Whilst watching a commercial for the new bacon crust pizza, I suddenly found myself equally torn between being really hungry, and considering the thin gray line of overindulgence. So while I wait for the pizza delivery guy to arrive, I present to you henceforth six slices of excess in energyland™.

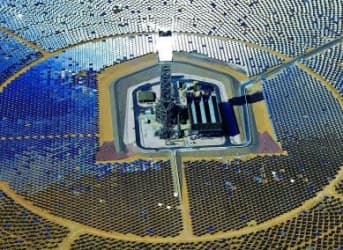

First up, let us ride the wave of renewables hitting California. For not only is its renewable generation target of 33% by 2020 aggressive, but also achievable. A rather impressive accolade considering if it were a country, it would rank as the 8th largest economy in the world.

It is already meeting 22% of its electricity needs from non-hydro renewables, while solar generation in 2014 was more than three times higher than 2nd placed Arizona, and more than all other states….combined. California is on target to meet 5% of its electricity generation needs this year from utility-scale solar, while 2,300 MW of small scale solar capacity has been installed in homes and businesses, helping to offset the lack of hydro due to worsening drought conditions:

Next up, we look at the momentum behind wind power in the US. Not only is it one of the fastest-growing sources of renewable power generation as it reaches 5% of the total generation mix, but with continued investment in technological innovation and grid integration the US could go from having 61 GW of wind generation capacity in 2013 to 224 GW by 2030, to 400 GW by 2050. Related: Forget Rig Counts And OPEC, Media Bias Is Driving Oil Down

On this trajectory, wind could account for 10% of the US generation mix by 2020, 20% by 2030, and 35% by 2050:

Switching to excess in the world of black gold, Texas tea, according to the EIA’s drilling productivity report new well oil production for the Permian region is set to increase by a whopping 20% month-on-month in April, as a precipitous drop in oil prices spurs producers to be much more nimble in achieving greater efficiencies.

A shift to ‘high grading’ – areas of greater productivity and lower costs – makes logical sense, but to see this shift manifesting itself so starkly illustrates the flexibility involved. Permian is still the most active US shale play, accounting for 35% of total active rigs (at 283 rigs). That said, the Permian rig count – like total oil rigs – has fallen 50% from its peak late last year.

Following on from the above, EIA monthly data shows US oil production in 2014 rose the most in over a hundred years. The rampant increase in the past half a decade has led to a scramble to transport it all, leading to an excessive ramp up in crude-by-rail (CBR). Related: Who Benefits Most From Cheap Oil?

From a mere 55,000 barrels a day in 2010, we have sequentially seen CBR volumes pick up speed (like a, um, runaway train) to reach over a million barrels a day last year. CBR moved about 10% of US oil production in January of this year, with the majority of these flows from the Bakken shale in North Dakota, with their primary destination to refineries on the East coast:

Next we shift to carbon emissions, as an excess of carbon permits in the EU trading scheme continues to expand to epic proportions. As EU lawmakers fail to reach a compromise as to when to start a Market Stability Reserve (a more nimble way to remove oversupply from the trading scheme), the surplus of permits in the system is projected to be in the realm of 2 billion tons, and according to some sources could double by the end of the decade if not addressed.

Related: Can Argentina Capitalize On Its Vast Shale Reserves?

Related: Can Argentina Capitalize On Its Vast Shale Reserves?

Talk of carbon emissions leads us to our final image of excess…that of total carbon emissions by country. The image below shows that China and the US account for over 40% of total global emissions. China produces the most emissions at 2.3 billion tons, with the US next at 1.5 billion tons – although the US produces nearly three times the emissions per capita.

Carbon emissions per capita pale into insignificance, however, when compared to Kuwait, Trinidad and Qatar, as these nations see sky-high per capita emissions due to small populations and heavy infrastructure.

Hopefully you found these six references interesting. I’ll sign off before I get too excessive – may your week be like my pizza: supreme.

By Matt Smith

More Top Reads From Oilprice.com:

- Texas Town First Of Many To Switch To 100% Renewable Power

- Many Big Guns Still Betting On Oil Comeback In 2015

- Wind Could Meet 20% Of U.S. Electricity By 2030