Look out, Tesla. There could be another mainstream FOMO electric vehicle stock coming.

VW common shares soared as much as 29% this morning - the most since the company's historic 2008 short squeeze - and VW preferred shares were up 6% after the company upgraded its profit guidance laid out plans for expanding the company's EV offering out through 2030 which also includes dethroning Tesla as the reigning EV world champ. VW hosted its "Power Day" yesterday and revealed plans to build six "gigafactories" with a total capacity of 240 gigawatt hours per year.

"The company is aiming to achieve an operating margin between 7% and 8% after 2021. VOW also confirmed it is looking to finish the year at the upper and of a 5% - 6.5% range in 2021. Higher profitability will be achieved through lower costs with as much as 2 billion euros savings identified for 2023 compared to 2020," according to StreetInsider.

Chief Executive Herbert Diess said on CNBC: “This period is probably the most crucial for the whole industry. Within the next 15 years we will see a total turnover of the industry. Electric cars are taking the lead and then software really becomes the core driver of the industry.”

“Electric cars already today are very, very competitive and they’re becoming more competitive over time. that gives us the certainty that this is the right way going forward. Electric cars actually will bring down the cost of individual mobility further,” he continued. Related: Another Investment Bank Is Betting On $100 Oil

VW also disclosed it was working on a "new unified battery cell" to be launched in 2023. Diess said: "The one size fits almost all cell design will radically reduce battery costs ... by up to 50% compared to today. Lower prices for batteries means more affordable cars, which makes electric vehicles more attractive for customers."

VW is a "less liquid" share listing, as Bloomberg notes that it is "owned by major shareholders Porsche SE, the German state of Lower Saxony and Qatar".

Does Volkswagen have a Master of Coin? Didn't think so. https://t.co/Y0E0jIKyt8

— Charley Grant (@CGrantWSJ) March 16, 2021

The move is also part of a general hysteria surrounding EV stocks. Recall, we wrote days ago that Rob Arnott of Research Affiliates referred to it as a "big delusion". Arnott's predictions could eventually rope in valuations across the board in EVs, not just for any one player.

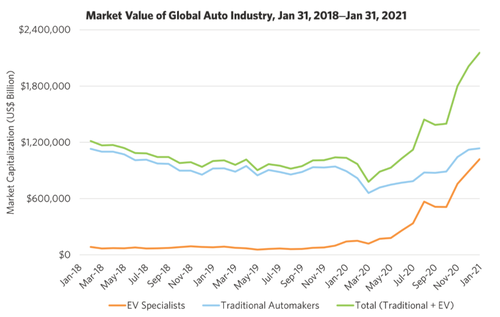

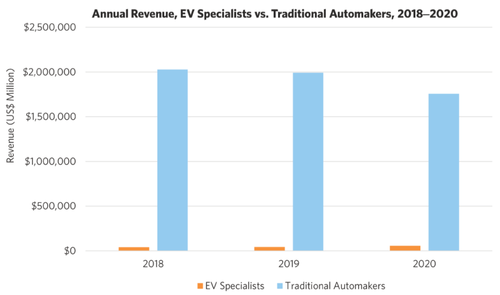

Current valuations in EVs are due to "pricing delusion", Arnott said in a new paper calling EVs the "Big Market Delusion" last week. “The electric vehicle industry, with its astronomical growth in market-cap over the 12 months ending January 31, 2021, is a prime example of a big market delusion,” he wrote.

In his paper, he defines a big market delusion as "when all the firms in an evolving industry rise together, despite that fact that they are competing against each other." He used airlines as an example of the BMD in the past. Technology “does not translate into great fortunes for investors unless it is associated with barriers to entry that allow a company to earn returns significantly in excess of the cost of capital for an extended period,” he argued.

He also singled out the valuation of Tesla, which had grown to be "almost on par" with the $1.1 trillion value of traditional automakers. "At that market capitalization, Tesla accounted for about 75 percent of the total EV group’s market value and 35 percent of the market value of the entire auto industry. Such an immense market capitalization makes sense only if the expectation is that Tesla will come to dominate the entire auto industry, not just the EV market.”

Arnott said that valuation only makes sense if Tesla is taking away market cap from other auto manufacturers, which it isn't. “However, the reverse is true. While Tesla’s stock price has been skyrocketing, the prices of competing EV firms have been too.”

“All of these companies are priced as if they are going to be huge winners, but they are competitors. They cannot all assume dominant market share in the years ahead!”

By Zerohedge.com

More Top Reads From Oilprice.com:

- Oil Prices Drop As Traders Take Profits

- How Middle East Producers Are Pricing Their Oil

- The Global Energy Transition Could Transform African Economies

Good bye, diesel and gasoline demand!