The last year has been particularly turbulent for the former South American Dutch colony of Suriname. A rapidly deteriorating economy, violent anti-government protests, and rising political uncertainty are all weighing on Suriname’s burgeoning oil boom. These are some of the reasons that the 50% partners in Block 58 offshore Suriname, Apache and TotalEnergies, delayed making a final investment decision concerning the development of the block. While considerable uncertainty has emerged over the outlook for Suriname’s oil boom, which is seen by the government in the capital Paramaribo as a remedy for the country’s economic ills, some good news is finally emerging.

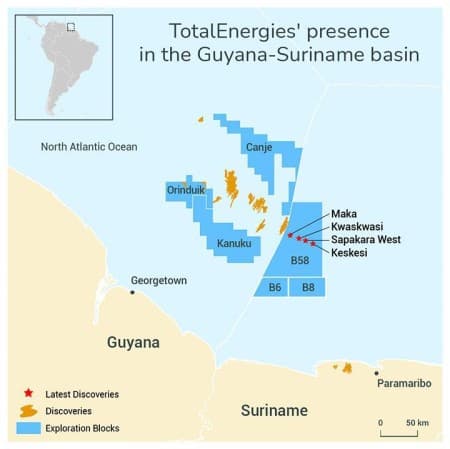

TotalEnergies, which last year chose to delay the multi-billion-dollar final investment decision, or FID, for Block 58 offshore Suriname, recently announced it had signed two Production Sharing Contracts (PSCs) with national oil company Staatsolie. The PSCs are for shallow water Blocks 6 and 8 where TotalEnergies holds a 40% working interest and is the operator alongside QatarEnergy with 20% and Staatsolie now controlling 40%.

Source: TotalEnergies.

Both blocks are immediately adjacent to Block 58 where TotalEnergies, the operator, and partner Apache have made five commercial oil discoveries and are currently conducting appraisal drilling.

The shallow waters off Suriname’s coast are underexplored, and according to Staatsolie seismic as well as other geological data points to the area being highly prospective for the presence of hydrocarbons. That perspective is supported by industry analysts who believe Suriname’s shallow coastal waters, especially near the international maritime border with Guyana and deep-water Block 58 offer significant exploration potential. This according to S&P Global Commodity Insights is supported by CGX Energy’s oil discovery with the Kawa-1 exploration well in the northern segment of the Corentyne Block offshore Guyana. The Corentyne Block, where CGX is the operator with a 32% working interest and the remainder is held by Frontera Energy, sits adjacent to Block 58 and Block 6 offshore Suriname.

Indeed, CGX Energy appears to have struck oil with the Wei-1 wildcat well, nearly nine miles west of the Kawa-1 well, also in the northern portion of the Corentyne Block. The well which was spudded during January 2023 and is to be drilled to 20,500 feet has been dogged by problems and delays, although CGX recently confirmed it will be completed within the planned period. CGX announced at the start of May 2023 that the Wei-1 wildcat well has encountered multiple oil-bearing intervals in the western channel fan complex in formations of Maastrichtian and Campanian ages.

Suriname’s oil boom was put on hold by the uncertainty created by TotalEnergies delaying the FID for Block 58 until 2024 at the earliest. The former Dutch colony’s national oil company Staatsolie, which has the contractual right to farm into 20% of Block 58, recently confirmed it expects the FID to be made sometime next year. TotalEnergies CEO Patrick Pouyanné pointed to inconsistencies between seismic data and drilling results as the reason for delaying the FID. The less favorable terms of Suriname’s PSCs, when compared to neighboring Guyana, along with heightened political tensions in the former Dutch colony also weighed on TotalEnergies’ decision. This is because it is estimated that it will take at least $10 billion to develop Block 58 and bring it to first oil.

Accordingly, for such a massive investment of capital Total Energies and Apache want to be certain they are developing a low-cost long production life commercially sustainable oil resource. In TotalEnergies' first quarter 2023 results, Pouyanné further explained another issue to arise is high the oil-to-gas ratio for the discoveries in Block 58 which is preventing the efficient exploitation of the oil discovered to date. As a result, TotalEnergies is focused on identifying prospective resources with lower oil-to-gas ratios. The French supermajor is seeking to identify 600 million to 650 million barrels of commercially recoverable oil resources before moving to the next stage of development. This has delayed first oil, which was originally anticipated during 2025, with that important milestone for Suriname’s nascent oil boom now expected during 2027.

There is, however, good news as TotalEnergies continues to conduct appraisal drilling on the block. The successful drilling and flow testing of two wells at the 2020 Sapakara oil discovery bodes well for the development of Block 58. According to Apache, the latest flow test at the Sapakara South-2 well identified an interconnected resource with at least 200 million barrels of oil in place. It is the Sapakara discovery that will likely become the first operation to be developed in Block 58 by TotalEnergies and Apache, especially with the total estimated oil resources upgraded to over 600 million barrels.

Then there is Apache’s Baja-1 oil discovery in neighboring Block 58 to consider. Apache announced its first ever find in Block 53 with the Baja-1 exploration well during August 2022. The well, which is seven miles to the west of the Krabdagu discovery in Block 58, was drilled to a depth of 17,356 feet or 5,290 meters and found 112 feet of net oil pay in the Campanian interval.

Source: Apache March 2023 Investor Update.

This discovery is important because it is believed to be located in the same petroleum fairway that passes through the Stabroek Block and the northern segment of the Corentyne Block in offshore Guyana into Block 58 offshore Suriname.

For nearly four years, a fiscally stretched Paramaribo has been counting on the tremendous economic windfall that successful exploitation of Suriname’s offshore oil resources will deliver. President Chan Santokhi is under considerable pressure politically and financially with IMF-imposed austerity measures, which saw the government end a range of subsidies for fuel and other essential items, triggering riots during February 2023. Paramaribo was forced to enact such measures, which essentially increased the financial burden on Suriname’s most impoverished, in order to access a desperately needed $688 million IMF loan package.

There was also considerable pressure on Santokhi to restructure Suriname’s sovereign debt with the South American micro-state having been in default since 2020 with it defaulting three times during the pandemic. A recent deal with private creditors regarding $675 million of bonds will see investors take a 25% haircut while receiving a new $650 million bond. There is a novel compensation mechanism attached to the new bonds, an oil-backed security that pays additional returns to investors from the oil royalties that Suriname earns from Block 58. That instrument, which expires in 2050, will pay 30% of oil royalties earned by Paramaribo to bondholders after the first $100 million has been allocated to the government. This is another reason Paramaribo is eager for TotalEnergies and Apache to make the FID for Block 58 and bring the block to first oil.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Cheap Russian Crude Is Replacing Middle Eastern Oil On India’s Spot Market

- Chevron To Buy Shale Firm PDC Energy In $6.3-Billion Deal

- Bank Of America Sees Oil Prices Heading Toward $90 This Year