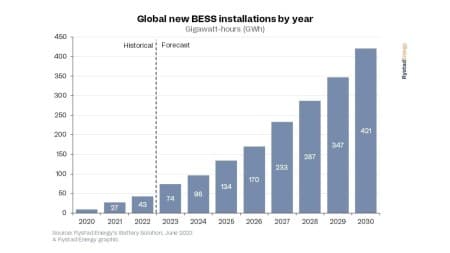

The era of battery energy storage applications may just be beginning, but annual capacity additions will snowball in the coming years as storage becomes crucial to the world’s energy landscape. Rystad Energy modeling projects that annual battery storage installations will surpass 400 gigawatt-hours (GWh) by 2030, representing a ten-fold increase in current yearly additions.

Battery energy storage systems (BESS) are a configuration of interconnected batteries designed to store a surplus of electrical energy and release it for upcoming demand. Consequently, BESS offers practical solutions for addressing power intermittency challenges. As the world transitions to greener sources of power generation such as solar PV and wind, battery energy storage developments will be critical in meeting future energy demand.

Global BESS capacity additions expanded 60% in 2022 over the previous year, with total new installations exceeding 43 GWh. A further 74 GWh will be added this year – a 72% increase – primarily driven by cost reduction in BESS systems in addition to incentives in North America, governmental funding programs in Europe, coupled with robust renewable capacity expansion in mainland China.?

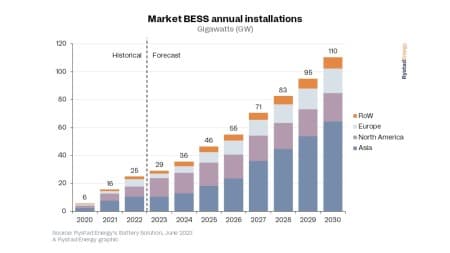

Assuming a status-quo policy scenario, we project annual installations will surpass 400 GWh by 2030, noting that GWh refers to the energy units, while gigawatts (GW) is the unit of power. This correlates to capacity additions of about 110 GW by 2030 on a power basis, almost equivalent to the peak residential power consumption for France and Germany combined. This projection is generally aligned with our climate change scenario compliant with 1.9-degree Celsius carbon budget. Related: Natural Gas Production In The Permian Basin Hit A Record High In 2022

“Batteries will play a fundamental role in the future of energy production and power demand, solving the intermittency problem of renewable energy generation. To decrease reliance on coal and gas as back-up power generation sources, countries must invest in BESS now,” says Sepehr Soltani, energy storage analyst at Rystad Energy.

Government policies are playing an important role in incentivizing investments and capacity expansion. Last year’s US Inflation Reduction Act has catalyzed renewable and clean tech expansion, boosting expected solar and onshore wind capacity by 40% and expecting to add more than 20 GW battery capacity compared to before the Act. As result, the US battery capacity will exceed 130 GW by 2030.

The European Green Deal Industrial Plan aims to accelerate the transition to a sustainable and low-carbon industrial sector in Europe, and gradually supports the BESS development in addition to the local fundings for BESS developers – for example, a £32 million energy storage funding program in the UK. China is committed to peaking its emissions by 2030 and sees battery developments as a steppingstone to achieving that goal. The country’s clean energy development will accelerate in the coming years, increasing the share of renewables in its power mix.

It is relevant to emphasize that China’s coal capacity expansion primarily targets addressing energy security concerns providing the domestic power sector with sufficient flexibility to mitigate future energy crises. Hence, this is the case when an increase in capacity does not translate into immediate increase in generation. Average coal capacity factors in China have been declining steadily since 2010. Meanwhile, the country has matured its solar and battery production capacity and is expected to continue investing in local supply chain expansion to deliver on both domestic demand and the role China plays in the global export market across the low-carbon energy value chain.

By 2030, annual BESS market installation will hit 110 GW, 58% of which will be developed in Asia. North America will account for about 20 GW and Europe will have 18 GW installed, with the remaining 8 GW from the rest of the world. This is a shift from current trends, as the projected installation at the end of 2023 is expected to be dominated by North America, which will account for 45% of total BESS capacity.

Utility scale battery storage is required to address power security concerns in national and regional electricity grids. Microgrids – self-contained, local power grids – will become more prevalent and distributed power generation is set to dominate as primary energy sources such as solar and wind are not limited to specific countries or regions.

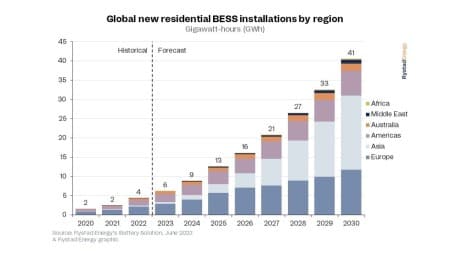

Most capacity additions will be at the utility level, but residential developments are also critical. Consumer power prices will drive standalone BESS growth in the short term, with residential battery installations set to grow alongside rooftop solar PV adoption. Countries with efficient and affordable solar energy production will emerge as pioneers in coupled-residential battery systems.

The residential market is lagging the utility segment globally, but we expect that to change. We expect residential adoption to grow in parallel and increase ten-fold, surpassing 41 GWh battery demand by 2030. Europeans are pioneers in utilizing BESS in their homes, as tax credits and high-power prices during peak periods have motivated consumers.

By Rystad Energy

More Top Reads From Oilprice.com:

- EU Steel Consumption Predicted To Surge In 2024

- China At The Forefront Of Nuclear Weapon Expansion

- Russia’s Year-Round Arctic Trade Route Initiative