Question: Mexico's Pemex announced in late May that it is close to reaching a deal with Chinese companies to create a Sino- Mex Energy Fund worth up to $4 billion dollars to invest in and finance large-scale infrastructure projects, the largest Chinese investment fund in Latin America to date. What opportunities does Mexico's energy sector offer Chinese companies, and what is behind the move? What does Mexico stand to gain from such a fund?

Answer: Evan Ellis, assistant professor of national security studies at the William J. Perry Center for Hemispheric Defense Studies in Washington:

"The proposed $4 billion fund is similar to the $10 billion China Development Bank loan to Petrobras in 2009. With Pemex, as with Petrobras, the deal provides symbolic 'fruit' for the deeper and better relationship sought by both the Mexican and Chinese presidents. As with Petrobras, Pemex has good access to Western financial markets, and thus doesn't 'need' Chinese financing as does PDVSA in Venezuela.

Yet the Chinese line of credit is welcome for a company struggling to invest to offset declining production from its core mature assets in the Campeche basin.

Future oil shipments to China would also offset declining petroleum exports to the United States and the persistent Mexican deficit with China in manufactured goods. For the PRC, the loan offers 'insider' access to Pemex and the Mexican oil industry, useful to the Chinese national oil companies (NOCs) in evaluating future acquisitions and bids, as ongoing reforms open up the Mexican petroleum sector to foreign investment, just as the CDB loan to Petrobras arguably paved the way for Chinese acquisitions of Repsol and Statoil assets in Brazil, and most recently, CNPC and CNOOC participation in the Libra auction.

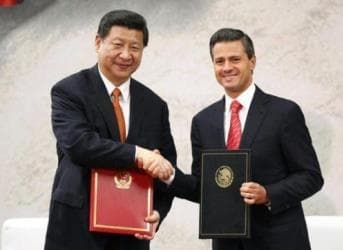

The signing of the deal, which was accidentally disclosed in May, was probably anticipated as a highlight of President Peña Nieto's trip to the PRC, programmed for this November.”

Related Article: Could Gang Violence End Mexico's Shale Dream?

Answer: Sun Hongbo, associate professor at the Institute of Latin American Studies of the Chinese Academy of Social Sciences in Beijing:

"Mexico is now becoming an important potential country for China to extend its energy cooperation in Latin America. In view of the current Mexican energy reform, both Pemex and Chinese national oil companies expect to tap great commercial opportunities within the oil sector, possibly supported by the future Sino-Mex Energy Fund. More importantly, Mexico regards China as a necessary partner to diversify its foreign investment and crude oil export markets.

In 2013, Pemex signed crude oil trading, financing and other cooperation framework agreements with Chinese companies and financial institutions. The energy interests of both China and Mexico have good convergence in energy trade, finance and infrastructure building because of the two countries' relative economic advantages and the complementarities in the energy industry.

In fact, Chinese national companies have entered into Mexico's upstream oil market by providing technical services in the last decade, and Mexico has been exporting crude oil to China since 2009. Considering the decline of the proven oil reserves and production, Mexican oil exports to China will not increase rapidly in the short term.

Chinese companies may consider financing, technical services and equipment trade and energy infrastructure participation as cooperation priorities. On June 13, President Xi Jinping

emphasized the importance of international energy cooperation and effective use of international resources for China’s energy security.

He also stressed that China shall strengthen international energy cooperation in a comprehensive way and safeguard China's energy security under open-market conditions. Without any doubt, Chinese companies will look forward to diverse cooperation deals with Mexico if the Mexican investment environment is favourable.”

Answer: Esenaro, Mexico City based lawyer and business consultant:

"The Chinese are looking for infrastructure projects around the world, and Latin America has been especially open to them. Considering the participation of Xinxing Ductile Iron Pipelines, they could be looking to supply for the upcoming five natural gas pipeline projects.

Mexico announced a $590 billion infrastructure plan for the next six years, of which 51 percent will be for Pemex and CFE, and 5 percent for hydraulic facilities.

Mexico on the other hand needs to secure funds for this plan to work on time. Getting infrastructure money from taxes is not a safe bet. Delays could be catastrophic for 'Mexico's moment,' as competition in Latin America and Asia is putting pressure on Mexican economy. Mexico has been working on expanding oil sales to Asia as the energy reform is being approved in full.

China has shown interest in Pemex's supply and a free-trade agreement. A first sale has been shipped already. Hong Kong plays a key role for Mexico as a regional financial hotspot. Mexico is now integrated into a common NAFTA energy market and has a great opportunity with the United States due to the Keystone XL situation.

Related Article: Mexico Shale Gas Industry and Energy Reform

The United States is going for an energy and manufacturing moment, though. Thus, Mexico needs to remake its export-first strategy with imported components and boost its domestic market. An encouragement policy for the middle class could help. Energy will work to leverage NAFTA economies, and China wants to profit from it. For that, it needs a foot in the region. That foot could cost $5 billion.”

Answer: Philip Andrews-Speed, principal fellow at the Energy Studies Institute of the National University of Singapore:

"This move is but one component of a broader political and economic rapprochement between China and Mexico. Mexico has large reserves of oil and gas offshore, which are now being opened to foreign investment, and may also have significant onshore resources of unconventional oil and gas.

For China's NOCs, investing in Mexico is a logical continuation of its exploration and production programs in Latin America, which date back more than 20 years. Over the last 5 years, the NOCs have increasingly focused their attention on large-scale, high-value projects, and Mexico offers such opportunities.

In addition to oil and gas exploration and production, Mexico offers opportunities to China's electrical power companies in power generation and transmission. The State Grid Company of China, in particular, has been investing outside China in recent times. The new Sino-Mex Energy Fund is relatively small in comparison to the total capital investment required by Mexico's energy sector over the next decade, but its establishment demonstrates a commitment by China and by Chinese companies to invest in Mexico.

In addition to this fund and to investment by Chinese energy companies, we might expect to see a loan-for-oil arrangement, which is one of China's favored instruments for securing overseas oil supplies.”

Q&A featured in Inter-American Dialogue’s Latin America Advisor - Energy