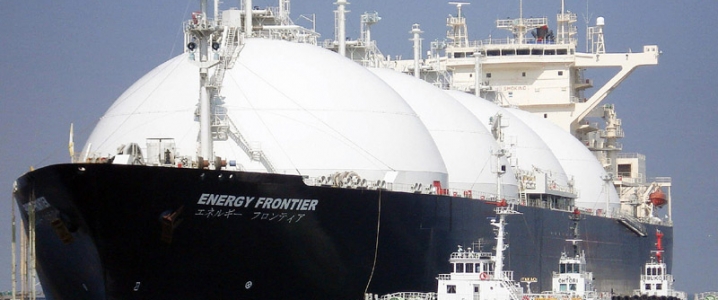

Warmer temperatures have also been putting downward pressure on LNG spot prices in the Asia-Pacific region, which accounts for 72 percent of LNG demand with that demand forecasted to increase soon to as much as 75 percent, amid increased usage from China and South Asia (Pakistan, India, and Bangladesh). Spot prices this winter have been hovering around six-month lows. For February delivery to Asia LNG-AS were assessed at $8.75/MMBtu compared to $9.10/MMBtu last week, industry sources said, also citing low liquidity as the reason for the fall.

Chinese appetite for spot dries up

Meanwhile, industry sources recently said that Chinese appetite for spot cargoes between November 2018 and March 2019 will not be as strong as the same period in 2018, with traders having started preparing to meet a spike in winter gas demand early last year. They are understood to have arranged enough supplies via long-term contracts. The sources added that Chinese buyers had lined up delivery of 3.4 million tonnes of LNG either from the spot market or via short-term supply contracts this winter, down from 5.1 million tonnes during the colder 2017-18 winter season.

Traders have also prepared for softer gas demand growth in anticipation of the warm winter. By securing enough long-term supply, buyers have shielded themselves from spot market price fluctuations. Yet, China’s continued efforts to shift industrial facilities, commercial outlets and residential heating from coal to gas is anticipated to lift gas demand this winter by 8 percent year on year to 29 bcm. China’s total winter LNG supply, however, is predicted to climb to 20 million tonnes, up from last winter’s 17.9 million tonnes. In November 2018, China imported 5.9 million tonnes of LNG.

Media in China has reported that industry officials are not worried about capacity constraints at LNG terminals, claiming that the country’s 21 receiving terminals are operating well below their capacity. The plants have a combined import capacity of 64.7 mtpa. China has not experienced any supply shortages so far this year, partially thanks to the relatively warm winter, they added. China’s northern cities can now access multiple gas supply sources, including PetroChina’s West-East Pipeline network, LNG imports as well as locally produced gas from on and offshore fields.

By Tim Daiss for Oilprice.com

More Top Reads From Oilprice.com:

- Darkening Outlook For Global Economy Threatens Crude

- OPEC’s No.2 Boosted Production, Exports Just Before Cuts Began

- Something Extraordinary Is Happening In Jet Fuel Markets