A visit from Jean-Claude Juncker, the President of the European Commission, to Washington last week resulted in an agreement between two of the biggest economic blocs in the world, which is a rare thing these days. It also marks a success for President Donald Trump, who famously claimed that “trade wars are good and easy to win”. The EU and the U.S. struck a preliminary deal on trade, which has the potential to prevent a major economic conflict between the allies and strengthen the transatlantic pact. Under the deal, Juncker declared that the EU will buy more products from the U.S., highlighting U.S. LNG as one key product in the agreement. A quick look at the economics of the global gas market, however, raises some serious questions about the viability of this agreement.

Although the Juncker and Trump meeting represented a cooling of tensions between the transatlantic partners, the lack of details to have come out of the meeting so far does not fill observes with optimism. On the infrastructure side, Juncker declared that the EU would construct more facilities across Europe in order to import U.S. gas. This promise seems an odd one considering that three-quarters of Europe’s existing import facilities already lie empty. Furthermore, the U.S. is facing bottlenecks as liquefaction facilities cannot cope with surging production, which is likely to be solved in the coming years as more facilities are being constructed.

It is highly unlikely that these U.S. facilities will serve European markets as LNG landing prices in Asia are significantly higher than those in Europe. Due to China’s push for cleaner air, demand for gas is expected to rise significantly over the coming years.

Furthermore, the market economy of the EU and the U.S. is based on a liberal economic model, raises questions about how these goals can realistically be achieved. As described above, the problem does not lie with infrastructure as there is more than enough capacity across Europe currently.

During the Cold War, Russia built an extensive network of pipelines in Eastern Europe and, in recent years, several major projects have increased alternative routes and capacity to the northeast and southeast of Europe.

Although recent geopolitical events have damaged Russia’s reputation as the most important supplier of natural gas to Europe, Moscow and Brussels remain perfectly positioned to collaborate in energy markets. Political differences aside, energy relations with Russia have been improving in the last couple of years, with 2017 being a record year in which a total of 193 bcm has been imported from Russia.

Related: Oil Prices Slip As Rig Count Inches Higher

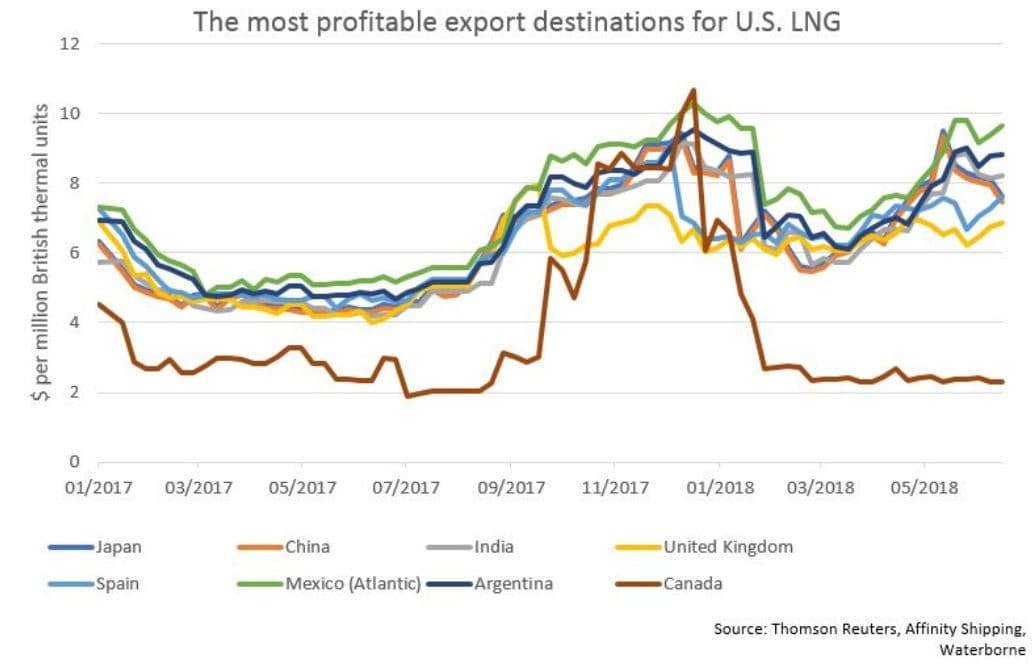

Pipelines have proven more important than geopolitics in recent times. Russian natural gas is being traded for an average of $4.5 per million British thermal units, which is far lower than prices on alternative markets and LNG shipped gas (see figure below). Ben Beurden CEO of Royal Dutch Shell does not exclude U.S. gas, but it has to adhere to economic rationale: “Will US LNG reach Europe? Yes, but only if there is an arbitrage opportunity to make sense.”

(Click to enlarge)

The détente between the EU and the U.S. on trade is a welcome sign. The agreement, however, is weak and ill-defined, which extends the risk of a trade war indefinitely. Although both sides have pledged to work towards a more positive economic relationship, the deal itself stands on weak ground. Very few details have been worked out, and even those that have don’t appear to make economic sense. Although the easing tensions between the western allies has been a welcome development, no tangible outcomes have materialized. Only time will tell how resilient this deal is going to be.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Why All The Experts Disagree On Oil Prices

- The 4 Key Chokepoints For Oil

- The Most Important Waterway In The Oil World

And part of the reason the LNG import is 3/4 empty might be the tariffs and barriers they are talking about eliminating.

Things with Russia could change in an instant, so we should grease the skids ahead of time in case they do.

I think you mean liquefaction facilities. A few years ago there were none in the US; this is a growing area with capacity expected to continue to increase in coming years.

Agreement or no agreement, the EU countries will have to look after their own interests. They are aware that US LNG can’t compete with Russian gas supplies now or in the foreseeable future.

When it comes to competing with Russia’s pipeline exports to Europe, the United States is at a disadvantage. Natural gas transportation by pipeline is significantly cheaper than LNG.

And with its current network of gas pipelines to the EU soon to be augmented by the Turkstream pipeline across the Black Sea to Turkey and Europe and the Nord Stream 2 under the Baltic to Germany, not only Russia’s grip on European gas markets is tightening but it will also continue unabated for the foreseeable future. Currently, almost 40% of the natural gas consumed by Europe comes from Russia.

As Europe’s gas demand grew in 2017 it turned first and foremost to Russia. Despite concerns over Russian dominance over supply, its gas exports to Europe have grown by 15.5% in 2017 over 2016 to reach a record high 224 bcm or almost 40% of total EU demand.

It is more likely that US LNG could have better chances in the Asia-Pacific region which is the world’s biggest market for LNG and where prices are much higher than other gas markets.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London