Indian oil demand rose over 10 percent in January, up for a fourth consecutive month. Although much of the magnitude of the year-on-year improvement is due to last year's low base, with consumption in January 2017 hamstrung by the hangover of demonetization, the upward trend signals ongoing strength in the Indian economy.

India has recently been dealing with a number of different changes to its domestic fuel market. It is still recovering from a change in the pricing methodology of its retail petrol and diesel - from fortnightly to daily - in order to pass on the benefit of price moves lower. (Unfortunately, this has had the reverse effect in the rising market of the last six months).

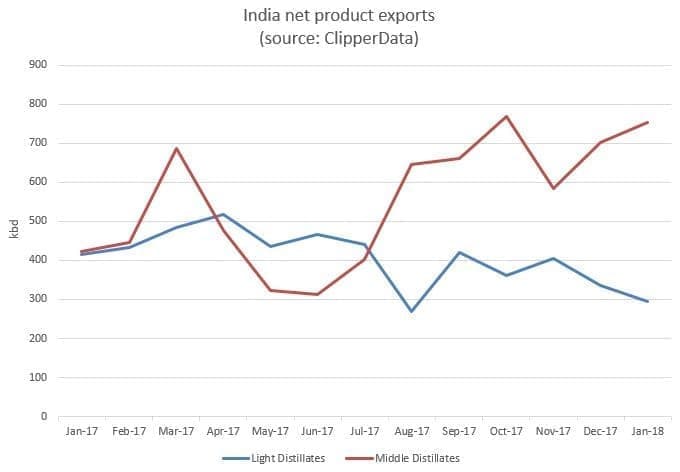

India is also set to introduce low-emission fuel to Delhi in April - Euro VI grade gasoline and diesel - some two years ahead of the countrywide launch, in an effort to curb pollution. There was extensive maintenance last summer to upgrade Indian refineries to meet more stringent standards, but we can see from our ClipperData that net exports have picked up dramatically since.

As the chart below illustrates, while net exports of gasoline have gradually dropped over the last year - as domestic demand has continued to improve - rising global demand for middle distillates has boosted exports to over 800,000 bpd in recent months - lifting net exports. India sent middle distillates last year to a whopping 56 countries.

(Click to enlarge)

India's status as a net exporter is set to grow in the coming years. Indian refiners are making plans to raise refining capacity by 77 percent by 2030, up to ~8.8 million barrels per day. Related: Saudi Arabia Vows To Cut More Production To Stabilize Oil Market

This is an effort to meet both rising domestic and international demand: India's close proximity to both the crude export hub of the Persian Gulf, and the product demand hub of Asia make it an ideal location - leaving some entities as Saudi Aramco to consider joining the likes of Rosneft by expanding its operations into India.

If current consumption patterns continue, India's fuel demand will rise to close to 8 million barrels per day by 2030 (up over 70 percent from last year). To meet these needs, India will continue to import the vast majority of its crude, given domestic production is ~700,000 bpd and in the doldrums.

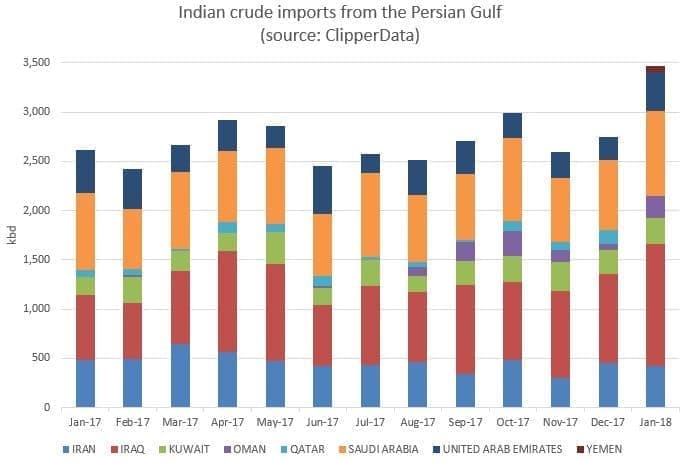

It relies on OPEC for about 85 percent of its crude imports, with two-thirds of imports coming from the Persian Gulf. We discussed earlier in the week how Iraqi flows had reached a record into India last month. This boosted Persian Gulf flows to close to 3.5 million barrels per day, as total Indian crude imports ripped to an outright record due to strong refinery demand.

(Click to enlarge)

In similar fashion to China, Indian energy demand is not only ripping higher from a fossil fuel perspective, but across all energy sources. From now until 2022, India is expected to be one of three countries accounting for two thirds of global renewable expansion. (China and the U.S. are the other two).

By Matt Smith

More Top Reads From Oilprice.com:

- Venezuela’s PDVSA Faces Mass Exodus Of Workforce

- Trump Proposes Sale Of Transmission Assets

- Saudi/Russia-Led Oil Supergroup In The Making