Thanksgiving week usually features low-volume, low-volatility moves in the energy complex, but so far in this holiday-shortened week, we have seen none of that with crude prices being influenced by heightened volatility in the equity markets and natural gas prices being supported by predictions of an extremely early triple-digit drawdown in supply.

After two-days of trading, crude oil futures were already down 5.73 percent, while natural gas prices were up 5.36 percent. Volatility came down a bit on Wednesday and Thursday after the government released its latest reports on crude oil inventories and natural gas supply (a 134 BcF draw in natural gas inventories, and a moderate build in crude oil stocks. These reports are likely to set the tone for the rest of the session and the rest of the week.

Prices are primarily being influenced by concerns over rising production and falling demand. Output is rising, led by increasing production from the United States, Russia and Saudi Arabia, which now accounts for about a third of U.S. daily consumption.

Signs of lower demand are beginning to emerge. On Monday, Japan’s Ministry of Finance reported that October crude oil imports fell by 7.7 percent from the same month last year, to 2.77 million barrels per day (bpd).…

Thanksgiving week usually features low-volume, low-volatility moves in the energy complex, but so far in this holiday-shortened week, we have seen none of that with crude prices being influenced by heightened volatility in the equity markets and natural gas prices being supported by predictions of an extremely early triple-digit drawdown in supply.

After two-days of trading, crude oil futures were already down 5.73 percent, while natural gas prices were up 5.36 percent. Volatility came down a bit on Wednesday and Thursday after the government released its latest reports on crude oil inventories and natural gas supply (a 134 BcF draw in natural gas inventories, and a moderate build in crude oil stocks. These reports are likely to set the tone for the rest of the session and the rest of the week.

Crude Oil

The Fundamentals

Prices are primarily being influenced by concerns over rising production and falling demand. Output is rising, led by increasing production from the United States, Russia and Saudi Arabia, which now accounts for about a third of U.S. daily consumption.

Signs of lower demand are beginning to emerge. On Monday, Japan’s Ministry of Finance reported that October crude oil imports fell by 7.7 percent from the same month last year, to 2.77 million barrels per day (bpd). The International Energy Agency (IEA) is also warning about lower demand due a weakening global economy. Also helping to keep a lid on prices are signs of lower demand due to the lingering trade disputes between the world’s two biggest economies, the United States and China.

Unless these scenarios change dramatically over the near-term, WTI and Brent crude oil are likely to remain rangebound amid reports that OPEC is planning to announce production cuts when it meets in Vienna on December 6.

According to early reports, traders are expecting top exporter Saudi Arabia to push OPEC and other non-OPEC investors to cut supply towards the end of the year. The most difficult task, however, remains convincing Russia to go along with the plan. The expected cuts are supposedly in the neighborhood of 1 to 1.4 million barrels per day.

Related: Trump Thanks Saudis For Lower Oil Prices, Wants Even Cheaper Crude

At the start of the week, crude oil faced additional headwinds.

In other news, U.S. energy firms added two oil rigs in the week to November 16, bringing the total count to 888, the highest level since March 2015, according to energy services firm Baker Hughes.

Additionally, money managers cut their bullish wagers on crude oil futures and options to their lowest level since June 2017, the U.S. Commodity Futures Trading Commission (CFTC) said on Friday.

The hedge fund and commodity fund money managers cut their combined futures and options positions on U.S. and Brent crude during the week-ended November 13 to the lowest level since June 27, 2017.

Looking at this another way, portfolio managers have sold the equivalent of 553 million barrels of crude and fuels in the last seven weeks, the largest reduction over a comparable period since at least 2013.

Furthermore, funds now hold a net long position of just 547 million barrels, less than half the recent peak of 1.1 billion at the end of September, and down from a record 1.484 billion in January.

Outside Factors Influencing Price Action

After consolidating for four trading sessions, crude oil prices spiked lower on Tuesday. The catalysts behind the move were a soaring U.S. Dollar and a steep sell-off in U.S. equity markets.

A firmer U.S. Dollar tends to weigh on crude oil prices because it is a dollar-denominated commodity. A stronger greenback tends to lead to lower foreign demand for U.S. crude oil. The sharp break in the U.S. stock market triggered another round of margin-call related hedge fund selling.

Crude oil is stabilizing as we approach the U.S. holiday on Thursday. Some of the move is being supported by profit-taking and position-squaring, but most of it is being fueled by a surprise draw in the American Petroleum Institute’s (API) weekly inventories report.

On Wednesday, investors will get the opportunity to react to the U.S. Energy Information Administration’s weekly inventories report. It is expected to show a 2.4 million barrel build, however, it could come out differently because of the change in the API report.

Crude Oil Technical Analysis

U.S. West Texas Intermediate Crude Oil

(Click to enlarge)

The main trend is down according to the weekly chart. The market isn’t close to changing the trend to up, but it is in a position to post a dramatic reversal bottom. All it needs to do is close over $56.68 on Friday.

The major range is $41.34 to $76.55. Its 50 percent to 61.8 percent percent retracement zone, which is typically recognized as value by professional traders, is $58.95 to $54.79.

The market spiked through this zone on Tuesday when stock market volatility drove prices through the support at $54.79. However, the friendly API report has pushed prices back into this zone. This indicates that Tuesday’s selling was likely fueled by sell stops rather than aggressive short-selling.

If Wednesday’s EIA report comes in bullish then look for buyers to extend the short-covering rally further into the retracement zone.

Look for a sideways trade until OPEC makes its decision on December 6 if crude oil can hold inside the retracement zone. Crude oil is going to have a hard time rallying until it stops going down and begins to build a support base. Furthermore, it needs to see a shift in the fundamentals before either of these factors takes place.

An unexpected draw in crude oil futures will be the first sign of a shift in the fundamentals. OPEC’s decision to reduce production will be the next.

As far as the weekly chart is concerned, a sustained move under $54.79 will indicate the selling is getting stronger. Overtaking $54.79 will indicate the short-covering is getting stronger, while a breakout over $58.95 will signal the return of buyers.

Natural Gas

Natural gas futures are moving higher on Wednesday shortly before the release of the U.S. Energy Information Administration’s weekly storage report. It’s also in a position to challenge last week’s spike top at $4.964. The catalysts behind the early strength are expectations of a triple-digit withdrawal from storage and the return of cold weather after a slight reprieve this week-end. Traders are also anticipating heightened volatility following the release of a major government storage report later today.

Weather Outlook

The focus remains on the weather models. The current models are maintaining long-range cold risks which is helping to underpin prices.

U.S. Energy Information Administration Report Estimates

Pre-report estimates are calling for a triple-digit withdrawal for the week-ended November 16. The range guesses are minus 92 Bcf to minus 121 Bcf. Last year, the EIA reported a 42 Bcf withdrawal for the same period. The five-year average for this time of year is a withdrawal of 25 Bcf. So if you do the math, today’s withdrawal is expected to come in at nearly 4 times the five-year average. That’s very bullish if you’re keeping score at home. Related: The Wildcard In OPEC's Next Deal

A survey from Bloomberg points to a range of 99 Bcf to 120 Bcf, with a median of 108 Bcf. A Reuters survey of traders and analysts predicts a range of 92 Bcf to 121 Bcf, with a median of 109 Bcf.

The Intercontinental Exchange (ICE) EIA financial weekly index futures contract settled Monday at a withdrawal of 114 Bcf.

Technical Analysis

January Natural Gas

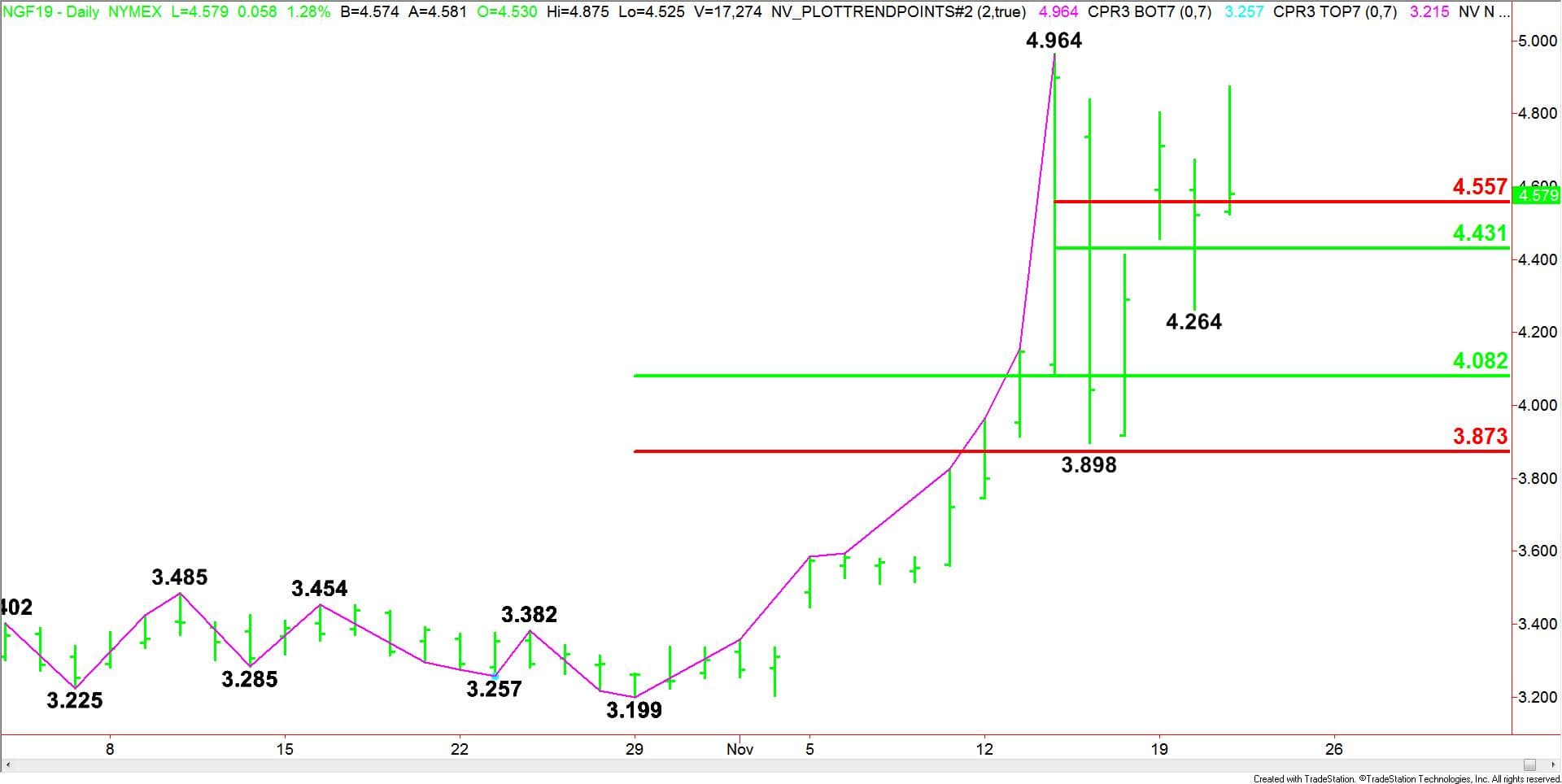

(Click to enlarge)

The main trend is up according to the daily swing chart. A trade through $4.964 will signal a resumption of the uptrend. If this move attracts enough upside momentum, we could see a drive into $5.50.

The minor trend is also up. However, it will turn down on a trade through $4.264. This will also shift momentum to the downside.

The main range is $3.199 to $4.964. Its retracement zone at $4.082 to $3.873 is support.

The minor range is $4.964 to $3.898. Its 50 percent to 61.8 percent retracement zone is $4.431 to $4.557. This zone is currently being treated like support.

Forecast

The triple digit draw in natural gas supplies is major news since it’s still only November and the winter heating season is just getting started. Furthermore, it will significantly widen the year-on-year and five-year storage deficits. This could pose problems later in the winter season if the cold blasts continue.

The longer-term weather models are indicating the return of frigid temperatures throughout most of the country after the week-end.

Volatility works both ways so a EIA miss could drive prices lower, however, I don’t expect prices to fall to far because of the weather. It would have to take a weak EIA report and a change in the weather to mild next week to drive prices sharply lower.

In order to sustain the upside momentum, the market is going to have to hold above $4.431. If it fails then we could see a pullback into $4.082 to $3.873.

If buyers continue to come in to support the market at $4.431 then this could create the upside momentum needed to trigger a breakout over $4.964.

By Jim Hyerczyk for Oilprice.com

More Top Reads From Oilprice.com: