Oil prices have stabilized after Monday's drop-off, with traders expecting a draw in both U.S. crude and product inventories - expectations that will be confirmed later today.

Chart of the Week

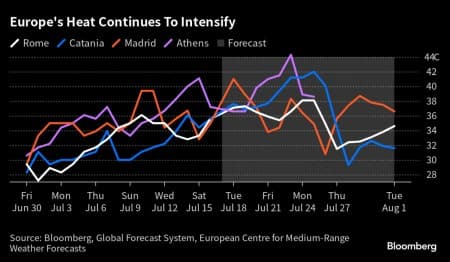

- A Saharan anticyclone called Charon is moving towards the Mediterranean and could lift temperatures in the region to all-time highs, with heatwaves aggravated by the first El Niño in four years, and testing the continent’s power generation capacities.

- Europe’s gas and power markets are gradually coming under strain as demand for air conditioning rose steeply over the past weeks and is set to soar more as Italy, Spain, Greece, and France are expected to see temperatures above 40° C.

- Whilst photovoltaic solar generation remained steady on the month, gas-to-power demand rose by 34% and 24% on the month in Italy and Spain, respectively. Despite that rise in demand, TTF front-month prices continued their decline to €25 per MWh ($9 per mmBtu).

- Similarly to natural gas, Europe’s power prices have been edging lower across the region, with Italy’s baseload August prices dropping below €100 per MWh and Spain’s same-month contract falling to €72 per MWh, both down 20% month-on-month.

Market Movers

- Oil major BP (NYSE:BP) and Azerbaijan’s national oil firm SOCAR have participated for the first time in Israel’s recent licensing round, jointly bidding for two offshore blocks alongside Israel’s NewMed Energy.

- India’s JSW Steel (NSE:JSWSTEEL) is considering buying 20% of Canada’s Teck Resources (NYSE:TECK) metallurgical coal business, with media reports suggesting the deal would be worth $2 billion.

- Confirming our report from two weeks ago, Austria’s OMV admitted it is in talks with the Emirates’ national oil firm ADNOC to combine their assets in Borealis and Borouge into a $20 billion chemicals giant.

Tuesday, July 18, 2023

The resumption of Libya’s largest oil field El Sharara, Beijing posting weaker-than-anticipated Q2 GDP growth figures, and China’s 12% year-on-year drop in exports for June, the biggest drop since peak Covid impact in the summer of 2020, have soured the overwhelmingly bullish sentiment of the past days. Some of Monday's losses were pared back on Tuesday morning as traders expect news of a draw U.S. inventories, keeping Brent steady within the $78-79 per barrel range.

Kerry Wants Climate Cooperation to Improve China Ties. In a three-day visit to China, US climate envoy John Kerry sought to polish ties between Washington and Beijing as both countries struggle with unprecedented heatwaves, despite China’s reticence to ring-fence climate amidst broader tensions.

Russia Pulls the Plug on Black Sea Grain Deal. Moscow refused to extend the Black Sea Grain deal brokered by the UN and Turkey last July, complaining that promises to free up Russian grain and fertilizer exports were not held, but market reaction was muted as wheat prices remained flat.

Disrupted Libyan Fields Resume Operations. The 300,000 b/d El Sharara field in Libya restarted over the weekend after tribal protests broke out following the arrest of former finance minister Faraj Boumtari on 12 July, as the Tripoli government caved in to demands and released the politician.

US Government Denies Small Refinery Biofuel Waivers. The US Environmental Protection Agency denied 26 requests from small refineries that wanted exemptions from biofuel blending standards under the RFS fuel standard, saying the RFS did not impose hardship on them in 2021-2022.

OPEC+ Monitoring Committee to Meet in August. Even though OPEC+’s next full alliance meeting is only scheduled to meet November 26, the monitoring committee of the oil group will convene on August 3 to assess the impact of its ongoing production cuts as oil prices started to climb again.

Japan and Saudi Arabia Talk Rare Metals Supply. Japanese Prime Minister Fumio Kishida and Saudi Crown Prince Mohammed bin Salman agreed to create a JV that would develop rare earth resources in other countries, combining Tokyo’s 2050 net zero goal and Riyadh’s diversification away from oil.

String of Force Majeure Events Sees Pemex Downgraded Again. Fitch has downgraded the credit rating of Mexico’s national oil company Pemex to junk territory, citing several fatal accidents that left critical infrastructure damaged and aggravated the outlook of the world’s most indebted oil firm.

Iran Wants to Add Oil Production Capacity. Iran’s oil minister Javad Owji pledged to increase the country’s crude production capacity by 130,000 b/d over the upcoming Iranian year by March 2024, with data published in its 5-year plan suggesting the target is to reach 4.11 million b/d.

UAE and India Agree to Trade in Local Currencies. As India’s prime minister Narendra Modi visited the UAE over the weekend the two sides have agreed to allow trade between the two countries to be settled in dirhams and rupees, paving the way for non-dollar-denominated oil purchases.

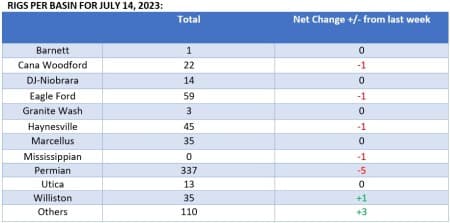

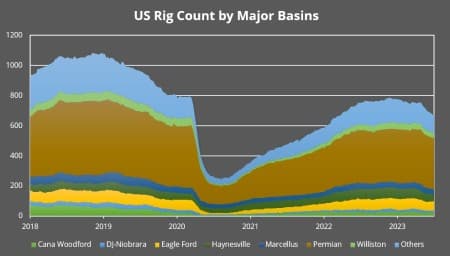

Shale DUCs Drop to Lowest Level since 2014. The number of drilled but uncompleted wells (DUCs) in the Permian basin fell to 857 in June, down 20 compared to last month, marking the 35th consecutive decline since its June 2020 peak as companies continue to work through existing well inventory.

ExxonMobil Learns Its Guyanese Lesson the Hard Way. Two businessmen from Guyana working as contractors to build a shore base for ExxonMobil’s (NYSE:XOM) offshore fields are being investigated by the FBI, DEA, and DHS for drug trafficking, money laundering and other criminal activities.

Japan Calls for Global Gas Strategic Stocks. The Japanese government will propose to create a global emergency stock for natural gas, similar to the IEA’s strategic reserve requirements for crude oil when each country has to hold stocks equivalent to at least 90 days of net imports.

Saudi Exports Drop to 2-Year Low. Saudi Arabia’s 1 million b/d production cut for July and August is already eating into the kingdom’s oil exports, with Kpler data showing Aramco exports dropped to 6.2 million b/d in July to date, down almost 700,000 b/d compared to June and the lowest monthly figure since June 2021.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia’s Imports Of Russian Fuel Oil Hit A Record High

- U.S. Shale Challenges OPEC With Record Production In 2023

- Russia To Overtake Saudi Arabia As The Largest OPEC+ Oil Producer