Over the past two years, power prices surged across Europe. The value of front calendar year power futures doubled while spot prices witnessed increased volatility and extreme levels. The evolution of the supply-side stack and the behavior of demand will keep driving this move. In the UK, structural changes are paving the way for a greener and more secured electricity.

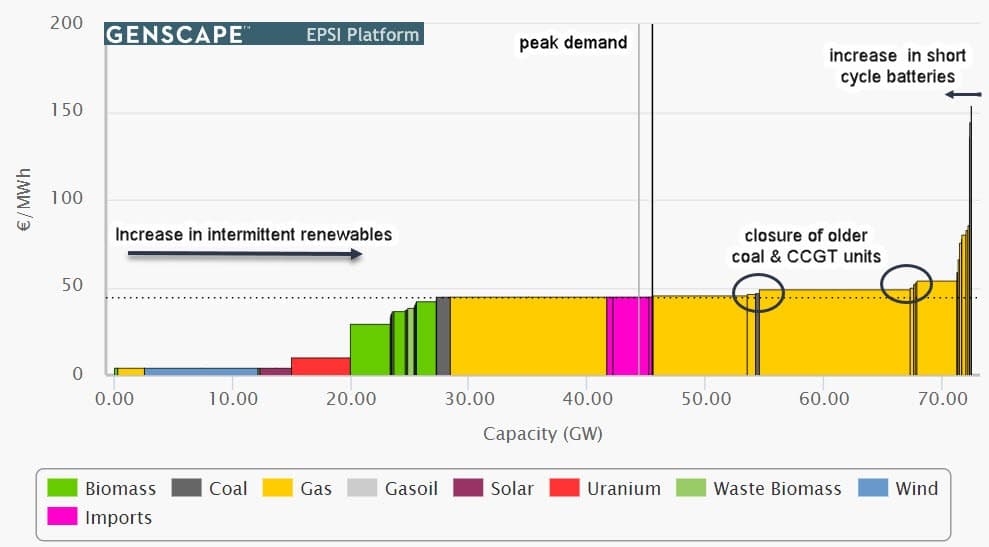

As current Co2 prices increase, the supply-side stack is showing around 40 gigawatts (GW) of closed-cycle gas turbine (CCGT) and coal capacity with similar variable costs. The direct effects of such a flat supply curve are a dampening of UK power price volatility and an increase of CCGT load factors, especially compared to the continent.

The flattening of the supply curve causes rent decreases for conventional generators since there are no higher-cost plants to set the marginal price. To increase their revenues, conventional generators must capture the higher power prices, and times of high volatility when there is a “high net system demand” (e.g. low wind, no solar, or high demand).

Genscape’s EPSI fundamental model shows the curve flatten in the middle of the stack and fuel peaks on the right-hand side (Figure 1 below).

Figure 1: Genscape’s EPSI Platform shows the UK merit-order on 15 October at 19:00. Click to enlarge

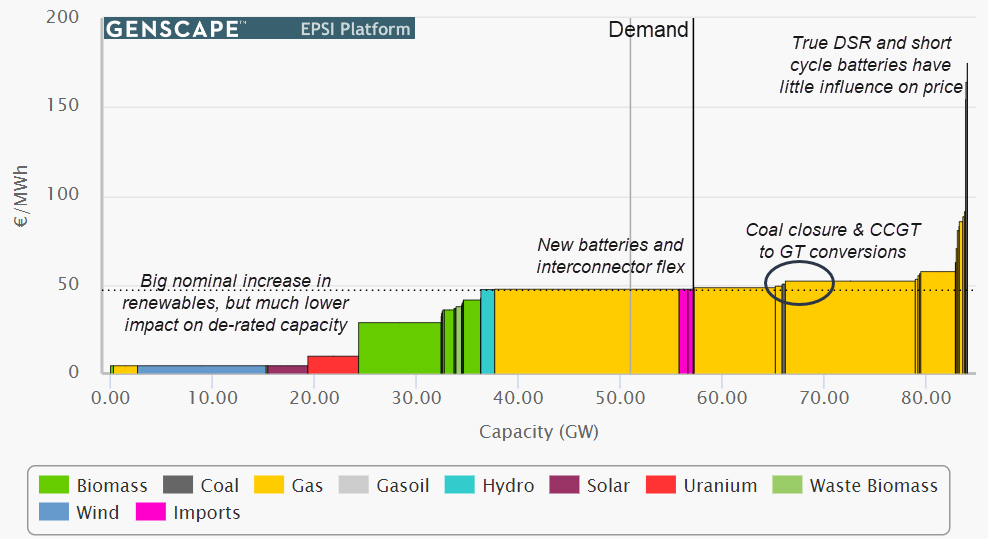

In the coming five to 10 years, the supply-side will evolve due to four major changes:

• First, the renewable generation rise will push new, cheap capacity into the bottom left of the stack. Offshore wind is a key factor contributing to this development, with the UK as the largest offshore wind market in the world at around 35 GW of installed capacity and counting. The direct impact will drive up the system intermittency and cause strains on the grid.

• Secondly, there will be thermal closures removing flex capacity from mid/right stack. The UK plans to close 11 GW of coal and eight to 14 GW of older CCGTs or convert them into Gas Turbine (GT).

• Third, gas engines and batteries will dominate new flex capacity. High Short Run Marginal Cost (SRMC) at 70 to 90 £/MWh will push into the top right hand of the stack. This will drag up the price to the top 10-15 percent of the price range.

• Fourth, the UK plans to add five to 10 GW of new gas engines, three to six GW new CCGT plants and six to eight new interconnectors. These actions will result in a smooth transition to greener electricity generation and help to maintain the security of supply

Figure 2: Genscape’s EPSI fundamental model shows the evolution of the stack. Click to enlarge

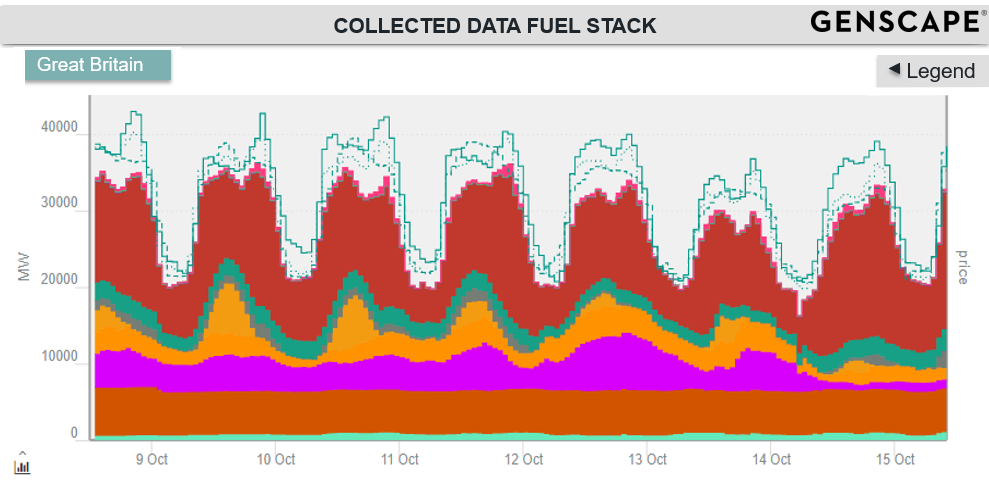

Genscape collects live electricity generation data in the UK, and by leveraging Genscape’s PowerRT platform, one can monitor the live evolution of the fuel stack in the UK. Related: Rig Count Inches Higher Despite Oil Price Slide

Figure 3: Genscape’s PowerRT platform shows live and historic monitored fuels stacks in the UK. Click to enlarge

As long as the government follows its planned actions, it should permit a transition of the UK power market, in line with that of Europe. However, due to extensive investments in power generators and the grid infrastructure, wholesale power prices are likely to increase. The current move is therefore not only sustainable but likely to continue into the near future.

By Genscape

More Top Reads From Oilprice.com:

- Oil Prices Crash, But Oil Majors Aren’t Panicking

- Can OPEC Halt An Oil Market Meltdown?

- Significant Crude Build Weighs On Oil Markets

Europe cannot survive its commitment to high cost and unreliable energy, just to be virtue signaling.