After frequent rescheduling and downgrading, including a last-minute delay after market close last Friday, September 21, New England’s main natural gas pipeline, Algonquin Gas Transmission (AGT), may finally run their biggest maintenance event of the year in terms of impact and duration. From September 25 through October 12, Algonquin will conduct an outage between its Stony Point (NY) and Oxford (CT) compressors.

The outage reduces operational capacity at the Stony Point compressor from 1,141 MMcf/d to 744 MMcf/d for the duration of the event. While AGT reported average flows of 1,110 MMcf/d through Stony Point over the last two weeks, implied flows including no-notice nominations show Stony Point averaging 1,274 MMcf/d, meaning this event will cut over ~0.5 Bcf/d of mainline flows relative to the previous two-week average. Assessing previous years’ flows through Stony is somewhat tricky because of recent years’ restrictions for the Algonquin Incremental Market (AIM) expansions, but Summer ’18 Stony Point flows are well above the five-year average, once adjusted for no-notice. The outage also limits the Oxford compressor to a capacity of 867 MMcf/d.

(Click to enlarge)

Algonquin Gas Transmission mainline as illustrated in Genscape's Natural Gas RT platform.

(Click to enlarge)

Stony Point Compressor Station to Oxford outage from August 21, 2018 through September 22, 2018.

(Click to enlarge)

Stony Point flows are well above the five-year average this September.

Stony Point is the main constraint point for the AGT mainline, meaning this event brings significant upside risk to AGT Citygate prices and downstream demand. Mainline demand will rely on supply interconnects downstream of Stony Point; including Everett liquefied natural gas (LNG), the Salem Essex interconnect with Maritimes, and the Lincoln and Mendon interconnects with Tennessee Gas Pipeline (TGP). AGT also notified preemptively declaring an operational flow order (OFO) effective on Monday, heavily penalizing shippers for imbalances. Algonquin also plans to suspend its no-notice service beginning on September 25 and lasting for the duration of the maintenance.

Coinciding Power Market Risks

So far in 2018, natural gas comprised 47 percent of electricity supply in ISONE, and 45 percent of their generation capacity are gas fired plants, which means gas and power markets are intrinsically tied in New England. On the power side of the energy market, we expect several coinciding transmission and generation outages bringing bullish risk to gas and power prices. From October 1 to October 6, a planned transmission line outage over the Phase I/II interface will further limit an average of 2,000 MW of imports from Hydro Quebec. This import tie de-rate brought elevated heat rates throughout most of the summer, and only recently returned to more than half capacity on September 22. Related: The Gas Revolution In Central And Eastern Europe

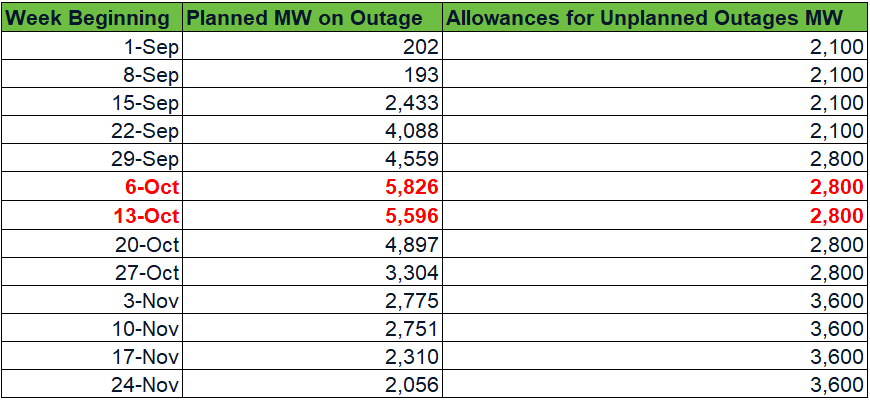

On the generation side, the Pilgrim nuclear plant experienced continuous operational issues since mid-August and has not sustained a full load since then. These outages also coincide with ISONE planned maintenance. During the week of October 6, ISONE will have up to 5,826 MW of planned outages, compared to 193 MW on outage for the week of September 8. There will also be 2,800 MW of allowances for unplanned outages, and this is likely to be used given the high summer demand preceding this shoulder season. This potential 8,626 MW of planned and unplanned outages are likely to include two nuclear plants – the 867 MW Millstone Unit 2 and the 1,251 MW Seabrook plant, as this lines up with their 18-month refueling cycle, which is all bullish for gas plants to pick up the slack. The Mystic Generation Station, New England’s largest power plant at 1,998 MW, will be crucial for the New England power stack as it is mostly fueled by LNG and not reliant on Algonquin for supply.

(Click to enlarge)

Planned outages during the week of October 6 in ISONE will reach up to 5,826 MW. Unplanned outage allowance for the same week is 2,800 MW. Click to enlarge

Conclusion

New England is currently forecasted to cool over the next two weeks, bringing significant downside risk, but unexpected heat waves could cause power demand spikes. Cold snaps could create residential/commercial gas demand for heating, which takes priority over gas demand for power. The ISONE demand forecast for September 24 – 25 only predicts ~15.3 GW of peak load over the next three days. Power demand was much higher during the last major Stony Point outage on August 16 and 17, peaking at 22.6 GW. During the last few major Stony Point outages, Algonquin Citygate prices did not blow out, but merely spiked. During the outage this past August, AGT basis spiked to $1.13 after averaging $0.29 for the month up to that point. Still, this is Algonquin’s longest and most impactful maintenance event in recent memory, and plenty of upside risk abounds in New England’s gas and power markets. Genscape’s power and natural gas analysts will continue to monitor Algonquin and ISONE and update this blog in real-time as these outages progress.

By Genscape

More Top Reads From Oilprice.com:

- Don't Underestimate The Trade War Impact On Oil Demand

- The U.S. Will Ensure A “Well Supplied Oil Market”

- $80 Oil: Increased Investment Or Demand Destruction?