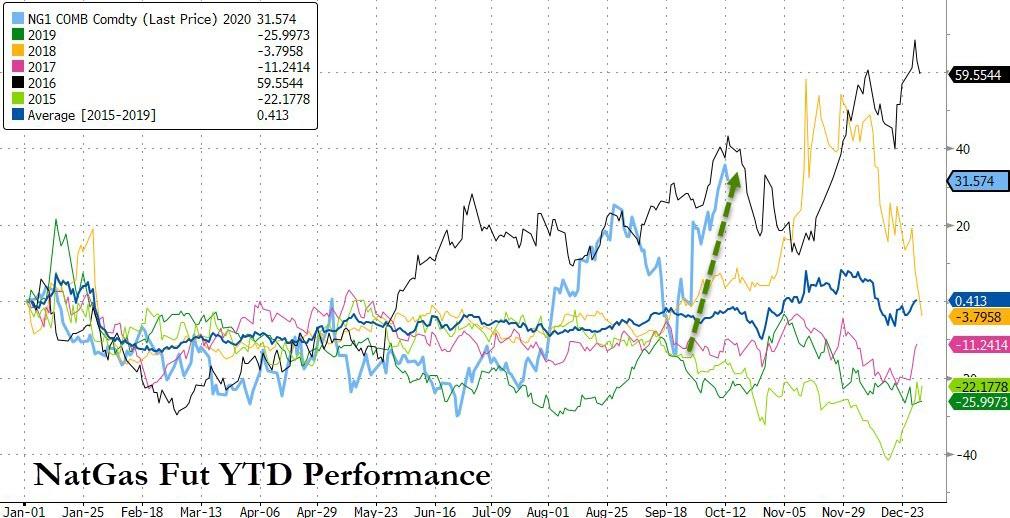

Natural-gas futures soared to levels not seen in more than seven quarters this week, as colder weather in the latest round of forecast data suggests energy demand is set to increase.

Natural gas futures inched towards $3 a million British thermal units (MMBtu) on Monday, closing up 5.1% at $2.881 MMBtu, their highest close since January 2019. Since July, prices have doubled with recent gains this month, around 19%, as nat gas power generation demand is set to increase.

This is the biggest relative seasonal surge since 2016...

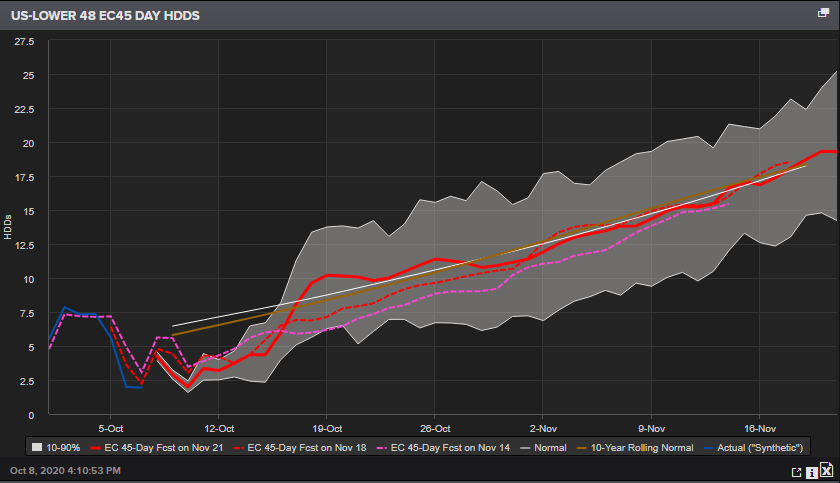

Natural Gas Intelligence, quoting the latest Bespoke Weather Services report, said Monday that weather shifted cooler in "another sizable addition" of gas-weighted degree days (GWDD).

Changes come throughout the 15-day forecast, and we now project October's total GWDD count to be over 340, nearly 50 GWDD above the projection from just 10-12 days ago, quite a substantial move," Bespoke said. "This is still well under the total demand level of the last two Octobers, however, but closer to normal. Best cooling versus normal lies in the middle of the nation, with occasional pusles into the East. Southern demand is strong the next few days, still thanks to heat" keeping cooling demand higher locally. - Natural Gas Intelligence

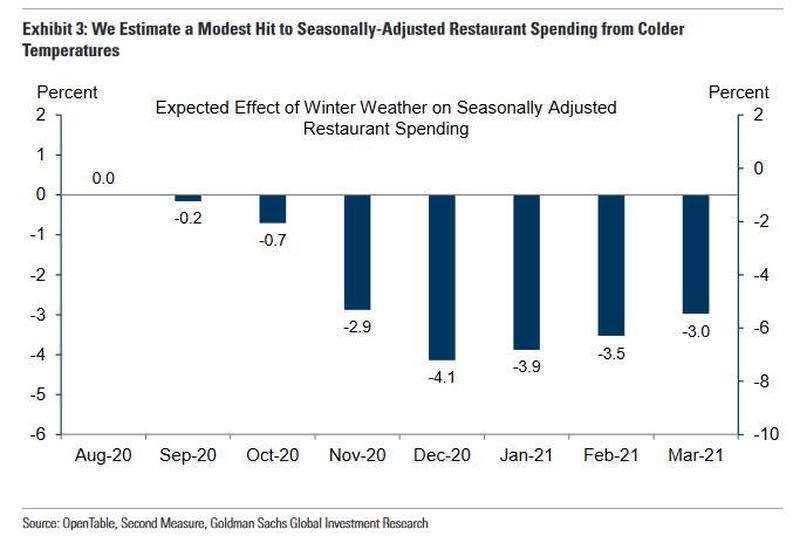

The forecast for temperature anomalies shows a blast of cooler air is set to arrive in the U.S. by this weekend.

Heating degree days for the US-Lower 48 is set to rise later this week. This means cooler temperatures are ahead as it will take more energy to heat a structure.

"While the weather can always be a wildcard, even with a fairly conservative demand rebound, there should be considerable upside to U.S. natural gas prices in 2021," Raymond James said.

Raymond James raised their full-year 2020 price forecast by 10% to $2.10 MMBtu. For next year, they expect Henry Hub prices to average $3.50-$4 MMBtu.

The Raymond James outlook follows Morgan Stanley's bullish outlook of nat gas prices:

Morgan Stanley analysts, citing both production declines and a potential rebound in winter demand, said last week that Henry Hub prices could soar to $5.00/MMBtu in 2021. Researchers said that the drop in oil prices stalled growth in associated gas coming from previously robust oil production. That, combined with a roughly 50% reduction in spending by E&P companies from 2019, could result in a 3-4 Bcf/d year/year decline in associated gas output by the end of 2020. With West Texas Intermediate crude currently below the $40/bbl threshold needed to hold U.S. volumes flat in 2021, the analysts said, declines could continue. - Natural Gas Intelligence

"We've seen somewhat of a 'Goldilocks' scenario take place in a few regions – enough pandemic easing for industrial activity to perform a bit better, but still strong residential demand as most people stay home. In response, international gas prices have doubled or even tripled off the bottom," Raymond James said.

Old Man Winter is coming...

By Zerohedge.com

More Top Reads From Oilprice.com:

- The Next Couple Of Months Are Crucial For U.S. Oil

- Where Will the World’s Next Giant Gold Discovery Be?

- Is U.S. Shale Finally Bouncing Back?