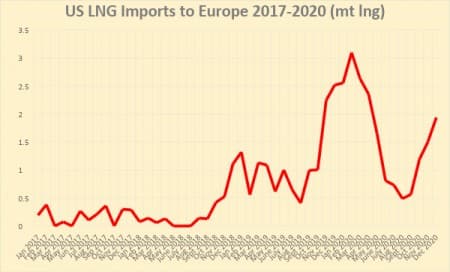

Making bold assertive statements is never a prudent strategy for any analyst, regardless of the topic to be examined. Risking the peril of not seeing the sudden twist behind the corner, a seemingly unavoidable assumption is to be put forward – this year is going to be much weaker for the European LNG market than was generally assumed. Moreover, the prime reason for LNG failing to repeat the all-time highs of the 2019/2020 winter season lies not with COVID-19 and its ramifications but with impressive competition between Europe’s pipeline suppliers between each other as well as between pipeline gas in general and LNG deliveries from other continents. With this, the battle for a European market share begins once again. Graph 1. LNG Imports into Europe in 2017-2020 (million tons LNG per month).

Source: Thomson Reuters.

Especially now, with Denmark announcing its gradual phasing out of North Sea production and abandoning oil and gas production altogether by 2050, Europe is poised to become the battlefield of Russian and US energy interests. The attentive reader might have come across news headlines that lauded the highest-ever volume of US LNG exports last month, however the overwhelming part of this can be accounted for by great netbacks in Asia. Europe, on the other hand, has been faltering amid robust Russian and Norwegian supplies and the overall volume of incoming LNG remains equivalent to that of the 2018/2019 winter season, with monthly volumes hovering between 5 and 6 million tons LNG. To put this into context, the highest-ever volume of LNG imports into Europe took place in March 2020 when a total of 10.1 million tons made its way to European LNG terminals.

Related: Oil Rises As Market Awaits OPEC+ Production Decision

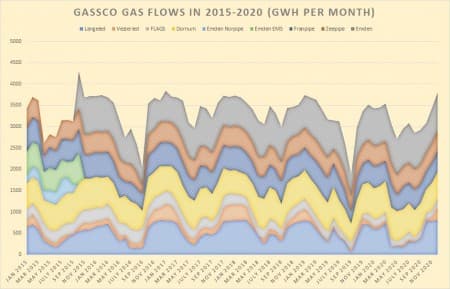

Graph 2. Gassco Gas Flows in 2015-2020 (in Gigawatt-hours per month).

Source: Thomson Reuters

One of the main reasons for such a slump is intense price competition from suppliers of pipeline gas. Autumn exports of Norwegian gas to buyers in the United Kingdom, Germany, Netherlands, Belgium and elsewhere have bounced back really robustly, to the extent that healthy demand and a positive futures market have compelled Equinor, the operator of the Troll and Oseberg fields (the largest ones on the Norwegian continental shelf with some leeway in terms of additional production capacity), to consider maximizing output in 2021. Needless to say, both Troll and Oseberg were held back in the past two years as gas prices in Europe were suboptimal for the producers. In addition to Norwegian volumes, Europe can avail itself of even cheaper gas coming in from Russia.

Gazprom recently reiterated that its pricing is split roughly along the following lines: one-third is straight out oil-indexed, one-third is hub-indexed and the remaining one-third is a hybrid of the two. The fact that Russia’s pipeline gas deliveries are priced in with a 6-to-9-month lag has rendered prices in the 2020/2021 winter season ideal for the buyers – for instance, the May 2020 Brent price averaged 29 USD per barrel. This might be the reason why Gazprom has stopped informing the market of its average monthly European landed price, generally assumed to have stayed below 100 USD per MCm from May/June 2020 onwards. Expecting all the pandemic fallout the only thing that could mitigate further Russian pipeline gas exports to Europe this winter is the relatively mild weather forecast, heretofore true to life.

Despite looking good in terms of pricing and availability, Russian pipeline exports have been heavily curtailed by the COVID-induced market slump. After two years of exports around 200 BCm per year in 2018 and 2019, this year will see a „mere” 170 BCm of gas supplies and Gazprom’s cautious utterances about 2021 indicate that Russia does not expect a quick rebound anytime soon (the current assumption is that next year will be around 183 BCm), especially with no definite understanding of when Nord Stream-2 could be ramped up. The Russian pipeline export monopoly has managed to safeguard its main export outlets (for instance, supplies via Nord Stream-1 in Jan-Nov 2020 have already surpassed the total annual throughput of 2019) but has lost some ground in nearer markets such as Finland where the increasing interconnectivity of EU countries has allowed for a higher penetration of LNG.

Graph 3. US LNG imports to Europe in 2017-2020 (in million tons LNG).

Source: Thomson Reuters.

Interestingly, all the above is taking place amid a rather beneficial pricing environment for LNG cargoes. Landed prices for LNG deliveries into the United Kingdom, Spain or France are all well above the $6/MMbtu threshold, i.e. they have gone back to where they were last in March 2019. As attractive as that might seem, it lags far behind the Asian market where Chinese, South Korean and Japanese landed prices have surpassed $11/MMbtu amid robust interest and tight shipping availability. In effect, additional LNG volumes from the United States might almost seamlessly counteract the underutilized capacities from Australia, Indonesia and partially Egypt. Hence, if US companies are aiming to maximize profit following a tough 2020, they would naturally opt to satisfy Asian demand.

In addition to the above, a rather unforeseeable factor contributing to the weak LNG winter in Europe are the maintenance travails of one of Europe’s most cost-competitive suppliers, Qatar. Qatar’s gigantic 77mtpa Ras Laffan liquefaction plant witnessed a string of setbacks as first Train 5 (nominal capacity of 7.8mtpa LNG) was taken offline in mid-November for planned maintenance and then Train 4 went off-stream for several weeks in November-December 2020 in what was rumoured to be caused by faulty compressor issues. Such a liquefaction squeeze has resulted In Qatar underperforming its European deliveries, all the while seeing to that its traditional buyers in Asia have all their requirements met (in Asia, the attractiveness of Qatari LNG was boosted by the usual thorn in flesh, its oil linkage).

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

- A Silver Lining For Kazakhstan Oil In 2020

- The Middle East Needs To Wake Up To Renewables

- The Russian Energy Giant Mining Bitcoin With Virtually Free Energy