A new report from Rystad Energy identifies five vital themes that will shape global gas markets in 2019.

Significant LNG production growth, the rise of US gas to challenge Russian dominance in Europe, insatiable demand in Asia, price pressure in selected regions, and a need for final investment decisions on planned liquefaction plants are the key market-movers identified in the report.

“The global market for liquefied natural gas (LNG) is geared for substantial supply growth this year, mirroring a major increase in US liquefaction capacity. Asia’s appetite for LNG – while vast – is not likely to consume all of the additional volumes,” said Rystad Energy head of gas market research Carlos Torres Diaz.

“With increasing export capacity, US LNG might be in a position to pose a serious challenge to Russian gas on the European market this year. Prices will come under pressure due to the healthy supply situation but the market is expected to tighten again after 2022, meaning that investment decisions for new liquefaction projects are needed this year in order to satiate future demand,” Torres-Diaz added.

Theme 1: Ramp up in US and Australian LNG production

Global LNG production is expected to rise 11% and reach 350 million tonnes per annum (tpa) this year, as fresh liquefaction capacity is added, leading to a looser market. Total liquefaction capacity is set to increase to 434 million tpa in 2019, up almost 10% from 2018.

“This is mostly driven by the commissioning of US projects. The US is expected to see capacity more than double in 2019, thereby making it the country with the third-largest exporting capacity and pushing Malaysia into fourth place. Australia could also overtake Qatar as the world’s largest LNG exporter this year,” Torres-Diaz remarked.

(Click to enlarge)

Theme 2: Russia vs US in Europe

One of the key outstanding questions for 2019 is how much LNG Europe will import, and whether Russia will cut back on gas exports in response or rather try to maintain its market share despite the risk of undercutting prices.

Russian gas delivered to Europe has a low breakeven price of around $5 per million Btu. This compares to a long run marginal cost of between $6.00 and $7.70 per MMBtu for US LNG. Related: Venezuelan Oil Exports Plunge On ‘Harsher’ Sanctions

“Given the fast increase in supply, US sellers might be willing to sell spot volumes at a short run marginal cost level, which is closer to $5 per MMBtu, if they are unable to find enough demand in Asia. Such a scenario could see US volumes compete quite closely with piped imports this year,” Diaz said.

Theme 3: Continued surge in demand in China and rest of Asia

Total Asian natural gas demand is forecasted to increase to 884 Bcm by 2019, driven by higher consumption in China and selected other countries. China, already the world’s largest gas importer, is expected to import around 87 Bcm of LNG this year, an increase of 21% from last year.

“South East Asian demand tends to be more sensitive to prices, but could be supported by a low-price environment helping absorb some of the new supply. As for Japan and South Korea, declining demand due to some nuclear restarts and milder weather may lead to lower LNG imports this year, which would compensate for the overall Asian increase,” Torres-Diaz added.

(Click to enlarge)

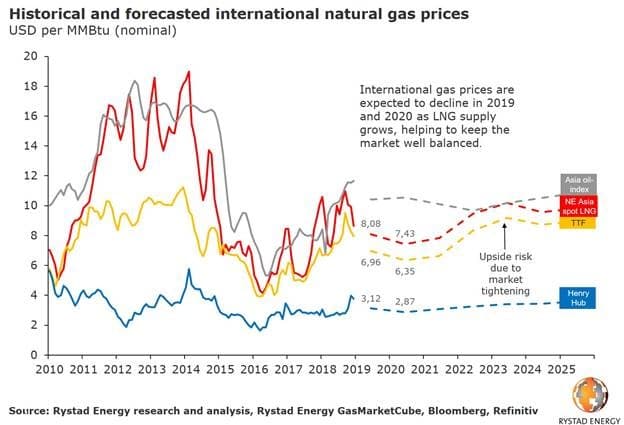

Theme 4: Will prices in Asia and Europe drop?

Market players have been expecting an oversupply of LNG over the past couple of years, but firming Asian demand has helped to balance the market.

“With the surge in US supply in 2019, LNG prices should come down compared to the levels seen over the past two years, especially since this has been a relatively mild winter and prices are already experiencing a counter-seasonal drop,” Torres-Diaz said.

(Click to enlarge)

Theme 5: Need for new LNG plants

The LNG market is poised to tighten again after 2022, and new liquefaction capacity is therefore needed to keep the market balanced. Projects that reach final investment decision (FID) in 2019 can be operational in 2024 at the earliest, emphasizing the importance of investment decisions being made during the course of this year. The market could tighten substantially in 2023 as rising Asian demand catches up with supplies, posing an upside risk for prices in this period.

“Projects developed by large E&P companies will have an advantage since they are not overly dependent on financing and long term agreements. Therefore, we see potential for Qatargas’ huge North Field Expansion project to be one of the first LNG developments to reach FID this year. Other projects closer to the Asian market, like Mozambique LNG, also have a competitive advantage that could help them reach FID earlier than some of the projects on the US Gulf Coast,” Torres-Diaz concluded.

More Top Reads From Oilprice.com:

- Big Oil Defies 40% Price Plunge, Posts Best Results In Years

- Why Are Asian Spot LNG Prices Plunging?

- Oil Prices Drop After Touching 2019 High