One year after Congress passed the historic Inflation Reduction Act (IRA), the U.S. remains as reliant on China as ever for critical minerals, materials and components that go into everything from electric vehicle batteries to solar panels. Indeed, de-risking has become the new buzzword among the political class, a notable shift from earlier calls for decoupling the U.S. economy from China’s, including by none other than President Biden himself. De-risking is a common term within financial circles and implies curbing risks while avoiding a clean break while decoupling suggests a radical separation.

And now the Biden administration has conceded that its envisaged goal of decoupling from China’s sprawling clean energy sector is much easier said than done.

“This is not about China. We are perfectly happy to work with them on this and right now we purchase many of the minerals from Chinese companies. It’s about diversifying. The world needs them to be involved--the broader picture is climate change, and we’re not going to solve the climate crisis without the involvement of the PRC,” Jose Fernandez, the U.S. undersecretary for economic growth and the environment, told a briefing last month in New York. ‘‘China is the second-largest economy in the world, a major trading partner of the US. We will continue working with them while pursuing our interests and protecting our companies and criticizing them when we feel they should be criticized,’’ he has added.

The U.S.’ unenviable position is perhaps best demonstrated by its utter dependence on China’s rare earth minerals. China accounted for 70% of world mine production of rare earths in 2022, with the U.S. importing nearly three-quarters of its rare earth supply from the Middle Kingdom. That leaves the country in a particularly precarious position, a point that was aptly driven home a couple of years ago at the height of tensions and trade wars between the two countries. Related: Oil Refiners Struggle To Access Financing As Banks Shun Fossil Fuel Projects

Luckily for the country and its Western allies, there’s a way out. The Nordic countries, particularly Greenland, Norway, Sweden, and Finland, are rich in a variety of rare earth elements (REEs), and cobalt, nickel, lithium and graphite, and nickel reserves which remain largely unexploited. According to the Nordic Council of Ministers, the Nordic bedrock hosts over 43 million tons of economically viable deposits of rare earth minerals. Finland, Sweden, and Norway are among the top eight countries favorable for critical minerals and battery supply chain development as per Bloomberg New Energy Finance. Further, Nordic governments have a history of commitment to low-impact, sustainable mining practices, making them ideal for industries looking for responsibly sourced minerals.

Clean Energy Policy Framework

Even better, the U.S. and its allies have already laid the groundwork that will make future supply deals possible. In June 2022, shortly after the Russian invasion of Ukraine and amid heightened tensions with China, the United States and its G7 partners launched the Partnership for Global Infrastructure and Investment (PGII) to build clean energy supply chains by friendshoring clean energy supply chains. The countries also signed the Minerals Security Partnership to produce, process, and recycle critical minerals. Subsequently, in January 2023 at Davos, Switzerland, European Commission President Ursula von der Leyen announced that a key pillar of the EU’s new industrial strategy will be global partnerships to access inputs needed for industry. This fresh drive builds on existing EU initiatives, including the European Battery Alliance and the Critical Raw Materials Act, both of which aim to onshore and secure supply chains.

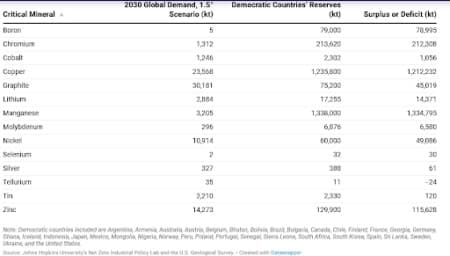

These initiatives mark the emergence of a “joint industrial policy” whereby the G7 states coordinate their industrial strategies at the international level and build supply chains collaboratively. This means these countries will be working together to secure supplies of needed technologies and create markets in support of net-zero industries in their home countries. Studies done by the Net Zero Industrial Policy Lab at Johns Hopkins University have concluded that partnerships among democratic states would be able to produce enough minerals to enable the world to limit warming to 1.5 degrees Celsius, the more ambitious target in the Paris Agreement. However, the same studies say that producing enough metals to meet these targets would require extraordinary technological and financial cooperation.

Critical Minerals Potential in All Democratic Countries

Source: Carnegie Endowment For International Peace

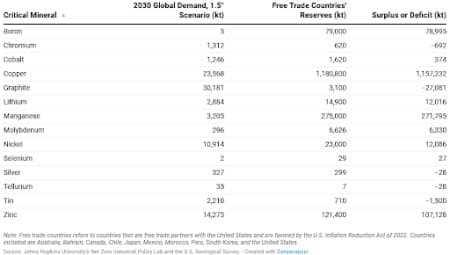

However, the picture is not quite as rosy when you only consider U.S. free trade partners, which are favored by the U.S. Inflation Reduction Act of 2022 (IRA), with shortages predicted for several critical minerals including chromium, graphite, silver, tellurium and tin.

Critical Minerals Potential in Countries With U.S. Free Trade Agreements

Source: Carnegie Endowment For International Peace

The report concludes by saying that it is possible for the United States and its key partners to significantly friendshore production of critical minerals, although such a task would require an unprecedented build-out of the mining industry to achieve 2030 clean energy targets.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Will ETF Progress Help Boost Bitcoin's Appeal As A Safe Haven Asset?

- Azerbaijan And Turkey Launch Joint Military Exercises Near Armenia Border

- Shell To Cut 15% Of Its Low-Carbon Jobs