Oil prices are once again under pressure as inflation data suggests the Fed will keep interest rates higher for longer. Meanwhile, COP28 looks set to end in disappointment as nations struggle to agree on any sort of fossil fuel phase-out.

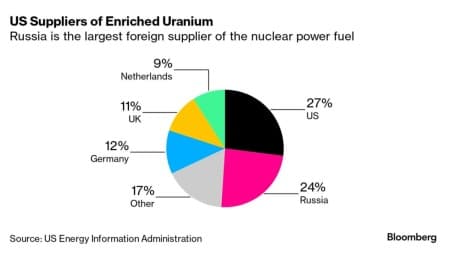

- The US House of Representatives is slated to consider legislation banning imports of Russian-origin enriched uranium, currently accounting for almost 25% of the US market.

- Russia is the largest uranium enricher globally, owning 46% of the world’s total uranium conversion infrastructure, whilst three-quarters of US nuclear fuel needs are met by imported uranium fuel.

- If passed, the cost of nuclear fuel is expected to increase by 13% for reactors across the US, adding a further impetus to runaway uranium prices that started 2023 at $48 per ounce and currently trade at $81/lb.

- The Russian uranium import ban does stipulate a temporary waiver until January 2028, upon regulatory approval from the US Secretary of Energy, although it is unlikely to be utilized frequently.

Market Movers

- Venezuela has asked oil majors BP (NYSE:BP) and ExxonMobil (NYSE:XOM) to revive the long-idled offshore gas project Plataforma Deltana, straddling the border with Trinidad and Tobago.

- The largest privately held Permian Basin-focused US oil producer Endeavor Energy is exploring a sale that could value the company at $30 billion, with production of some 330,000 b/d of oil equivalent.

- Canada’s midstream major TC Energy (NYSE:TRP) is seeking $750 million from pipeline contractor PAPC owned by Italy’s Bonatti holding for alleged poor performance in building the $11 billion Coastal GasLink.

Tuesday, December 12, 2023

The COP28 conference has widened the rift between energy-hungry emerging nations and developed countries seeking to curb their carbon footprint, leading to no tangible progress on climate talks. Concurrently, the prospect of seeing US interest rates higher for longer, confirmed by today’s inflation data, has pushed Brent back below the $75 per barrel mark. Should US crude inventories provide another bearish narrative on Wednesday, the plunge down south could get even worse.

OPEC Speaks Out Against Fossil Fuel Phase Out. OPEC is rallying members and affiliated countries to veto a COP28 final document that could call for a phase-out of fossil fuels, saying the undue pressure on fossil fuels might lead to irreversible consequences, triggering the ire of environmentalists.

Warm Winter Sends US Gas Prices Southwards. Front-month futures of the Henry Hub gas contract plunged 10% this week on the news of US gas inventories trending 5% above the 5-year average and of forecasts indicating warmer-than-usual weather will remain in place until at least end-December.

Occidental Splashes the Cash on CrownRock. US oil major Occidental Petroleum (NYSE:OXY) agreed to buy privately owned shale producer CrownRock in a cash-and-stock deal for $12 billion including debt, boosting its Permian production potential by 170,000 b/d of oil equivalent.

Brazil Seeks to Mediate Essequibo Spat. Brazil will act as a mediator between Venezuela and Guyana as the two countries’ presidents meet in St Vincent on 14 December, seeking to defuse tensions between two major oil-producing countries over the future of the disputed Essequibo region.

EU Close to Agreeing on 12th Russia Sanctions Pack. European Union members have been getting close to a deal on a proposed 12th package of sanctions on Russia, banning Russia-origin diamonds however the EU watered down initial suggestions to ban sales of EU-owned oil tankers.

Mexico’s President Declares War on Regulators. Outgoing Mexican president Andres Manuel Lopez Obrador plans to submit reforms to dissolve all regulatory bodies in the country, including the energy regulators CRE and CNH, three years after he failed to absorb them into the Energy Ministry.

Tellurian Sees Management Shake-Up. US LNG developer Tellurian (NYSEAMERICAN:TELL) ousted its chairman Charif Souki as an executive officer after auditors started raising doubts over the company’s financial statements, failing to attract clients for the firm’s delayed $14.5 billion Driftwood LNG plant.

Russia to Finance South Africa Refinery Revamp. South Africa’s national oil company PetroSA selected Russia’s leading commodity bank Gazprombank as its investment partner to restart the 45,000 b/d Mossel Bay gas-to-liquids refinery, idled in 2020 for lack of domestic gas production.

China Starts First 4th Generation Reactor. China’s national nuclear corporation CNNC started commercial operations at the 210 MW Shidaowan nuclear plant, the world’s first-ever fourth-generation production site that is a modular pebble-bed reactor using gas as a coolant.

Nigeria Wants to Hand Over Utilities to Local Authorities. Nigeria’s Tinubu government is mulling the handover of its stake in 11 power utility companies to the regional government to improve oversight and address recurring blackouts, all the while actively cutting the federal authorities’ liabilities.

Hedge Fund Sell-Off Weakens Aluminium. The three-month aluminum price on the London Metal Exchange dropped to $2,125 per metric tonne this week, the lowest since August after hedge funds cut their positions on the back of Chinese consumer prices falling at the fastest rate since 2020.

Argentina Embarks on Pricing Crash Course. Just as Argentina swore in its new President Javier Milei, the country’s state oil company YPF (NYSE:YPF) has increased fuel prices at the pump by an average of 25%, marking the first step of what was vowed to be economic shock therapy measures.

India Keeps on Paying More. According to Indian government data, the average price of Russian oil delivered to Indian refiners soared to $84.20 per barrel last month, way above the $60 per barrel price cap and the highest monthly average since December 2022, boosting the Kremlin’s oil revenue.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- M&A Boom Sees Permian Oil Deals Surpass $100 Billion in 2023

- EU to Allow Members to Ban Russian Pipeline Gas

- China’s Oil Demand Growth Is Set for a Significant Slowdown in 2024