Matador Resources, (NYSE: MTDR) is a small Permian oil driller that doesn’t get a lot of coverage, taking a back seat to some of the more widely covered names like Devon Energy, NYSE: DVN), or Pioneer Exploration, (NYSE: PXD). They are just the right size to be a tasty bite for some acquisitive larger company looking to expand their portfolio in the much desired Delaware basin.

But, even if that doesn’t happen, Matador has the right balance sheet and development portfolio to survive to better times in the oil patch. In this article, we will take a look at this perky little company to see if their current valuation is justified, or if they might move even higher now that the Covid-19 situation is looking less desperate.

The thesis for Matador

MTDR is primarily a Permian Player with just enough acreage to put them on some larger companies target list...at the right price. We might be near that now. They also have acreage in the oily section of the Eagle Ford and in the gas-rich Haynesville and East Texas areas. In its latest 10-Q, the company notes it may monetize these areas to narrow the current gap between costs and cash from operations.

“To narrow any potential difference between our 2020 capital expenditures and operating cash flows, we may divest portions of our non-core assets, particularly in the Eagle Ford shale in South Texas and the Haynesville shale in Northwest Louisiana, as well as consider monetizing other assets, such as certain mineral, royalty and midstream interests, as value-creating opportunities arise. “

We'll say more about that later.

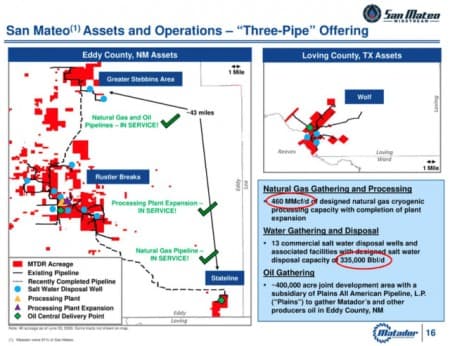

MTDR also has a pipeline subsidiary, San Mateo, that provides some takeaway capacity for their core Lea and Eddy county wells in the Delaware basin as well as a water line for salt water disposal.

Source

With the current trend toward take-outs being all stock and debt assumptions these days, the notion of buying in cheap and waiting for an offer that is substantially higher than the current share price is weakened. The best case for MTDR can be made on its revenue stream vs its share price. We will do that as we close out the article.

Liquidity and cash on hand

MTDR has $41 mm in cash, and credit line access of about $300 mm on a revolver that isn't due until 2023, and a debt to EBITDA ratio maximum of 4X. The company has $1.05 bn in long term debt with a maturity of 2026. No big roadblocks here, and not a reason itself to avoid the stock. Related: Adapt Or Die: Refiners Face An Impossible Decision

Hmm. I wonder if they still like that 1,200 acres they picked up in Lea County in the 2018 BLM lease sale as much as they did then. $100 mm smackers for this block, or $83K an acre looks pretty rich these days. We'll answer that question a little later in the article.

Cash From Operations

The company generated $109.5 mm in cash from operations in Q-3. Unfortunately, this didn't cover CAPEX of run-rate $125 mm or other variable costs as noted. This is troubling, but as the signs point to a lift in commodity prices soon thanks to news of the Pfizer vaccine for Covid-19 and the second major draw in oil storage in the last two weeks, it shouldn’t keep us up at night.

Cost-cutting

The company has done a good job of reducing CAPEX costs associated with D&C their wells, as you would expect. Getting costs under $800' is about par these days, and is more a function of lateral length, reducing time for frac stages, optimizing fracs with 4-D fracking, drilling efficiency, and commodity costs falling through the floor than anything else.

Source

They have also done the obligatory pay cuts, bigger pay cuts for executive staff, and the like. You can't cost-cut your way to profitability.

Federal acreage exposure

As I write this the landscape has changed for fracking on Federal Lands. Joe Biden has just claimed the presidency and he's not fracking's biggest fan. I wouldn't say that MTDR is over-exposed here with 28% of their Delaware basin on Federal lands. If they can get those 300 permits, it probably gives them an 8-10 year window if the boom gets lowered. We don’t see this as something investors need to get worked up about right now.

And, let's face it. There's a lot of stuff candidates for president say that Presidents don't and can't follow through on. The power of the office also comes with its own realities and I don't think Biden wants to be known as the guy who killed energy independence. Harris is another story, but she's not the president...yet.

Source

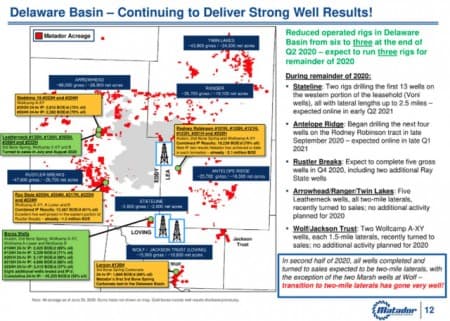

Guidance for the rest of 2020

Source

Your Takeaway

So here we come down to the meat of this article. Is there a reason to buy MTDR at this extraordinarily discounted price, even though it’s bumped up in the last few days? There's no dividend to consider, so we would be strictly looking for upward price movement from here.

Related: OPEC+ Getting Closer To Hatching January Plan

As noted above, MTDR expects to produce 75 K BOEPD on a 1-year run-rate basis. With an EV of $1.75 bn, it comes out to ~$23 K PFB. Not excessive really and they are making some pretty good wells. The slide below has some interesting data. Worthy of note are the results from the Boros wells, testing the Bone Spring and Wolfcamp A formations. IP's in the 3,500-5,000 BOEPD are common and compare favorably with what other operators are doing.

Source

Now for the best part! You will remember above where I questioned the company's wisdom in shelling out nearly $100 mm for that 1,200 acres? Scroll your eye up to the top yellow box in the slide above where the Rodney Robinson wells are discussed. You read that right, that's 19,236 BOEPD from those 6-wells, and production of over 2-mm BOEPD of 79% oil since completion. It looks like that $100 mm was well spent to me.

I bring this up as it is this the kind of acreage that could bring a suitor. Food for thought anyway. I think with the current state of 'merger mania' rolling through the West Texas shale patch, hungry eyes have to be looking at MTDR. Now it doesn't appear this is anything the company is reaching out for. Just the opposite actually. Joe Foran, CEO made some very cogent and far-reaching comments on selling the company in response to an analyst question on the topic-

“Scott, at this present time, I don't see much of an advantage. Look, we're achieving what everybody wants to have, which is production is going up, costs are coming down. We're starting to return, thanks to the banks. We have grown from a standing start. You remember when we went public in 2012, we had no production in New Mexico. And now we're probably going to be - we're currently in the top 10 in both gas and oil. And as this consolidation happens, we'll probably move up to 5 or 6, we're at 7, I think, currently. So we're ahead of WPX and some of these marathon, some of these other much bigger companies. So we think we're playing with them and that our numbers or returns are as strong as anybody.”

“Now having said that, we don't think we need a partner, we also recognize we're a public company, and we play a straight game. So if someone were to make a serious offer, we'd give it a serious consideration. But in the meantime, Scott, is that if you look at the ownership of Matador and the Executive Group, we make far more from our stock going up with our ownership. I'm the largest single shareholder. But Matt and David, the whole group own a multiple of most of their peers and other companies. We make far more from our stock going up than we do from our salary.”

So our primary interest is getting the price up. So the no premium deals don't have much -- we don't see the appeal. The staff is complete. The others don't have a midstream, which is, again, gives us a big advantage operationally and financially. And that's built out pretty well in our areas. And -- but again, we -- as you've heard us say often, we reserve the right to get smarter. And if some opportunity is presented in front of us that is good for our shareholders, we'll do it. But we're shareholders, too. I mean, that's about it. We have a big ownership.

So we're motivated. We just haven't seen the deals -- any deals that would be a good fit culturally or financially or from a property asset base. And we think we have a really good path ahead of us now that we've proved up, Stateline, Rodney, other deals and have the midstream.”

On the other side of the coin, if nothing happens the company expects to be cash positive soon so the debt should stop piling up, and the company seems capable of improving returns and motivated through compensation to get the stock prices higher!

We think Matador represents a reasonable risk/reward proposition for investors with a moderate risk profile. The company has shown execution excellence with recent drilling activity and will need to drill fewer wells to maintain and grow production in the coming years. This adds value and capital efficiency to the operation and adds oomph to the share price in the coming year.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Growing Crude Inventories Put A Cap On Oil Prices

- EIA Sees WTI Crude Averaging $44 In 2021

- OPEC+ Getting Closer To Hatching January Plan