Lithium shares are on a roll after investment bank Macquarie (ASX: MQG) joined peers in predicting a further increase in prices for the key battery metal driven by increasing demand from the electric vehicles (EVs) sector, which is expected to push the market into undersupply.

Analysts at the bank are now forecasting prices to rise by between 30% and 100% over the next four years.

“Our bullish EV demand outlook sees the lithium market move to deficit in 2022 with material shortages emerging from 2025,” Macquarie said in the report.

That scenario would push spodumene prices to above $720 a tonne, the bank said. Of the two main processed forms of the metal, lithium carbonate, is tipped to remain above its “incentive” price of $13,000 per tonne, while lithium hydroxide is expected to sit comfortably above $16,000 a tonne.

Chinese spot lithium prices started to recover in late 2020, with the recovery accelerating over the first three months of 2021. Lithium carbonate prices have been stronger, up around 70% year to date, while Chinese lithium hydroxide prices are up 55-60%. Macquarie notes lithium carbonate prices in the Asian market are currently trading at 10-20% premiums to lithium hydroxide prices.

The rise in China spot prices has begun to translate through to a recovery in regional lithium prices, the bank said. Given that Chinese carbonate prices are up 110% and 80% from the beginning of 2020 — while Chinese hydroxide prices are up around 40% — Macquarie believe there could be further upside to regional prices in coming months.

Escalating prices threaten to slow the push toward making cheaper EV batteries, key to more widespread adoption of emissions-free vehicles.

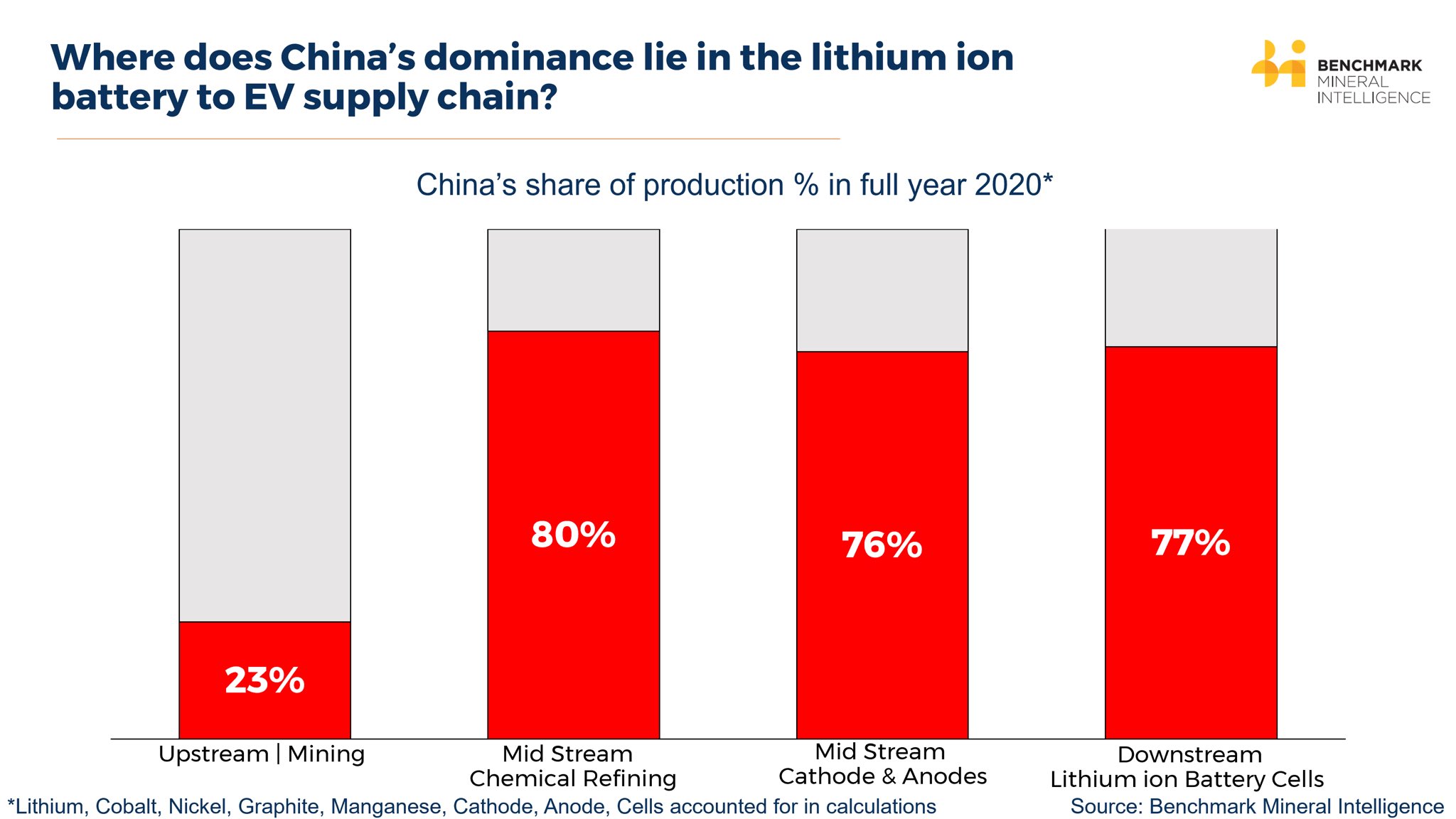

“If lithium and other high-cost inputs, such as cobalt and nickel, enter periods of sustained higher pricing, this would eventually take its toll on the ability of battery producers to keep lowering costs,” Cameron Perks, a senior analyst at Benchmark Mineral Intelligence (BMI) told Bloomberg on Tuesday.

Ratings revision

Macquarie’s lithium price upgrade has led to earnings upgrades and re-ratings for Australian lithium miners. Both Orocobre (TSX: ORE) and Galaxy Resources (ASX: GXY) have been upgraded to outperform.

The analysts have also resumed coverage of Pilbara Minerals (ASX: PLS) with outperform, and after remodeling the miner’s growth outlook with a staged approach, expect to see a nine-fold increase in spodumene production by 2028. Related: OPEC’s Bullish Demand Data Sparks Hope Of New Oil Rally

Orocobre issued an upgrade of its own on Tuesday, announcing that sales price for its lithium carbonate jumped 50% to $5,853 a tonne in the March quarter compared to the previous quarter.

“Orocobre also advises that prices for the June 2021 quarter are expected to be approximately $7,400/tonne FOB, subject to shipping schedules,” the company said.

The bank predicts a global penetration rate for EV sales of 16% for combined battery electric vehicles and plug-in hybrid electric vehicles by 2025.

Longer-term, Macquarie assumes 2030 penetration rates of 33% globally and 41% in China.

Macquarie’s bullish price outlook is based on the same data Citi used mid-February, when it upgraded its view of the battery metals sector and proclaimed that EVs were driving lithium price recovery.

“EV sales proved to be extremely resilient in 2020, growing by more than 35% year-on-year while overall passenger vehicle sales fell by 20%,” Citi said at the time.

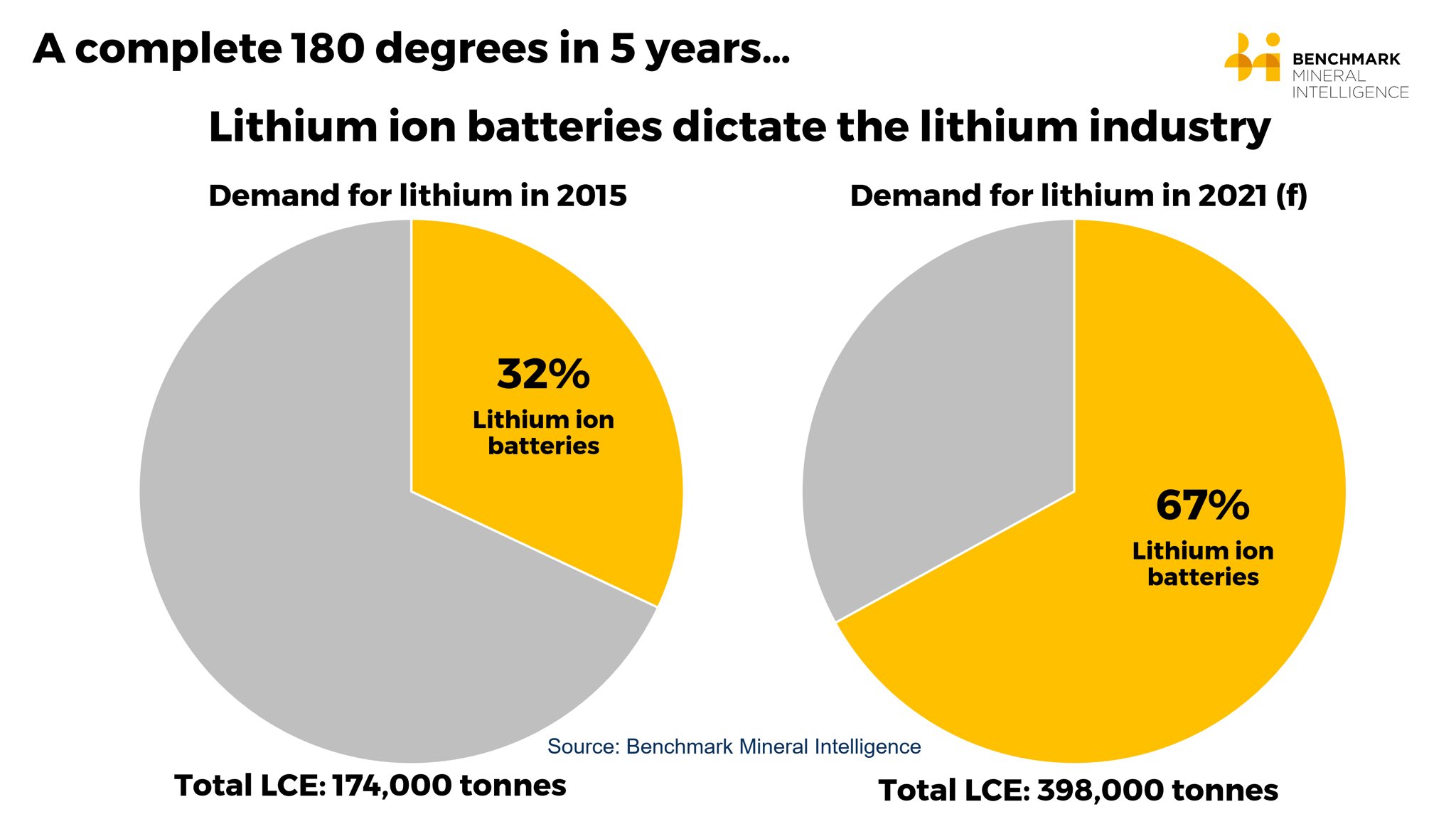

Lithium has done a complete 180 degree flip in five years, according to Simon Moores, managing director at BMI.

“From lithium-ion batteries accounting for 32% of demand in 2015… To the “other” now being 33% of demand in 2021,” he said on Wednesday.

BMI expects a structural deficit for lithium could emerge as soon as later this year and increase to 120,000 tonnes in 2022.

By Mining.com

More Top Reads From Oilprice.com: