Argentina has often been held up as the next most likely location for a shale revolution, with some of the largest shale oil and gas reserves in the world.

Argentina could hold more than 800 trillion cubic feet of shale gas, more than the U.S., and second only to China, according to the EIA. Its shale oil resources, at 27 billion barrels, are also significant.

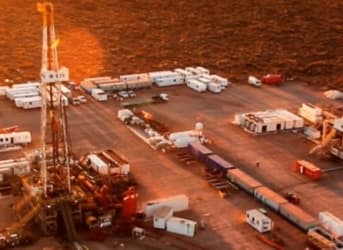

If Argentina is to succeed in developing its shale resources, the Vaca Muerta is where it will happen. The shale basin in central Argentina has been one of the most watched shale basins outside of North America, with significant interest and investment from major international oil companies including ExxonMobil, Royal Dutch Shell, Chevron, Wintershall, Total, and Russia’s Gazprom. Chevron’s $1.2 billion deal with Argentina’s YPF in 2013 raised expectations that the boom was not far behind. YPF says that the Vaca Muerta could require $200 billion in order for Argentina to erase its energy deficit. Related: Oil Majors Sacrifice Production To Protect Dividends

Despite the presence of international companies and the few hundred wells drilled to date, it is still early days. Production has ticked up, but the shale region has barely been picked over. Chevron and YPF are producing around 43,000 barrels per day of oil equivalent from the Vaca Muerta.

Low oil prices, however, are dampening activity in the country. YPF’s Miguel Galuccio said in April that, with oil prices so low, some wells are not profitable. “It is not profitable with an $11 million well and prices at $50 per barrel. We drilled our vertical wells with the expectation that they would be profitable at $84 per barrel and with wells that cost between $6.5 or $7 million,” he said. YPF has succeeded in bringing down the cost of drilling, but it is still shy of its target of $4 to $5 million per well, which would be much closer to the drilling costs in North America. Related: How Russia’s Oil Companies Are Defying Sanctions and Low Oil Prices

Producing oil in Argentina does have one unique benefit, however. The Argentine government regulates prices, allowing producers to sell oil at a set price of $77 per barrel, rather than the much lower international price. Brent crude, for example, has been selling for under $50 per barrel since early August. The fixed price effectively means that Argentine motorists are subsidizing drillers. Argentina does have much higher drilling costs and less infrastructure in and around the Vaca Muerta, but the regulated oil price offers one advantage for oil companies in Argentina when market prices collapse.

However, there could be quite a few changes in the works in Argentina with a presidential election set to take place in October. International companies in a variety of sectors, including oil and gas, are hoping that the new administration will be much friendlier to business, foreign investment, and capital flows. Current President Cristina Fernandez de Kirchner has been blamed for slowing investment. Her government has put in place capital controls, which is reviled by the capital-intensive oil industry. The government’s confrontation with debt holders, dating back to the country’s default more than a decade ago, has also locked Argentina out of international financial markets, making borrowing costs (and as a result, drilling costs) much higher.

The potential for a change in government has raised hopes that the much-anticipated energy bonanza in Argentina will kick into a higher gear. But the change could be a mixed bag for oil and gas companies. Related: Is This The Decade's Most Important Mining News?

According to several experts surveyed by Bloomberg, the new government could cut the regulated price for oil down to just $66 per barrel. Whether the new president is Daniel Scioli, the governor of Buenos Aires province and a member of the ruling party, or Mauricio Macri, a more business-friendly opposition candidate, changes are expected for the price of oil.

If that were to occur, it would significantly cut into revenues for oil companies operating there. YPF may be forced into spending by up to 20 percent next year, after hardly touching its budget for this year and despite major cuts by its international peers. A cut to the oil price would also force YPF to refocus its efforts on relatively more natural gas instead of oil. Natural gas prices are also regulated in Argentina, set at $7.50 per million Btu.

Ironically, while the cut to the regulated price would be negative for oil companies, it would amount to a more market-based approach for the government, something that the private sector has been clamoring for. So while the industry is eager to see a new president to replace the current one, it is not as if the drilling environment will improve on all fronts for the industry with a new government.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Exxon CEO: Alaska Is Its Own Worst Enemy

- How Much Longer Can Venezuela Keep The Wolves At Bay?

- With Shell’s Failure, U.S. Arctic Drilling Is Dead