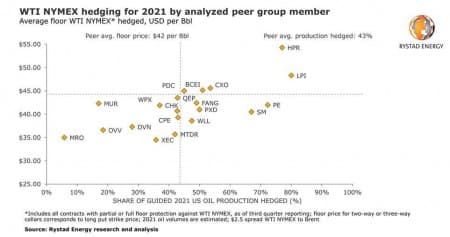

US E&P companies have so far hedged 41% of their total forecasted 2021 oil output at an average price floor of $42 per barrel (Nymex WTI equivalent), lower than this year’s floor of $56 per barrel, a Rystad Energy analysis shows. Gas has proven more resilient as more than 45% of the expected production is hedged at a Henry Hub base floor price of $2.58 per MMBtu, marginally lower than 2020’s $2.70 per MMBtu.

Hedging strategies of US upstream operators have taken center stage as a tool that is helping companies cushion their cash flows amid weak oil prices. From the usual representative oil-producing peer group that Rystad Energy analyzes, 20 companies had communicated their hedging volumes for 2021 as of early October. These operators account for 32% of the expected 2020 US shale oil production.

The analysis includes all contracts, with full or partial floor protection: swaps, collars and three-way collars. Collected contracts reference different price strips – WTI Nymex, WTI Midland, WTI Houston and Brent. Rystad Energy has converted everything to a WTI Nymex equivalent, assuming a spread of $0.30 per barrel for WTI Midland, $0.70 for WTI Houston and $2.50 for Brent versus WTI. “The share of three-way collars has dropped significantly since the spread of Covid-19, accounting only for 17% of the 2021 settlements compared to 41% in 2020. This change comes as the collapse in the crude market in early 2020 meant that prices broke the subfloor of most of these contracts, generating only around $10 uplift to the pre-hedged realized price,“ says Alisa Lukash, senior shale analyst at Rystad Energy.

Interestingly, Occidental has sold a large volume of call options for 2021 settlement, even though these contracts alone are not considered hedging contracts because they have no floor protection. They provide a price ceiling at around $74 per barrel Brent and can potentially be combined with the puts to create a collar or a three-way collar in the future, similar to the operator’s 2020 derivative strategy. That means the share of its 2021 three-way collars might still grow significantly in coming quarters.

Related: The U.S. Has A Major EV Problem

Laredo Petroleum, Parsley, Pioneer and Diamondback have hedged a significant amount of their expected oil production against Brent. It is important to outline that the calculated floor in some cases is also an actual price per barrel in a swaps contract. The distribution of the hedged volumes is quite wide. Only three operators – Marathon Oil, Murphy Oil and Ovinitiv – have less than 20% of their expected 2021 oil production hedged.

Again, only three – SM Energy, Parsley and Laredo Petroleum – have above 60% of their forecast 2021 output protected. Most others come in between 20% and 60%. Some of the names on the chart, mainly highly leveraged companies, added hedges in early 2020 to cover a large volume of their expected output, taking advantage of a higher strip price.

Laredo Petroleum secured swaps at $49 per barrel Brent for 50% of its expected 2021 crude output. In contrast, Pioneer continued with large volumes secured through three-way collars, only adding an extra ceiling for the purpose of capturing premiums for its 2021 settlements (short calls) despite the expected crude price volatility.

We are expecting the share of hedged 2021 oil production to grow post 3Q and full year reporting.

While market sentiment for US gas looks brighter in 2021 based on the latest Henry Hub NYMEX futures strip – with average quoted prices breaking $3.00 per MMBtu already for December – most gas producers effectively remain cautiously optimistic. Looking at their hedged positions for 2021, Rystad Energy also analyzed a peer group of 10 dedicated public US shale gas players whose net production represents over a fifth of the total expected US gas volume in 2020.

Generally, the gas peer group is also well hedged – though there is still room for additional hedge positions to be layered on in 2021, especially given that this peer group hedged nearly 70% of its 2020 volumes.

Notable outliers include Antero, which has hedged most of its production already, as it did in 2020, and at a higher floor price. On the other end, Cabot Oil and Gas, which has historically maintained a low hedging profile, currently remains unhedged for 2021. This perhaps also reflects bullish views on gas prices communicated by the management.

By Rystad Energy

More Top Reads From Oilprice.com:

- Big Profits Are No Longer The Top Priority For Oil Investors

- North American Oil And Gas Bankruptcy Debt Has Hit An All-Time High

- 2021 Could Be A Much Better Year For Canadian Oil