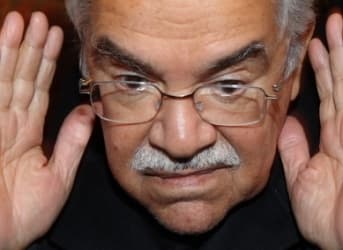

Saudi Oil Minister Ali al-Naimi, the architect of OPEC’s strategy to regain market share by causing the price of crude oil to plunge, says his plan is working, and data from petroleum research firms seem to back him up.

Making his first public comments in two months, al-Naimi told reporters in the southwestern Saudi city of Jazan that the markets have cooled off, and cited Brent crude, the global benchmark, as an example, noting that its price has stabilized at about $60 per barrel.

He also pointed to data that inexpensive oil is driving up demand, notably in China and the United States, which eventually could lead to price stability or to a price rebound.

But Al-Naimi warned naysayers not to upset this new balance. “Why do you want to rock the markets?” he asked. “The markets are calm. … Demand is growing.” Related: OPEC Considers Emergency Meeting On Oil Prices

If al-Naimi is right, then his strategy was correct, and it acted quickly. It was only three months ago at OPEC’s headquarters in Vienna that the Saudi minister pushed through a plan to maintain oil production at 30 million barrels a day, declaring a price war with US shale oil producers who rely on costly hydraulic fracturing, or fracking, to extract oil embedded tightly in underground rock.

The US shale producers had not only created a global oil glut, which was depressing the price of oil, but they also had turned their country from OPEC’s biggest customer to a nation headed towards energy independence.

OPEC’s decision led to even lower oil prices, meaning lower revenues, and sometimes even losses, for many oil companies. The financial services concern Cowen & Co. estimates that as a result, total capital expenditures for both production and exploration will plunge by more than $116 billion this year.

As for US shale producers, some folded under the Saudi strategy. Baker Hughes Inc., one of the world’s largest oilfield services companies in the world, reports that the number of oil rigs operating in the United Stated declined by fully 35 percent since as recently as Dec. 5, leaving the country with the fewest rigs in four years.

Still, lower fuel prices are attractive at the retail market, whether on an industrial scale or for the motorist who simply needs to fuel his or her car. On the large scale, Chinese manufacturing has expanded, if only slightly, this month, according to the HSBC/Markit Purchasing Managers’ Index. It climbed to a four-month high of 50.1, where an even 50 separates economic growth from contraction. Related: Could This Be Saudi Arabia’s Best Kept Secret?

There’s more optimistic news, particularly on the smaller retail level. The research group JBC Energy says US demand for gasoline grew by nearly a half-million barrels a day in January. In India, it says, the demand was 18 percent higher in January than in the same month the previous year.

The JBC report said the allure of cheap fuel can alter driving habits, including what car a customer buys next. And that’s supported by Autodata Publications Inc., which reports that consumers again are opting for cars that are more fuel-hungry: Sales of SUVs and light trucks grew by 19.3 percent from January 2014 to January 2015, while more economical passenger cars grew by only 7.7 percent.

Despite this good news for al-Naimi, if the price of oil has finally bottomed out and begins to rise again, won't the US shale producers get back into the act with a vengeance?

By Andy Tully of Oilprice.com

More Top Reads From Oilprice.com:

- Could Venezuela Become World’s Next Energy Giant?

- OPEC Production Cut May Not Be Needed After All

- Libya Oil Output Plunges Amid Heightened Violence

the Fracking market in the US is not going anywhere. If anything, the Saudis are the one who are soon going to feeling it the most, as they burn through cash reserves to cover debt, as they need oil to be at $92 a barrel (as of 2013) to cover their goverment costs.

http://tinyurl.com/of4b5ed