Crescat's Tavi Costa points out something remarkable which many may have missed amid the short squeeze and "growth" stock frenzy: oil, that "value" age relic, has had its best YTD performance in 30 years. As Costa puts it "commodities are leading the way and the inflationary thesis keeps building up" (incidentally none of this is lost on those long XOM which is not only the most levered - for better or worse - way to bet on rising oil prices but pays a generous 7%+ dividend while waiting for Warren Buffett to announce that he has amassed a 10% stake).

Oil.

Best YTD performance in 30 years.

Stunning how no one is talking about this.

Commodities are leading the way and the inflationary thesis keeps building up. pic.twitter.com/SWnX1gdjgV

— Otavio (Tavi) Costa (@TaviCosta) February 6, 2021

In any case, those following the reflation theme better pay attention, because with crude oil prices joining their commodity cousins in repairing the pandemic damage, inflation rumblings are getting a little louder which means that the day central banks may be forced to tighten financial conditions (perish the thought) is nearing once again.

Related Video: The Silver Squeeze Conspiracy

Of course, with every major developed economy still printing headline and core inflation below 2%, this is not today’s problem, but there is a reason for that: metrics such as CPI and PCE are politically convenient measures that strip away virtually all basket components whose prices are surging to give central banks leeway to pursue politically acceptable policies of reflating all assets (until the bubble bursts, but by then that will be some other politician's problem).

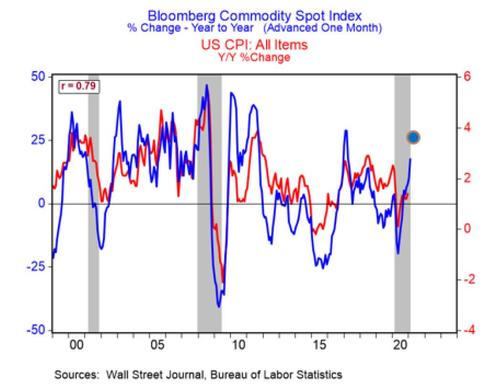

Still, as BMO's Doug Porter shows, the year-over-year rise in a basket of commodity prices (and they mostly all show a similar pattern) is now a bit above 25%. This is a problem because in the past 20 years, that’s been consistent with headline inflation of just under 4%... or rather, it would be a problem if government headline inflation data actually reflected the reality of prices.

That said, Porter notes some caveats and cautions that some of the biggest misses (where commodities popped and inflation didn’t) were immediately after recessions. That’s because there is still so much slack in the economy that cost increases don’t get fully passed along. (Note especially 2010/11.)

Still, as the BMO strategist concludes, "barring a fast fall in resource prices, it looks like the days of sub-1% inflation are rapidly drawing to a close."

By Zerohedge.com

More Top Reads From Oilprice.com: