Rumors and speculation appear to be driving oil markets this week, adding to volatility as the world awaits a potential ceasefire agreement between Israel and Hamas.

Friday, February 2nd, 2024

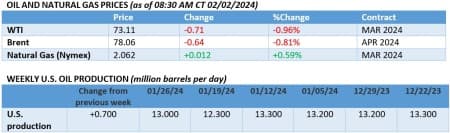

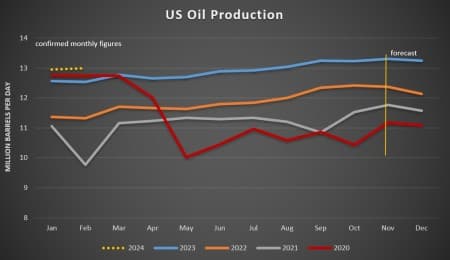

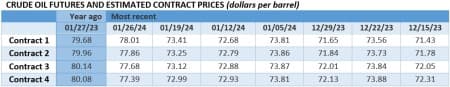

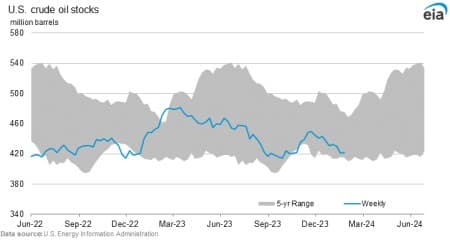

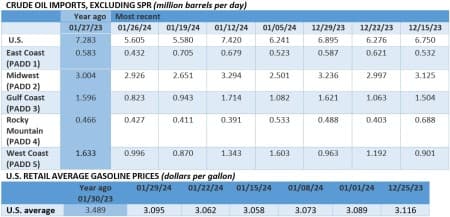

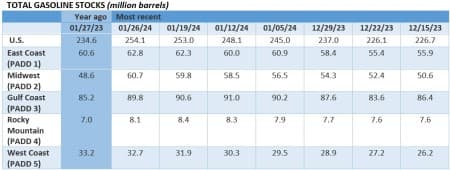

Speculation has overshadowed market fundamentals this week, with unsubstantiated reports of an impending ceasefire between Israel and Palestine dragging Brent futures below $80 per barrel again. On the fundamental side, with OPEC+ rolling over its policy and refusing to change its pre-set course, unforeseen refinery outages in the United States might have an even more lasting impact on prices by weakening US demand even further.

US Senate Seeks to Overturn Biden’s LNG Pause. The US House of Representatives will seek to overturn the Biden administration’s halt on new LNG project approvals next month, accusing the White House of appeasing radical climate activists, although it is unlikely to get past the Senate.

OPEC+ Sticks to Course, Flags March Meeting. This week’s OPEC+ ministerial meeting made no changes to the oil group’s production policy, with participating top officials indicating they will meet again in early March to decide on an extension of the 2.2 million b/d cuts into Q2.

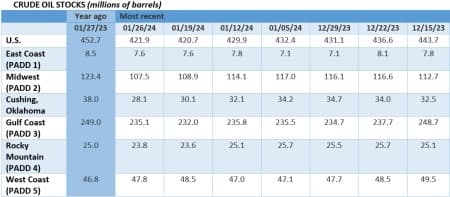

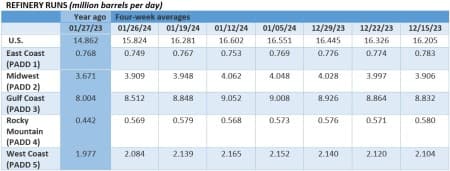

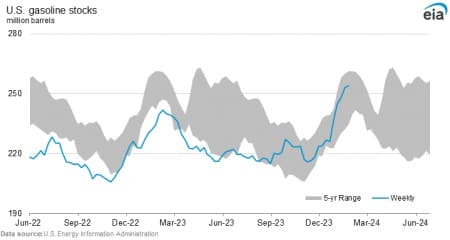

BP’s Whiting Refinery Shutdown Rattles Midwest. A transformer failure caused a plant-wide power outage at BP’s (NYSE:BP) Whiting refinery in Indiana, forcing the UK oil major to halt all operations at the Midwest’s largest downstream asset, boasting a capacity of 435,000 b/d.

Westinghouse Excluded from Czech Nuclear Tender. In another blow to US nuclear firm Westinghouse, the Czech government has excluded it from its tender to build a new 1,200 MW reactor saying it failed to fulfil its conditions, leaving only Korea’s KHNP and France’s EDF.

Saudi Aramco Mulls $10 Billion Share Sale. Bloomberg reports that Saudi Arabia’s national oil firm Saudi Aramco (TADAWUL:2222) is considering a secondary share offering worth up to $10 billion as early as February, capitalizing on its market value of more than $2 trillion.

Germany to Sell Nationalized Gas Giant Soon. The German government is considering selling part of its 99% stake in distressed utility firm Uniper which Berlin spent $15 billion on to bring back to life, although market participants believe Germany would need to offer discounts.

Diverting Tankers Turn to Fast Steaming. Tankers that are diverting around the Cape of Good Hope have been increasingly fast steaming, sailing above normal speeds, to cut back on delivery delays, with container ships sailing at 22 knots, boosting marine fuel demand in Africa further.

Arctic Hurricanes Boost Scandinavia’s Wind. Norway registered the highest-ever wind speeds this week as hurricane-like wind gusts swept through Scandinavia, with record wind generation in the Nordics exceeding 29 GW and even turning power prices negative for a few hours.

Shell Plays Down M&A Pressures. The CEO of Shell (LON:SHEL) Wael Sawan indicated the UK-based oil major is not tempted to join the US shale patch’s acquisition frenzy, whilst its Q4 results surpassed analysts’ expectations at $7.3 billion despite multi-billion impairments.

Qatar Seeks to Expand Oil Output. QatarEnergy awarded service contracts worth $6.2 billion to develop the third phase of its key oil-producing asset, the offshore Al Shaheen field overlying its vast gas reserves in the sea, eyeing a production hike of about 100,000 b/d by 2027-2028.

India to See Coal Power Bonanza in 2024. India will commission an additional 13.9 GW of coal-powered generation capacity this year, marking the highest annual increase since 2019 and more than triple 2023 additions, as last year’s electricity demand surged 11% year-on-year.

Glencore Inks China Term Deal for Colombia Coal. More Atlantic Basin coal will be sent to China after Glencore (LON:GLEN) agreed to sell most of the production from its giant Cerrejon mine in Colombia to Chinese utility buyers and traders, up to 10-15 million tonnes across 2024.

Mining Giant Lobby for Silver to Become Critical. Top executives of 19 mining companies in Canada have addressed a letter to the country’s Energy Ministry saying that silver should be requalified as a critical mineral, prompting similar calls in the United States, too.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Set for a Weekly Decline on Hopes of a Gaza Ceasefire

- Fresh Sanctions Could Seriously Curtail Iran’s Surging Oil Exports

- Red Sea Crisis Tests China’s Sway in the Middle East