Global investments in renewable energy generation capacity will vastly outnumber investment in new fossil fuel-fired plants by 2050, as the share of renewables in the world’s generation capacity will grow exponentially, research company BloombergNEF (BNEF) says in its report New Energy Outlook 2019.

Investments in new generation capacity around the world is set to hit US$13.3 trillion over the 32 years to 2050, according to BNEF estimates. Of this US$13.3 trillion, as much as 77 percent will be investment earmarked for new electricity generation from renewable sources.

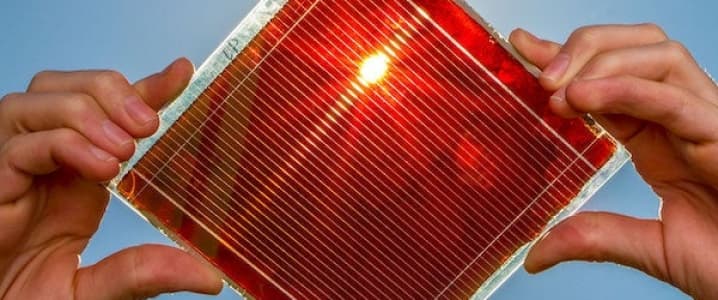

Wind and solar will lead the renewable investment over the next three decades, BNEF’s analysis showed.

Wind power is set to attract US$5.3 trillion in new generation by 2050, solar will see spending at US$4.2 trillion, while investments in batteries will amount to US$843 billion.

To compare, global investment in new fossil plants is set to not exceed US$2 trillion by 2050, which works out to around US$416 billion a year until then, according to BNEF’s estimates.

Global investment in new power generation capacity will help build 15,145 GW of new power plants between now and 2050. Of this capacity, 80 percent will be zero carbon, the report said.

Another 1,666 GW of non-generating capacity such as batteries and flexible capacity for demand response will be built over the next three decades.

In terms of batteries, BNEF expects a lot of new investments by 2040 in another recently published report. Related: China’s Ultimate Play For Global Oil Market Control

Continuously falling battery costs, and rising capacity and usage of clean energy are set to result in booming global stationary energy storage over the next two decades, which will require total investments of as much as US$662 billion, according to the key findings of the latest report on new energies by BNEF. Energy storage installations across the world are expected to soar to 1,095GW, or 2,850GWh, by 2040, compared to a modest current deployment of just 9GW/17GWh as of 2018, according to BNEF’s latest forecasts.

Batteries will help growing green generation capacity to integrate into the grid.

Wind and solar will grow so much that by 2032, the world will have more wind and solar electricity than coal-fired electricity, BNEF’s New Energy Outlook 2019 said.

The use of coal will peak globally in 2026, and coal generation will collapse all around the world except for Asia. Yet, even in the biggest markets in Asia—China and India—coal will peak over the next decades, and those two markets will drive the Asian investment in renewable capacity by 2050, according to BNEF.

Globally, by 2050, coal-fired generation in the world will drop by 51 percent, supplying just 12 percent of the world’s electricity, compared to 27 percent today.

In terms of the pace of transition to renewables by region, Europe will be the leader, with renewable energy accounting for 90 percent of Europe’s electricity mix as early as by 2040, of which wind and solar will make up 80 percent, BNEF has estimated. Related: U.S. Sanctions Backfire, Lead To Boost In Russian Oil Exports

Major European economies are already on the road to decarbonization, thanks to policies supporting it and to carbon pricing. The U.S., where low-priced natural gas fired power plants, and China, with modern coal-fired plants, lag behind Europe at a slower pace of decarbonization, the report says.

“Our power system analysis reinforces a key message from previous New Energy Outlooks – that solar photovoltaic modules, wind turbines and lithium-ion batteries are set to continue on aggressive cost reduction curves, of 28%, 14% and 18% respectively for every doubling in global installed capacity,” Matthias Kimmel, NEO 2019 lead analyst, said, commenting on the NEO 2019 findings.

Kimmel then added:

“By 2030, the energy generated or stored and dispatched by these three technologies will undercut electricity generated by existing coal and gas plants almost everywhere.”

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Shale’s Dark Side: Methane Emissions Are Soaring

- Saudi Arabia’s Newest Strategy To Send Oil Prices Higher

- Is Renewable Hydrogen A Threat To Natural Gas?