Energy stocks had a rough start of the week on Monday, as the newfound panic sets in about just how far the coronavirus will reach and how devastating the effects of the virus will be on the global economy.

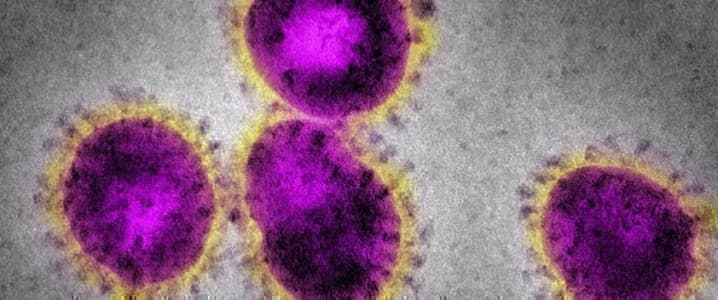

So far, the coronavirus has claimed the lives of nearly 2,600, with 77,262 infected.

On Monday, the coronavirus reared its ugly head in Kuwait, Bahrain, Afghanistan, Iraq, and Oman, bringing the total number of Middle Eastern countries that have incidence of the infection to nine. Iran already has reported nine deaths due to the coronavirus.

Also on Monday, Italy saw an uptick of cases, so far reporting seven deaths, with 229 confirmed cases.

The growing trend is for countries who have not had a major outbreak yet to restrict travel with countries who are having trouble containing the virus—such as China, South Korea, and Iran—and this trend is causing unease in the market.

The Energy Select Sector SPDR ETF (XLE)—the largest energy equities ETF--was trading down over 4.5% on Monday at $51.68 at 3:55 pm EDT. Vanguard Energy EFT (VDE) was also trading down more than 4.5% at $69.07. The third largest energy ETF, the SPDR S&P Oil and Gas Explore & Production ETF (XOP) was trading down even more, by 6.09% on the day.

The oil majors were trading down on Monday afternoon as well, with Shell trading down 3.8%, Exxon by 4.67%, Chevron by 3.94%, Occidental by 6.24%, Apache by 5.86%, Phillips 66 by 3.04%, EOG Resources by 5.79%.

Some smaller stocks such as Valaris PLC (-15.95%), Nabors Industries (-15.0%), and Kosmos Energy (18.71%), all saw double digit losses.

The S&P Energy Sector is, overall, trading down 4.5%.

And energy stocks aren’t the only stocks taking a beating; airline stocks, hit particularly hard by the lowered demand and by fears that even more travel may be restricted as the virus rages on.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Two Abundant Elements That Could Create A Superbattery

- Aramco To Invest $110 Billion In Huge Gas Field

- What Iran’s Election Result Means For Oil Markets