Crude oil prices are expected to finish the week higher, but the price action late in the week suggests the market may be getting a little top heavy. Early in the week, crude oil surged to a five-month high and continues to hover around these levels, however, new concerns over future demand have slowed down the upside momentum on the daily chart.

Weekly Recap

Earlier this week, the Energy Information Administration reported that U.S. crude inventories rose to their highest level since November 2017. Additionally, U.S. crude output remained at a record 12.2 million barrels per day. However, U.S. gasoline stocks fell by a whopping 7.7 million barrels last week. This was more than enough to offset the crude oil build.

At the same time, the International Energy Agency (IEA) reported that OPEC production fell 550,000 bpd. The IEA also said that U.S. sanctions and power outages pushed OPEC member Venezuela’s crude output to a long-term low of 870,000 bpd, even lower than OPEC had reported the day before.

Support has been strong because supply is tightening. This is being supported by real supply data. Concerns over demand are just speculation. Earlier in the week, Bernstein Energy said in a note, “We believe global demand has another 10 million bpd…

Crude oil prices are expected to finish the week higher, but the price action late in the week suggests the market may be getting a little top heavy. Early in the week, crude oil surged to a five-month high and continues to hover around these levels, however, new concerns over future demand have slowed down the upside momentum on the daily chart.

Weekly Recap

U.S. West Texas Intermediate and international-benchmark Brent crude oil futures are trading higher on Friday, helped by better-than-expected trade balance data from China, which dampened concerns over a global economic slowdown. Prices also continue to be supported by the on-going OPEC-led supply cuts and the U.S. sanctions against Iran and Venezuela, which have helped tighten global supplies.

Prices plunged on Thursday as traders continued to react to rising U.S. inventories. The price action, however, suggests the selling may have been fueled by technical factors.

Earlier this week, the Energy Information Administration reported that U.S. crude inventories rose to their highest level since November 2017. Additionally, U.S. crude output remained at a record 12.2 million barrels per day. However, U.S. gasoline stocks fell by a whopping 7.7 million barrels last week. This was more than enough to offset the crude oil build.

At the same time, the International Energy Agency (IEA) reported that OPEC production fell 550,000 bpd. The IEA also said that U.S. sanctions and power outages pushed OPEC member Venezuela’s crude output to a long-term low of 870,000 bpd, even lower than OPEC had reported the day before.

Support has been strong because supply is tightening. This is being supported by real supply data. Concerns over demand are just speculation. Earlier in the week, Bernstein Energy said in a note, “We believe global demand has another 10 million bpd of growth, with over half from China.”

The Chinese economy is likely the key to future demand. Traders aren’t as bearish on China’s economy as they were near the start of the year. This is because a deal to end the trade dispute between the United States and China seems imminent, and China’s government made available massive amounts of stimulus to keep the economy afloat.

The markets may appear to be top heavy, but the selling pressure is not coming from the supply side although rising U.S. production remains a concern. The problem may actually lie within the price action. With the nearly four month rally at or near key technical resistance areas on the major charts, speculative buying seems a little scarce as investors are being forced to decide whether to continue to buy new strength or buy a pullback into a support or value zone.

Essentially, buyers may be seeing risk in buying strength or “chasing the market” higher nearly 120 days from a bottom and at current price levels.

Weekly Technical Analysis

June West Texas Intermediate Crude Oil

(Click to enlarge)

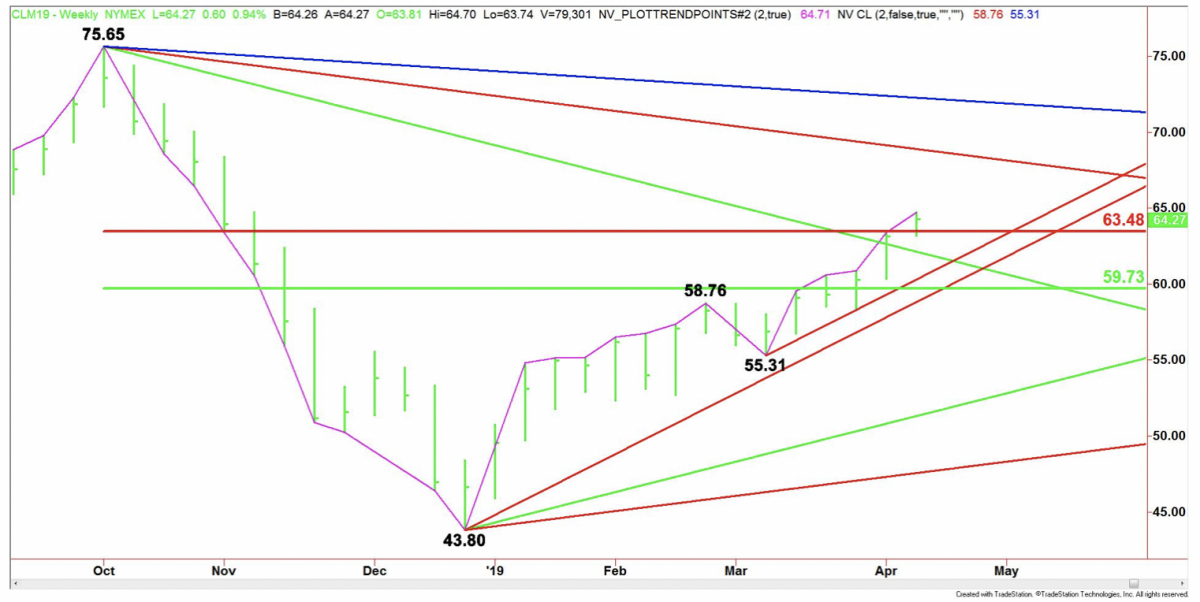

The main trend is up according to the weekly swing chart. The nearest main top target is $75.65. The trend will change to down on a trade through $55.31.

The main range is $75.65 to $43.80. Its 50% to 61.8% retracement zone is $59.73 to $63.48. This zone is controlling the longer-term direction of the crude oil market. Traders should treat this zone as support.

This week, June WTI crude oil crossed to the strong side of the retracement zone, putting it in a bullish position. A sustained move over $63.48 will continue to signal the presence of buyers.

If $63.48 fails as support, it won’t change the trend to down, but it will indicate the selling is greater than the buying at current price levels. If the selling pressure continues to increase, we could see a pullback into a pair of uptrending Gann angles at $61.31 and $59.80.

Since the main trend is up, buyers could show up on a pullback into $61.31 to $59.80. If these angles fail as support then look for the selling to extend into the 50% level at $59.73. Look for the start of a steep sell-off if $59.73 fails as support.

Weekly Forecast

Traders are trying to decide whether to buy strength or play for a pullback into a value area.

A sustained move over $63.48 will indicate that buyers are still interested in buying strength. In this case, they are going to try to continue to post higher-highs in order to continue the upside momentum.

If $63.48 fails as support then this will indicate that buyers are looking for value. In this case, they are likely to wait for a pullback into support levels at $61.31 to $59.73.

Despite the possibility of a short-term correction, there is nothing on the weekly chart that suggests the trend is getting ready to change to down.

Saudi-led OPEC is determined to continue with the production cuts in order to ensure that the global oil market is irrevocably balanced and prices are beyond $80 which is the level most of its members need to balance their budgets.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London