Russia's Rosneft and Italy’s Eni have announced they will sign an agreement on mutual oil supplies to European refineries.

The new agreement comes amid increased cooperation and burgeoning bilateral trade between Russia and Italy, which imports most of its oil and gas and is struggling to dig itself out of recession.

Rosneft will supply Eni’s refineries with 1 million tons of oil, while Eni will supply Rosneft refineries with 400,000 tons of oil under the agreement, Reuters reported.

Related article: Only Oil Insiders Are Looking At This Play

The Rosneft supplies will go to the PCK Schwedt refinery Germany and the ?eská Rafinerska refinery in the Czech Republic, in which Eni holds stakes. Eni’s supplies will go to Germany’s Ruhr Oel GmbH refineries, in which Rosneft holds a 50% stake.

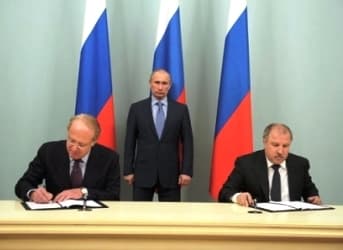

“The reached agreements are a consecutive step in strengthening of cooperation between Rosneft and Eni in the field of trading and the logistics, following signing of the agreement on development of opportunities in the field of trading and logistics from February,” Rosneft president Igor Sechin said.

The new agreement follows a February general agreement signed by the two companies as a framework for trading and logistics cooperation.

Ties between the two companies continue to expand, with the eyeing of joint investment in a new logistics center near Venice and Rosneft’s stated plans to raise its stake in Italian refiner Saras from the current 21%, depending on approval by the Italian government.

In 2012, Eni and Rosneft signed a pact to jointly develop offshore reserves in Russia’s Barents and Black Seas in a deal that gave Eni a 33% stake in the joint venture in fields with estimated recoverable reserves of 36 billion barrels of oil equivalent.

Related article: Small Company’s New Subsea Wellhead Tap Design Attracts Oil Majors Interest

Also earlier this year, Italian utility firm Enel signed an agreement for collaboration with Rosneft to develop oil and gas fields outside of Russia.

On 26 November, Russian President Vladimir Putin said the two countries hoped for a bilateral trade volume of $50 billion this year, up from $45.8 billion last year. Bilateral trade has already grown 24% from January through September this year, and Russian investment in Italy has quadrupled to $500 million in four years. Italian investment in Russia has reached $1 billion.

“Italy is fourth among Russia’s largest trade partners,” Putin said after talks in Trieste with the Italian Prime Minister Enrico Letta. “Bilateral trade has been growing. This year, despite problems in the global and European economy, it will grow by another 24%. I think it will reach or even exceed the $50 billion mark.”

By. Joao Peixe of Oilprice.com