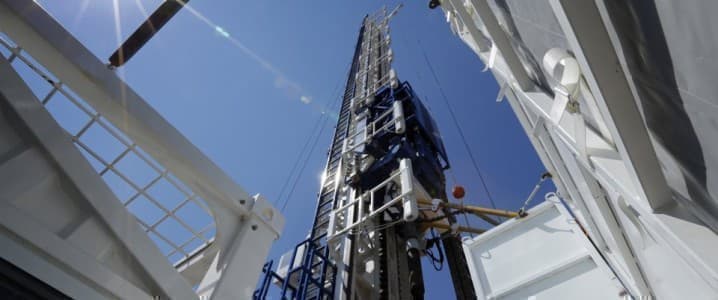

The number of active drilling rigs in the United States rose by 22 this week—the 16th straight weekly increase to the number of oil and gas rigs in the United States, and the largest single-week rise since February 2018.

The total rig count now sits at 635 as the price of a WTI barrel slipped this week from its multi-year highs.

Baker Hughes reported this week that the total active rig figure—oil, gas, and miscellaneous—is 238 rigs higher than the rig count this time in 2021.

Oil-directed rigs rose 19 to 516, while gas-directed rigs were up by 2 to 118. Miscellaneous rigs were also up 1.

U.S. weekly production of crude oil this week increased, breaking its recent downward trend. Crude production for the week ending February 4 rose 100,000 bpd to 11.6 million bpd, according to the Energy Information Administration.

The rig count in the Permian Basin rose by 7 this week, bringing the total rig count in the prolific Permian basin to 301. The nation's second most prolific basin, the Eagle Ford, saw its count rise by 4 to 54.

Primary Vision's Frac Spread Count, which tracks the number of completion crews finishing off previously drilled wells, shows that completion crews rose for the fifth week in a row by 3 to 264 for week ending February 4. The frac spread count is now up 89 from a year ago.

At 11:38 a.m. EST, oil prices were trending up the day, intent on setting multi-year records. WTI was trading at $91.80—up 2.14% on the day and down $1 per barrel on the week. The Brent benchmark traded at $93.25 per barrel at that time, up 2.01% on the day and down $0.25 per barrel on the week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- IEA: Chronic OPEC+ Undersupply Could Propel Oil Prices Even Higher

- Geopolitical Risk Premium Could Send Oil Prices To $120

- OPEC Gets Further Behind Oil Production Quotas