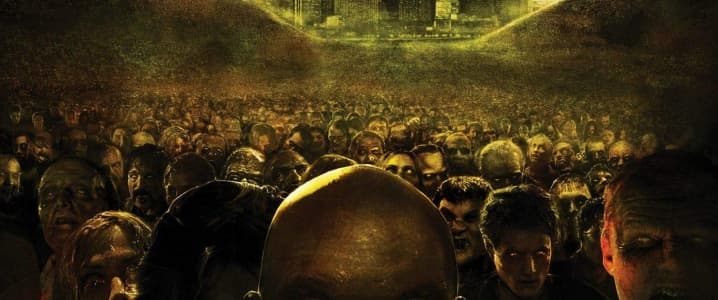

Investors may not realize it, but the Walking Dead is not the only zombie show running right now. The oil markets are at least as scary and have zombies that are much harder to kill than AMC’s popular program. While about 100 oil companies have gone bankrupt in 2015 and 2016, almost none of those companies have actually “died”. Instead, most of the firms are still pumping oil just as rapidly as before. That, in turn, has significant implications for investors in the market.

The 70 bankrupt firms are producing roughly 1 million bpd of oil – about the same level of production they had before bankruptcy. Those zombie firms represent around 5 percent of U.S. production and there are no signs of that production declining. The theory that bankruptcy would reduce oil production was always flawed. Producers have largely gone bankrupt under Chapter 11 provisions, which in turn has allowed them to keep producing oil and paying upkeep expenses, while at the same time shedding their debt burden.

Midstates Petroleum provides a good example of the problem with zombie production. The firm filed for bankruptcy on April 30th. It began drilling a new oil well the next day. While Midstates stopped running some rigs ahead of its bankruptcy filing, it kept another going after filing. Firms like Midstates have also continued to honor oil service and rig contracts based on drilling plans that were put in place months in advance. Those drilling plans enable the bankrupt firms like Midstates to continue generating revenue and cash flow on behalf of creditors. Bondholders and banks have every incentive to keep the oil and the cash flowing. Related: Is the Era of Oil Megaprojects Over?

The problem with zombie production is that like on the Walking Dead, zombies beget zombies. As oil prices have rebounded, zombies get more incentive to produce which in turn keeps prices from rebounding to profitable levels for most firms. That in turn leads to more bankruptcies and more zombies, and the cycle continues.

The zombie problem is set to become even more acute if Schlumberger, Haliburton, and Baker Hughes make good on the recent implied threat to begin adhering to greater price discipline. Schlumberger’s CEO was recently quoted as saying that the company planned to only take on profitable contracts going forward, and that they were willing to give up market share if it meant avoiding deals that were not justified by the economics. In other words, pricing concessions are a thing of the past. If the major oil services firms hold to that line, then many of the productivity gains and cost cuts that have let E&P firms survive the downturn could prove illusory. Removing the armor of cost cuts would leave the market more exposed to the currently stagnant and still weak oil price. Without that armor, zombies may have greater power in the market.

The reality is that these zombie companies are a true nightmare for the oil markets. Being “dead” already, they have nothing to lose and so there only goal is to keep producing as much as possible as fast as possible. Without a head (executive) to take out, the markets can do little but watch in horror as zombie producers keep eating away and destroying the brains of the oil market trying to rationalize production and prices.

By Michael McDonald of Oilprice.com

More Top Reads From Oilprice.com:

- Will Oil Majors Ever Recover?

- Iraq Publishes Oil Data Never Seen Before To Prove OPEC Wrong

- Oil Prices Slammed By Higher OPEC Exports