The market may be having trouble holding on to gains amid trade war fears and volatile sentiment every time the Fed opens its mouth about economic growth, inflation or interest rates, but you might be surprised to learn that the first quarter has seen unprecedented boosts in earnings estimates—the highest since 2011.

Data compiled by FactSet shows that estimated earnings for the first quarter of 2018 have risen by 5.3% since 31 December—it’s a market anomaly at a time you wouldn’t expect and runs contrary to the usual reductions by analysts.

Five years of data proves it: For 20 quarters past—that’s five years in a row—earnings expectations have fallen by 3.9 percent on average during a quarter, FactSet says. Over the past decade, they’ve fallen by 5.5 percent on average.

If the quarter ends on 31 March with earnings estimates up 5.3 percent, “it will mark the largest percentage increase in the bottom-up EPS estimated during a quarter since FactSet began tracking” in 2002.

Perhaps surprisingly, given the fact that oil and gas seem particularly flat, the energy sector has had the largest increase in expected earnings growth since the start of the quarter—but it’s still seen a 7-percent decrease in price.

Marathon Oil topped the charges in estimated earnings increases, from $0.01 to $0.13—over 10 percent. But the biggest contributor, even if not in terms of percent increase, was Exxon Mobil, whose mean EPS estimate rose from $1.02 to $1.14. That hasn’t done anything for its share price, which has lost well over 11 percent this quarter.

(Click to enlarge)

In the telecom’s sector, AT&T and Verizon lead the upticks in estimated earnings. AT&T saw its EPS bumped from $0.75 to $0.87, while Verizon saw a boost from $0.97 to $1.11. But again, share prices have fallen in both cases. Related: Trump Hits China With $50 Billion In Tariffs

For finance, the leaders in increased EPS for the quarter are led—in terms of percentage only—by Aon (from $1.78 to $2.73) and Progressive (from $0.77 to $1.13). But the biggest contributors were JPMorgan Chase, whose EPS is up from $195 to $2.25, and Bank of America, which has seen an increase from $0.51 to $0.59.

But here’s where the story diverges—in the finance sector. Shares of both JPMorgan Chase and Bank of America have been trending upward at the same time.

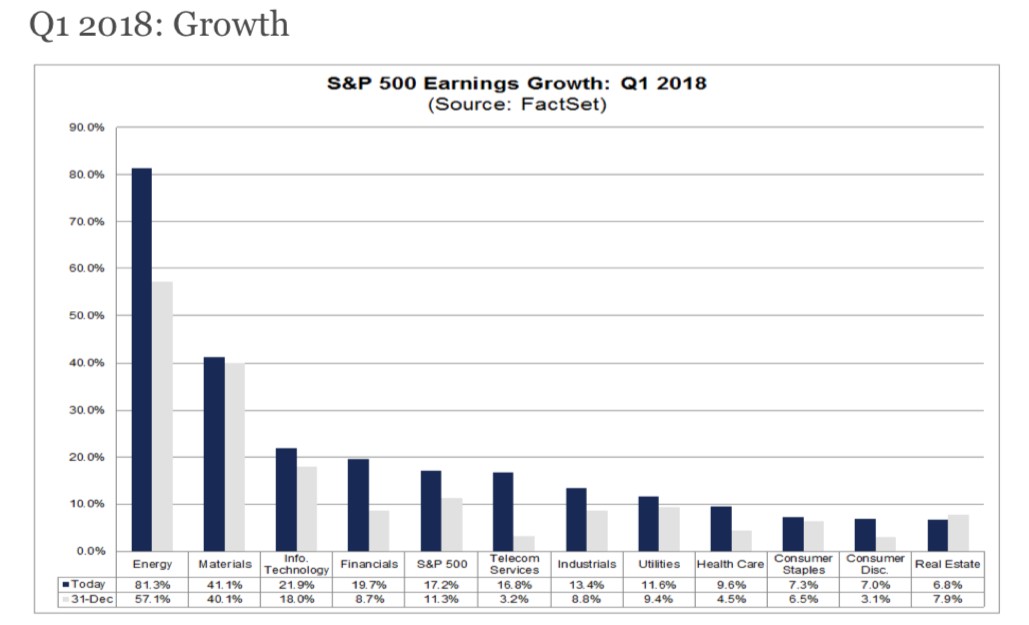

Overall, the energy sector is set to report the highest year-over-year earnings growth of all 11 sectors, according to FactSet. That would come in at 81.3 percent, led by exploration and production, listed at 2,728 percent.

(Click to enlarge)

So why the dramatic increase in estimated earnings?

Related: What The Saudi-Russian Alliance Means For Oil Markets

According to FactSet, one factor was the decline in the value of the dollar, giving a boost to U.S. exporters. But corporate tax cuts helped, too.

Over the next 12 months, FactSet puts the bottom-up target price for the S&P 500 is 3099.16—or 17.2 percent above the closing price of 2643.69.

The biggest price increases, based on this data, are expected to be in the energy and healthcare industries—both of which have the “largest upside differences between the bottom-up target price and the closing price”.

And trade wars and Fed whispers aside, buy ratings are at high. Of 11,094 ratings on stocks in the S&P 500, FactSet says that 52.2 percent are buy ratings, led by the information technology sector, and following by healthcare and energy.

(Click to enlarge)

By Tom Kool for Safehaven.com

More Top Reads From Oilprice.com:

- Oil Prices Up As EIA Confirms Crude Draw

- Trafigura Leads The U.S. Oil Export Boom

- Will China’s New Oil Futures Flop?