Mozambique’s failure to provide sufficient security to the operators of Mozambique and Rovuma LNG has triggered ample speculation in oil and gas market lobbies as potential investors assess the risks of East Africa degenerating into long-standing conflict. Although Maputo has suffered a lot more than any other adjacent country and still struggles to control the province of Cabo Delgado, the revival of Christina-Muslim tensions in Mozambique’s most oil-prolific territories also bodes well for Tanzania just across the border. To be fair, Tanzania’s prospect of kickstarting its upstream sector was debilitated long before Ansar al-Sunna appeared on the horizon, meaning that seeing its plentiful hydrocarbon resources moving closer to the commissioning part will remain a Sisyphean task.

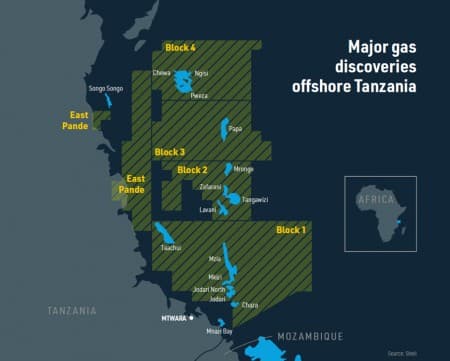

Looking just at Tanzania’s resource potential, one wonders how come this African country remains so devoid of media publicity. Discoveries in Mozambique’s Rovuma basin in the 2000s have compelled oil companies to seek for further oil across the border in Tanzania, Rovuma itself is a river that separates the country countries and forms the basis of their maritime border. Up to 2010, Tanzania was home to 2-3 mid-sized onshore gas fields that were utilized for domestic purposes – within some 3-4 years the country increased its aggregate gas reserves eightfold to more than 40 TCf and freeing up drillers’ imagination on how much gas might actually be in its offshore zone. A total of 16 discoveries was made in 2010-2015, with operators ranging from Statoil to BG Group (now part of Royal Dutch Shell) and Ophir.

Equinor remains the largest acreage owner in offshore Tanzania, boasting some 18 TCf discovered across 8 fields) and describing the sandstone reservoirs it has encountered along its acreage as having excellent quality. Within Block 02 the Norwegian NOC is partnered by the US major ExxonMobil that also happens to have interest in Mozambique’s LNG projects, eliciting the inevitable question whether it would want to run the risk of competing two of its own assets in an environment that is by definition constrained by relatively high costs of extraction. Regardless of the exact stakeholder composition, Tanzania’s favorable location vis-à-vis South and East Asia, i.e. the main prospective market for its LNG exports, as well as its own utilization of natural gas in electricity generation (accounting for roughly 50% of its electricity output), point towards a bright future for gas, provided the economics work for the offshore fields.

Graph 1. Map of Tanzania’s major gas discoveries.

Source: Natural Gas World.

Should Tanzania witness a string of FIDs on the fields discovered, the idea of creating a liquefaction terminal in Lindi, a port town in the southeastern part of the country where the gas would be aggregated and processed before the liquefaction might take a resolute step towards materialization. It was assumed that Lindi LNG would have three or four trains and a total capacity of 7.5 or 10mtpa LNG. Considering the assumed cost of $30 billion for Lindi LNG, international majors have somewhat unsurprisingly shied away from committing to Tanzania’s LNG – Equinor has even dropped it from its 2020 balance sheet, saying that for now it would rather negotiate the most suitable financial terms that would allow Block 2 fields to be launched. Officially Lindi LNG was expected to start the construction phase in 2022 and start up in 2028, however the coronavirus delays might push the commissioning date even further out into the future.

Tanzania’s challenges in developing its offshore oil and gas resources remain multifaceted and might be best assessed as belonging to three main categories – structural, psychological and technological. The structural challenges revolve around the ineluctable competition between Tanzania’s LNG with Mozambique’s two concurrently developed LNG projects and the fact that Mozambique has so far outclassed its neighbor in terms of gas reserves in place. Mozambique also happens to enjoy the advantage of a more stringent and delineated set of upstream terms, most notably it has set the domestic NOC participation at 10% whilst Tanzania regulates it at 25%. The psychological effects hinge on the 3-year hiatus in offshore exploration drilling (as well as spudding appraisal wells) further aggravated by safety concerns of the COVID-era.

Interestingly, the last exploration well (Pilipili-1) that Statoil spudded in February 2018 turned out to be a gas discovery and was assumed to be commercial, hence it cannot even be said that the drilling halt was triggered by unfavorable results. Arguably the hardest task to master would concern the technological side of extracting gas in Tanzania’s offshore. The thing is that in contrast to Mozambique where most of Rovuma Basin discoveries are located in moderately deep depths, the heretofore discovered gas bounty of Tanzania tilts towards the ultra-deepwater. For instance, Tanzania’s largest gas find Zafarani was drilled in water depth of 2400 metres, whilst Rovuma fields in offshore Mozambique are within the 1000-1500 metres range. This means that higher cost of extracting the gas from ultra-deepwater fields will put Tanzania in a competitive disadvantage to Mozambique.

This being said, the prospect of Tanzanian LNG taking its rightful place under the sun is by no means lost. Tanzanian authorities have plentiful instruments to aid the process, for instance forgoing its insistence on the oil companies’ adhering to Tanzanian law and disallowing any foreign court of justice might alleviate oil companies’ concerns that upstream terms remain vulnerable to arbitrary government changes. Without a tangible government push the move from its current on-hold status towards actual construction seems somewhat utopian. It has taken the Tanzanian authorities 2 years to review its own Production Sharing Agreements, only to be subsequently delegated to the Prime Minister’s Office for further reviewing (already taking another year). This dillydallying needs to stop if Tanzania wants to appear on the global LNG map.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- Is This Oil Rally The Start Of Something Much Bigger?

- Texas Winter Storm Highlights The Importance Of Fossil Fuels

- What The Media Isn’t Telling You About Texas Blackouts