Domestic Chinese battery-grade lithium carbonate prices assessed by Benchmark Mineral Intelligence are on a tear in 2021 after bottoming out in the second half of last year, following a lengthy slump.

Ex-works lithium carbonate in China (≥99.5% Li2CO3) jumped by 68% to its highest since June 2019 in the first two months on the back of high battery demand, particularly for lithium iron phosphate (LFP) cathode, and a slower-than-anticipated transition to high nickel chemistries, according to Benchmark.

Benchmark’s megafactory tracker points to the extent of the rise in demand reflected in China’s battery production figures, which totalled 12 GWh in January, an increase of nearly 320% compared to the same month last year when the country was in the first stages of the pandemic.

The surge was led by production of LFP batteries which is growing at a breakneck speed, up nearly 500% year- on-year.

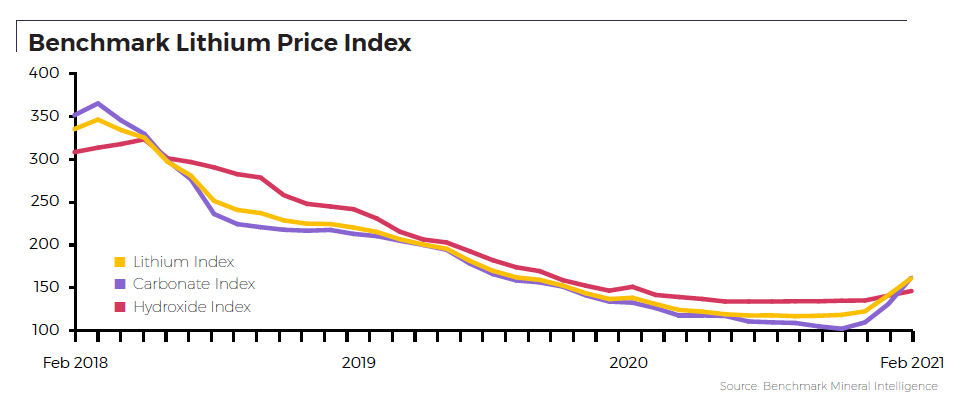

Surging Chinese lithium carbonate prices, which now hold a premium over hydroxide prices for the first time since April 2018, helped push the Benchmark Lithium Price Index up by 14.4% in February 2021, its second-largest move on record after January 2021, the London-headquartered research and price reporting agency said.

While the most rapid gains were in China, Benchmark’s global weighted average lithium hydroxide prices are up 8% year-to-date and ex-Chinese carbonate prices up by an average of 17.1% in February:

Related Video: Why & How To Trade Lithium

In fact, all 11 of Benchmark’s lithium prices registered increases in February 2021 as producers of both spodumene and lithium chemicals worldwide have begun to sell out inventories and fill order books through until the end of Q2 2021.

While lithium’s majors are beginning to reengage in expansion plans, three years of falling lithium prices have failed to incentivise sufficient investment into the supply chain, leading to greater risks of price volatility as battery demand ramps up.

By Mining.com

More Top Reads From Oilprice.com: