China’s rise as a global economic superpower has brought with it an ability for the nation to utilize its economic dominance for geopolitical purposes.

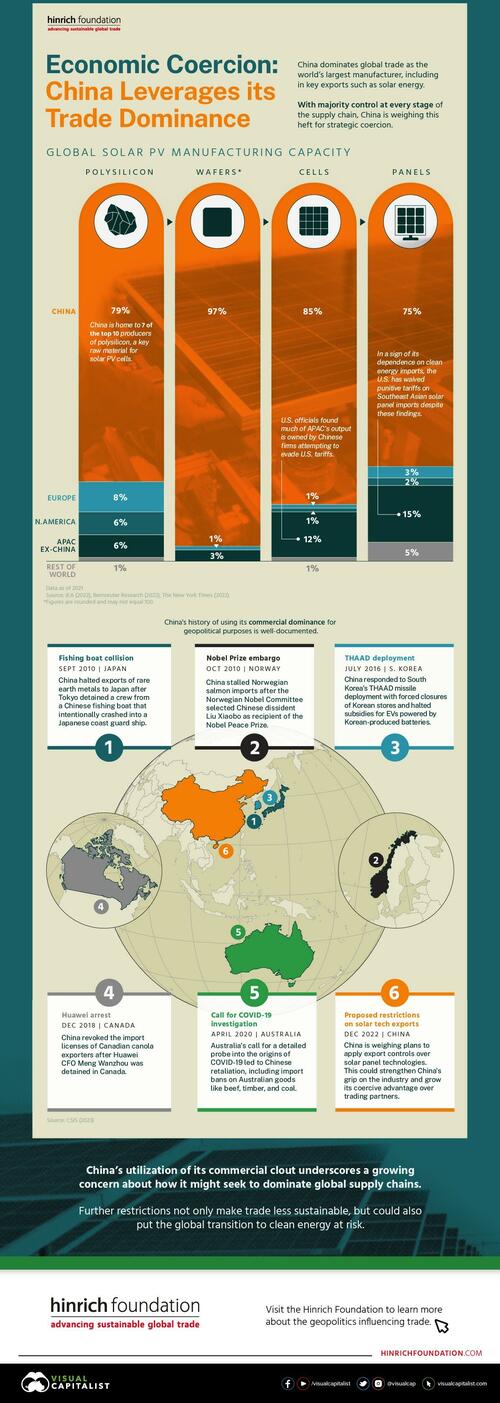

As Visual Capitalist's Marcus Lu shows in this infographic, sponsored by The Hinrich Foundation, China’s dominant position in the solar photovoltaic (PV) supply chain has used as leverage against countries that are dependent on it for clean energy.

Dominance in the Solar Supply Chain

Solar energy is playing a significant role in the green energy transition, and as this infographic shows, China’s dominance in the sector is clear.

The solar PV supply chain starts with polysilicon, a key raw material needed to create wafers. China is home to seven of the top 10 producers of polysilicon, which includes companies like Tongwei Solar and Asia Silicon.

Where China is most dominant though, is in the manufacturing of wafers and cells. This is partly because it’s more economical to make these components close to wherever polysilicon is being produced.

The second-largest producer of cells and panels is the APAC region (ex-China), at 12% and 15% of total capacity. However, according to U.S. officials, much of this output is actually owned by Chinese firms attempting to evade U.S. tariffs.

While these companies would normally be subject to higher tariffs, the Biden administration has paused any tariff increases for the next two years. This can be interpreted as a sign of the country’s dependence on China for clean energy infrastructure, which could prove problematic given China’s history of economic coercion.

Leveraging Trade for Geopolitical Purposes

The second part of this infographic highlights past instances where China has used its commercial dominance for geopolitical purposes.

For example, in October 2010, the Norwegian Nobel Committee awarded the Nobel Peace Prize to Liu Xiaobo, a jailed Chinese dissident. China began stalling Norwegian salmon imports in response, and Norway’s market share of salmon exports to China fell from 92% in 2010, to 29% in 2013, according to the Financial Times.

China took similar actions towards Australia in April 2020 after the island nation called for a detailed probe into the origins of COVID-19. Import bans on Australian goods like beef, timber, and coal were announced in retaliation. These restrictions were eventually lifted in May 2023.

Given the massive size of China’s economy, import bans such as these can heavily impact a trading partner’s industries.

More recently, China announced in December 2022 that it would be looking into new export controls over solar panel technologies. Given China’s already tight grip over the solar PV industry, this move could expand the nation’s playbook when it comes to economic coercion.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil, EVs, And Big Tech Hit The Ground Running In The Second Half

- Tesla Stock Climbs 6% After Beating Analyst Delivery Estimates

- Why The EU Is Hesitant To Implement Its New Sanctions Framework