Seven years into the Syrian civil war and hundreds of thousands of casualties, the conflict is presumably entering its final stage. At the start of the uprising during the Arab Spring seven years ago, few could have predicted the current state of the participating states. The Syrian regime is in a comfortable position where it does not face an existential threat anymore, but merely strategic choices to optimize its end result.

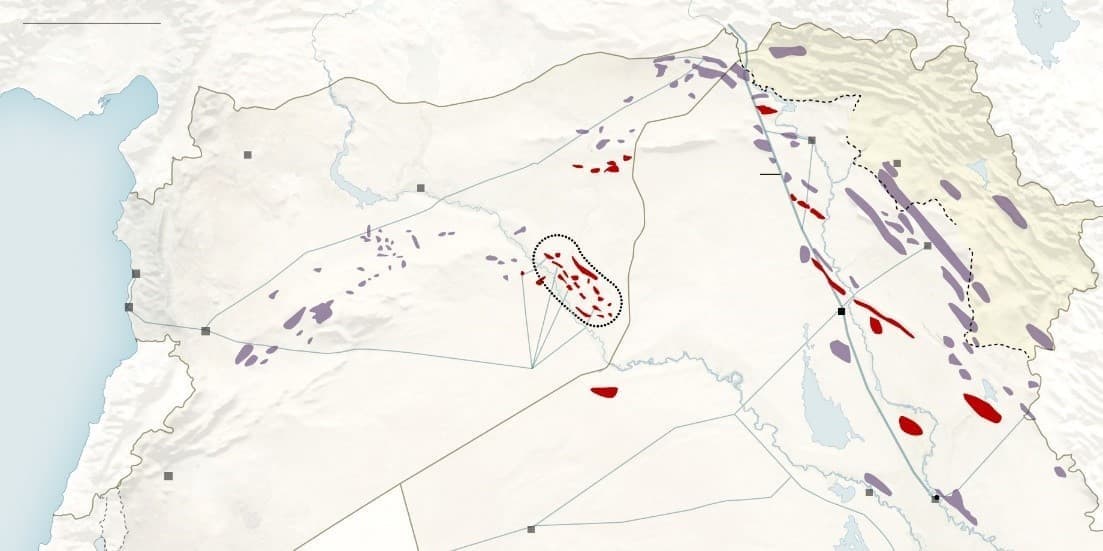

A few remaining major assets are the oil and gas fields in Eastern Syria controlled by the SDF which contain a significant part of the energy resources of the country. Signs have been appearing that both parties prefer negotiations over a military confrontation. However, the reason behind it differs for Damascus and the SDF.

The decision of Putin to send in Russian troops created a turning point in the crisis. It set in motion an unlikely chain of events that changed the configuration and position of involved parties. Combined with the unwillingness of the U.S. to react in kind and confront its adversaries, created an opportunity for Russian and Iranian supported forces. The financial and material support of Arab countries to rebels proved insufficient, effectively sidelining Arab Gulf involvement. The success of Assad’s forces and radicalization of rebels pushed the U.S. towards the Kurdish YPG in northeastern Syria, which led to the creation of the multi-ethnic but Kurdish dominated Syrian Democratic Forces in October 2015.

Two separate developments have led to the Syrian government in Damascus and the Kurds to negotiate on the status of SDF held territory. First, the success of the SDF in northern Syria and the affiliation of the YPG with the PKK created fear with Ankara on the destabilizing effect on its own Kurdish population. Second, the attack on Afrin and the settlement with the U.S. to withdraw Kurdish forces from Manbij created uncertainty with the YPG regarding continued support from Washington in the face of Turkish aggression.

Although Western Syria is considered ‘valuable Syria due to its concentration of large cities, infrastructure, and industry, the east contains other vital resources: energy. The cost of reconstructing Syria is estimated at $250 billion. One of the options to earn some hard currency is the energy sector.

Before the civil war, Syria produced 380,000 barrels/day and an all-time high of 667,000 in 2002. The war has ravaged the industry, which currently produces just 15,000 barrels/day. Gas production has been hit less hard as it declined from 8 bcm/year before the war and currently produces 3.5 bcm/year.

Related: A Price Spike Looms For Natural Gas

In January 2018 the inevitable happened and a significant development for the future of the energy industry in the country with the signing of an energy cooperation framework with Russia. With this agreement, Damascus provided Russia with the exclusive right to produce oil and gas including the right to construct infrastructure, provide energy advisory services, and training of Syrian oilmen.

Damascus and the SDF have realized in the past that they need each other when it comes to exploiting these resources. While the SDF controls most of these fields, transporting them to markets is another story as existing infrastructure is constructed to facilitate industrialized Syria in the west or export to international markets via port cities on the Mediterranean. After the collapse of ISIS in 2017 and the seizure of the Conoco gas processing facility and field northeast of Deir Ez-Zor, SDF forces reached an agreement with Damascus and handed over the assets. Competition concerning other fields remained though.

(Click to enlarge)

Pressure from Turkey and uncertainty on the future of U.S. forces in Eastern Syria have forced the SDF, but mainly the Kurdish YPG faction within it, to recalculate its strategic position. Ankara will never tolerate the creation of an autonomous, let alone independent, Kurdish region adjacent to its southern border. The invasion of Afrin and the deal with the U.S. to chase away Kurdish forces from Manbij is proof of Turkish red lines.

Related: Russia’s High Risk Global Oil Strategy

Unreliability on the U.S.’ part due to statements by President Trump do not strengthen the position of the YPG. The U.S. President has claimed before to leave Syria as soon as possible: “I want to get out, I want to bring the troops back home, I want to start rebuilding our nation”. In case this does happen, the forces that brought down IS will be facing pressure from all sides, including Assad’s forces.

Although Assad has stated to retake all areas within Syria, by force if necessary, the costs and availability of alternatives create an opportunity. Damascus knows that the Kurdish YPG is a different kind of organization than what they've encountered in other areas: a battle-hardened and well-organized force of thousands. Furthermore, Russia does not support such a move as it would lengthen a costly war and potentially push the Kurds to make for concessions with alternative players in order to consolidate their gains.

With another playbook on the table, both parties have started exploratory talks on the future of Eastern Syria. The alternative is a confrontation, which would weaken both parties in an area where threats remain from both neighboring countries and Islamic militants. The stakes are high, but so are the gains from peaceful cooperation and the efficient exploitation of Syria oil and gas resources.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- A New Booming Market For U.S. Crude Exports

- Russia Reverses Almost All Its Oil Production Cuts

- Falling Rig Count Supports Oil Prices

Syria was never a major oil and gas producer even before the civil war. Its oil production at the start of 2011 averaged between 380,000 barrels a day (b/d) and 400,000 b/d from which some 100,000 b/d were exported to the European Union (EU). The rest was mostly consumed domestically. Proven reserves are 2.5 billion barrels (bb).

Syria’s offshore waters contain a sizeable chunk of the oil and gas reserves in the eastern Mediterranean estimated by the US Geological Survey (USGS) at 132 trillion cubic feet of gas and 1.7 bb of oil.

The signing of the energy framework agreement between Russia and Syria in January 2018 recognizes Russia’s efforts in enabling the regime to stay in power by the diplomatic, military and economic support Russia has provided Syria during the civil war.

Under the agreement, Russia has the exclusive right to explore for oil and gas in Syria including Syria’s offshore resources in the eastern Mediterranean and produce oil and gas including the right to construct infrastructure. Syria badly needs Russia’s investment and technical know-how in order to rehabilitate its oil and gas industry and get production to its pre-civil war levels.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London