The US and its G7 partners have slapped more than 300 economic sanctions on Russia since the invasion of Ukraine over a year ago. Initially, Washington and Brussels pitched the idea of sanctions as a strategy to paralyze Moscow. However, Western sanctions have backfired as Russian companies are redrawing commodity flows from the West to Asia.

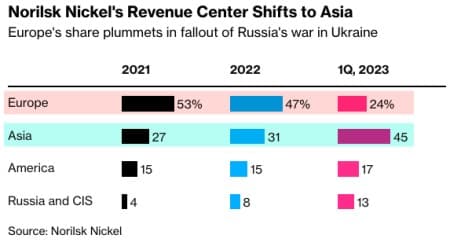

The latest example of global supply chains being rejiggered comes from Russia's biggest miner MMC Norilsk Nickel PJSC. Bloomberg said the miner recorded 45% of revenue from Asia for the first quarter of 2023. Traditionally, its revenue from Europe is the largest but plunged to 24%. Asia's revenue share has increased from 27% in 2021 to 31% in 2022 to 45% in 2023.

Nornickel controls about 7% of global nickel output and 40% of palladium. The US and UK have imposed sanctions on Norilsk Nickel's top shareholder and president, Vladimir Potanin. But no sanctions have been placed on the miner. However, the company faces challenges such as shipping, insurance, and logistics in getting products to Western countries, which is one of the main reasons the miner has easily found new customers in Asia.

Nornickel sought to increase sales to China this year, in some cases offering metals for yuan, people familiar with the matter said in March. Those prices are set in Shanghai, a sign of how the conflict is redrawing the global trade map for commodities and handing greater power to China, they said. --Bloomberg

Western sanctions have pushed Russia and China closer:

Chinese President Xi Jinping concluded his Russian visit on Wednesday without much progress on peace in Ukraine. China, however, has pushed for deeper trade and investment links with its northern neighbor using its own currency. That suggests the path of least resistance for yuan internationalization now runs through Moscow instead of London or Singapore. -- Bloomberg Markets Live reporter George Lei wrote in March.

Lei also noted the share of yuan in Russia's export payments has surged:

The share of yuan in Russian export payments surged 32-fold in 2022 to 16% by year-end, according to the Bank of Russia. Its use in Russian imports also jumped to 23% from 4%. Yuan savings accounted for 11% of Russia's total FX deposits as of January, compared with practically zero when the war broke out. The Chinese currency has also overtaken the dollar and euro as the most traded FX on the Moscow Exchange.

Western sanctions severely limited Russia's access to dollars and euros, forcing Russian companies to seek new business opportunities in Asia.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Are We Nearing An Inflection Point For Oil?

- European Natural Gas Prices Drop To The Lowest Level Since 2021

- China Is Breaking Records As Its Solar Industry Booms