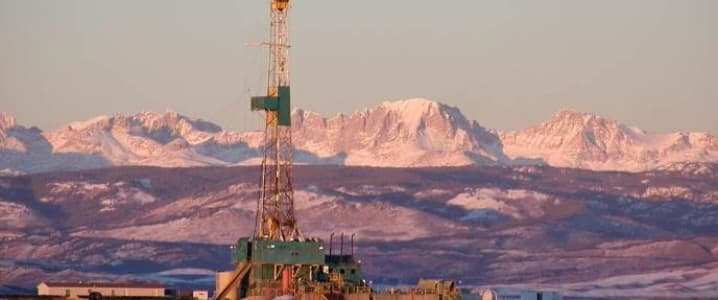

Baker Hughes reported an astonishing 20-rig gain this week to the number of active oil and gas rigs in the United States for its November 18th reporting period, bringing the total number of active oil and gas rigs in the US to 588—169 fewer than this same time last year.

The breakdown for this week’s monumental increase is 19 oil rigs and 1 gas rig. This week marks the largest increase in oil rigs in the US since July 2015, and in the last three weeks alone, 30 new oil rigs have been made active. The number of oil rigs now stands at 471.

The increase in rig count indicates continued confidence in the sector, despite weekly US crude oil inventory builds that continue to add to the supply side of the already imbalanced supply/demand equation.

Not surprisingly, the Permian saw the largest increase of 11 rigs, bringing the total rigs in the Permian to 229, which is four more than this time last year, making it only the second basin to be at or above last year figures, after Cana Woodford.

In the hours leading up to the data release, both WTI and Brent were trading down, with WTI clocking in at $45.07 (-0.77%) and Brent at $46.15 (+0.73%) around 10:00 a.m. EST, despite OPEC’s mad dash to get out as many positive comments as they could regarding the production cap that is supposed to be solidified on November 30.

Related: OPEC: Iran Must Cap Output At 3.9 Million Bpd

This week, at least, the markets are not buying what OPEC is serving up—particularly in the wake of a strong dollar and steadily increasing crude stockpiles—possibly signaling that OPEC’s barrage of rah-rah comments may be losing steam as it tries to swing the oil markets in a positive direction despite its monthly increases in oil production.

And showing the true volatile nature of oil prices as of late, WTI had rallied moments before the data release to $45.61, with Brent up to $46.69. Within 10 minutes after release, WTI started to slide on the news as the shaky market braces for the inevitable addition to oil already high inventories.

Canada, which saw a huge 22-rig increase last week, also saw another hefty increase this week of 8 rigs this week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Is The Trump Presidency A Boon For Nuclear Power?

- Trump Could Send A Shockwave Through Natural Gas Markets

- Why The Permian Just Got Even Hotter